Atalanta’s 2024/25 financial results cover a season when the team from Bergamo finished in an impressive third place in Serie A, while they reached the quarter-finals of the Coppa Italia, where they were defeated by the eventual winners Bologna.

They also returned to the Champions League after a 3-year absence, reaching the knockout round before being eliminated by Club Brugge.

In addition, they lost to Real Madrid in the UEFA Super Cup, having qualified by winning the Europa League the previous season, after thrashing Bayer Leverkusen 3-0 in the final.

Their charismatic manager Gian Piero Gasperini was understandably proud after the victory in Dublin, “Winning with Atalanta is one of those footballing fairytales that rarely crop up. It gives scope for meritocracy: there is still scope for ideas and doesn’t have to come down to cold, hard money.”

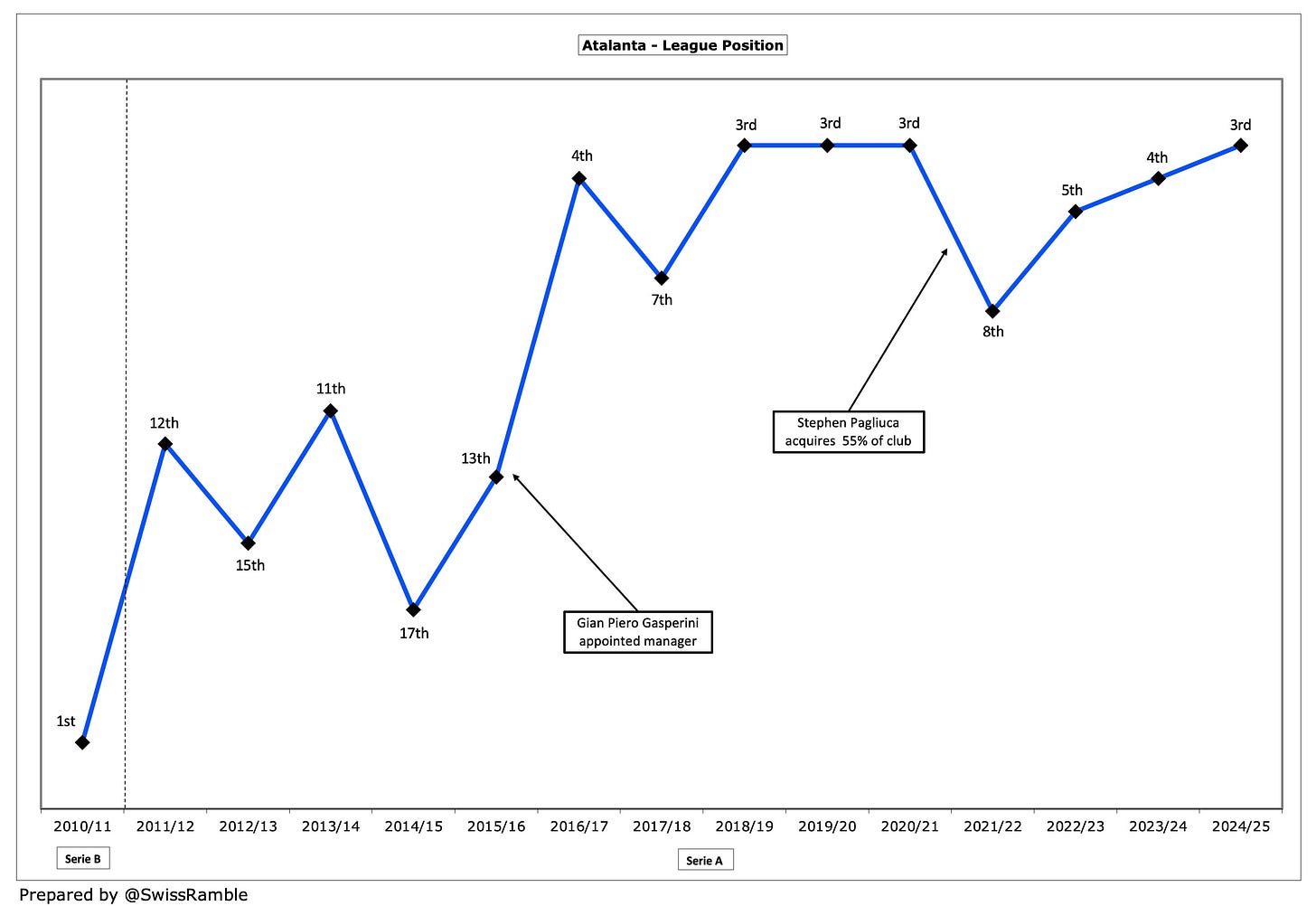

League Position

This was a reference to Atalanta’s financial disadvantages compared to the elite clubs, but the fact is that this is a club that has consistently punched above its weight, especially since the arrival of “Gasp” in June 2016.

In the following nine years, Atalanta have come third on no fewer than four occasions, while seven times finishing in the top five. Their lowest position was eighth, so they have clearly prospered, while other clubs of a similar size have struggled.

Ownership

This is the third set of accounts since the arrival of a US-based consortium led by Stephen Pagliuca in February 2022. They acquired a 55% stake in La Dea Srl, the controlling company of Atalanta, which holds about 86% of the club’s share capital, while the Percassi family retained a 45% stake.

Under the new agreement, Pagliuca was named co-chairman, with Antonio Percassi staying on as chairman and Luca Percassi as chief executive. In other words, the club’s governance effectively reflects an equal partnership.

Pagliuca is the co-owner of the storied NBA club, the Boston Celtics, and also co-chairman of Bain Capital, one of the leading investment funds in the world.

After sealing the deal, the American said, “We believe that the Percassi family has built very solid foundations on which to work together to strengthen the brand globally, with the aim of encouraging further diversification and growth of revenues, allowing the club to become more and more competitive on the Italian and international scene.”

Managerial Change

Given how much the club has relied on Gasperini, there was much trepidation among Atalanta fans, when the great man resigned at the end of last season, moving to Roma the following week.

The somewhat surprising choice as his replacement was Ivan Juric, who had failed in his last two jobs at Southampton and Roma. Indeed, the Croatian coach only lasted three months before he was dismissed, following a run of six consecutive draws and two defeats in Serie A.

He was succeeded by the former Fiorentina manager Raffaele Palladino, though this has not yet proved to be a silver bullet, as the team is currently languishing in mid-table.

Nevertheless, few would bet against Atalanta, as the club’s business model has proved rock solid for many years. Let’s take a look at the most recent accounts from the 2024/25 season to better understand their strategy.

Profit/(Loss) 2024/25

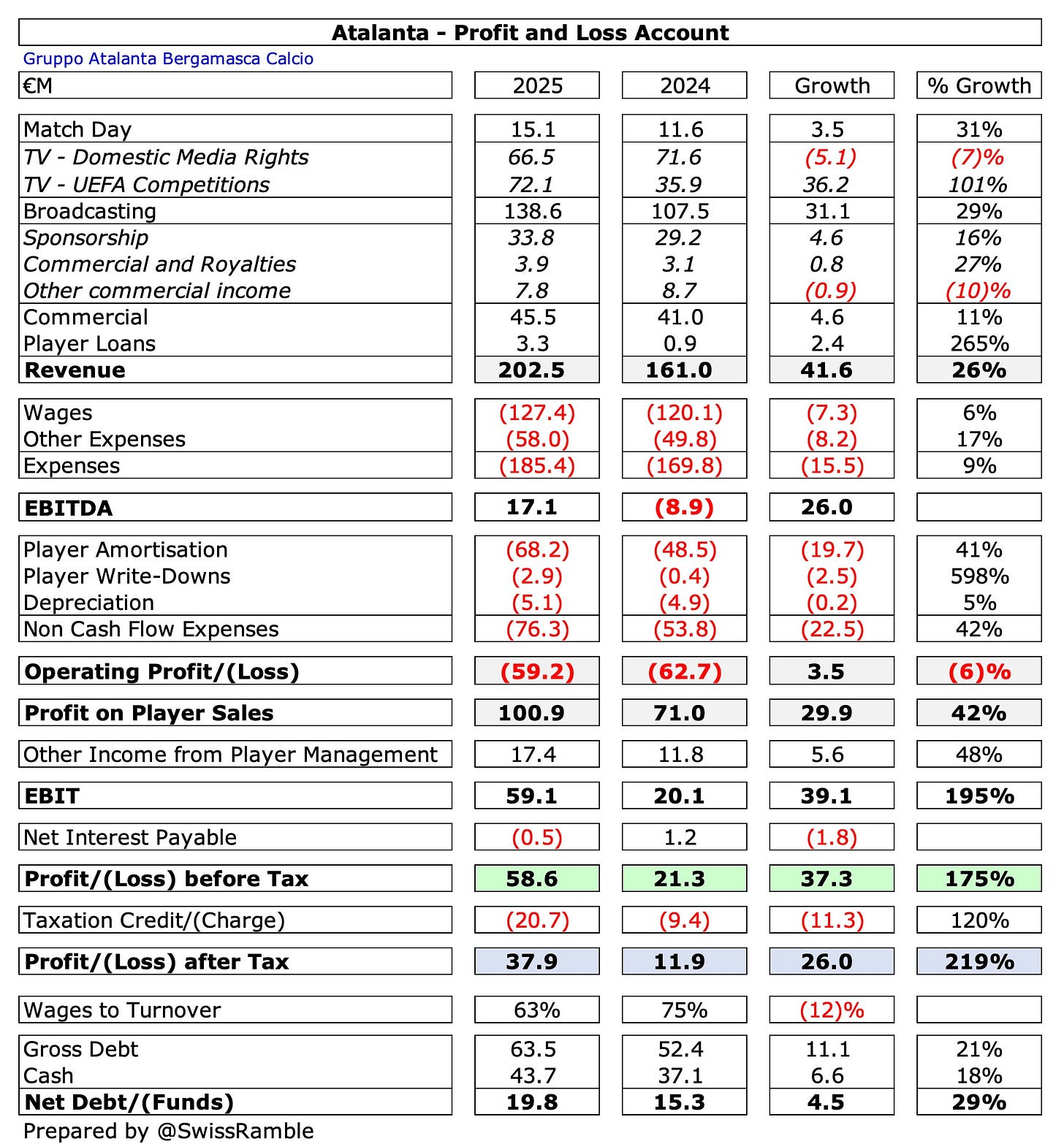

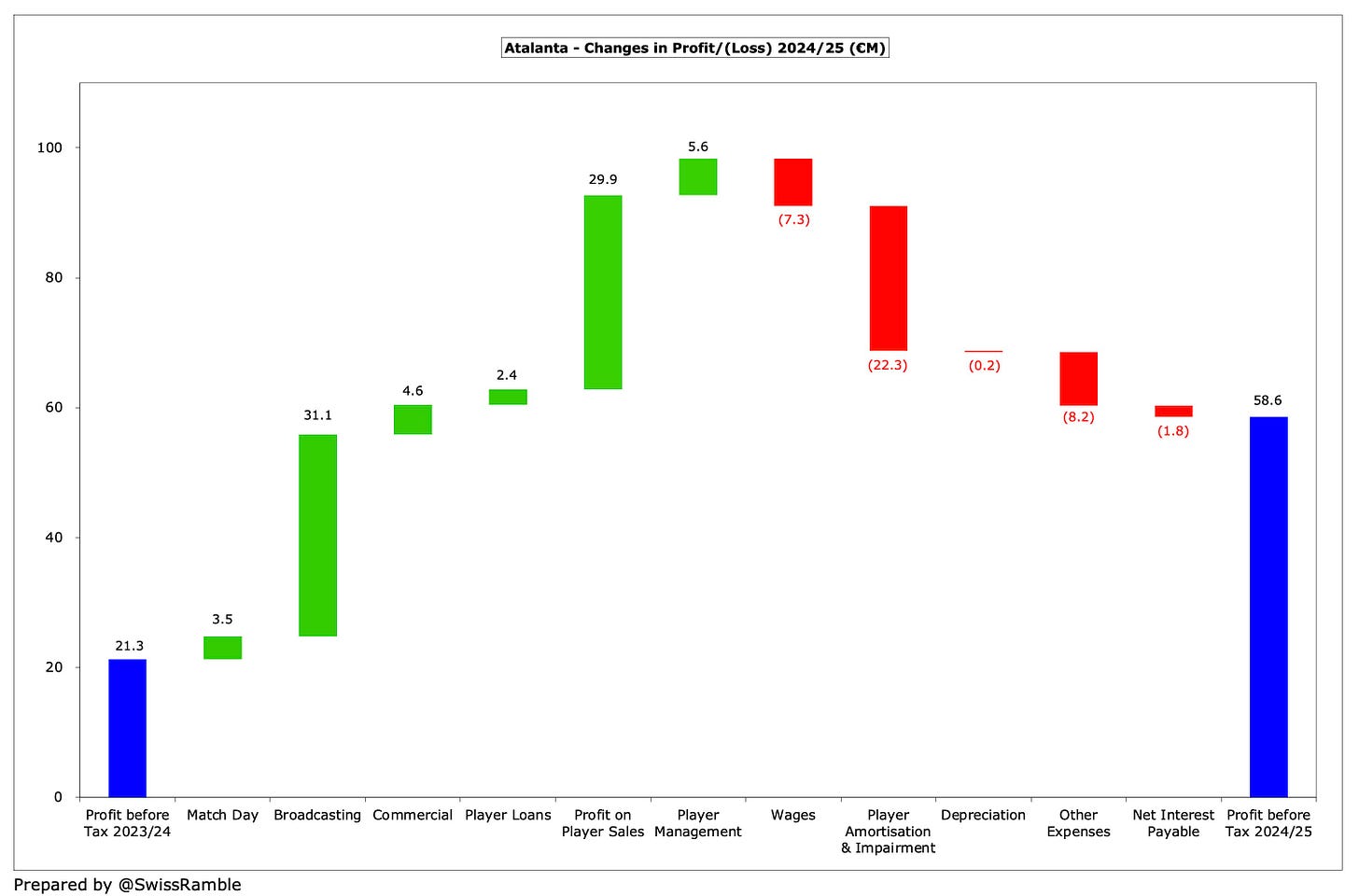

To highlight their strong performance, Atalanta posted an incredible €58.6m pre-tax profit last season. That’s very impressive, but it is no flash in the pan, as they have now been profitable ten years in a row, which is unprecedented in Italian football.

This was almost three times as much as the previous year’s €21.3m profit, after revenue rose €42m (26%) from €161m to €203m, a new club record.

The bottom line was further boosted by player trading, as profit from player sales increased by €30m (42%) from €71m to €101m, another club high, and other income from player management rose €5.6m (48%) from €11.8m to €17.4m.

This was partly offset by cost growth, as operating expenses rose €38m (17%) from €224m to €262m. In addition, net interest swung from €1.2m receivable to €0.5m payable.

Profit after tax was much lower at €37.9m, due to a €20.7m tax charge, though still much better than the prior year’s €11.9m profit.

The main driver of Atalanta’s revenue improvement was the return to the Champions League, which led to increases in broadcasting, up €31.1m (29%) from €107.5m to €138.6m, and match day, up €3.5m (31%) from €11.6m to €15.1m.

In addition, commercial rose €4.5m (11%) from €41.0m to €45.5m, while player loans tripled from €0.9m to €3.3m.

As a technical aside, this international definition of Atalanta’s €203m revenue is different to the one used in the club accounts, which excludes the €3m player loans to give €199m operating revenue.