In spite of their numerous financial challenges, Barcelona managed to win La Liga in 2022/23, as their former midfield star Xavi guided the Catalan club to their first title in four seasons, which Joan Laporta described as a “return to sporting excellence”.

The president added that the board had “stabilised the club”, pointing to substantial accounting profits in each of the last two years, but, as is often the cases, the devil is in the detail.

The reality is that these excellent financial results have been significantly influenced by the club’s famous levers (“palancas”), which have been pulled in order to raise much needed funds, albeit at the expense of sacrificing some future income.

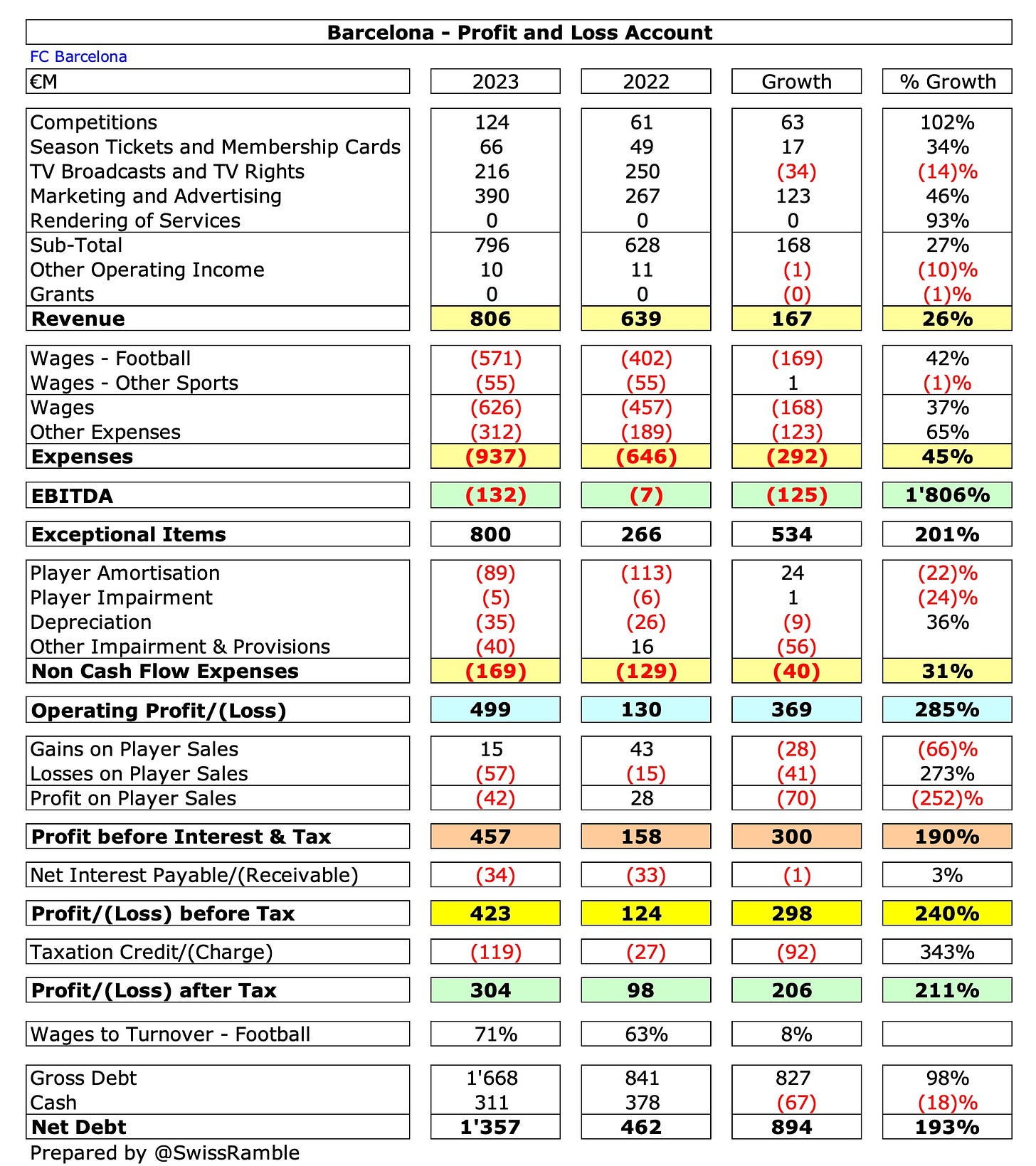

Profit/(Loss) 2022/23

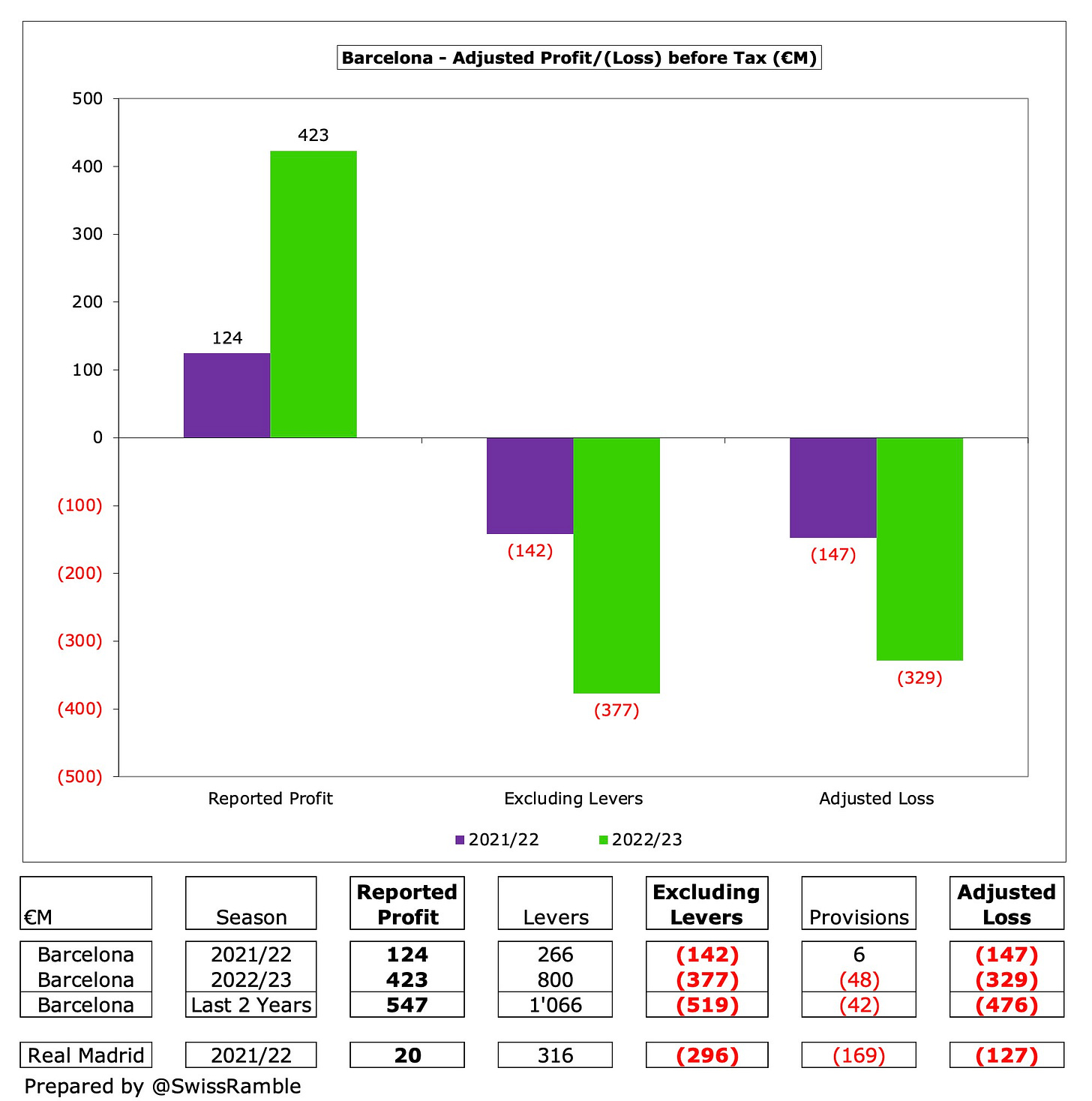

Barcelona’s pre-tax profit shot up from €124m to an incredible €423m, though this included €800m from the financial levers, which increased €534m from the previous year’s €266m.

Revenue rose €167m (26%) from €639m to €806m, but this was more than offset by €331m (43%) growth in operating expenses. Player sales generated a €42m book loss, which was €70m worse than the prior year’s €28m profit. Net interest payable was slightly higher at €34m.

The growth in profit after tax was “only” €206m, rising from €98m to €304m, as the tax charge leapt from €27m to €119m.

The end of COVID restrictions meant steep increases in both competitions income, which more than doubled from €61m to €124m, and season tickets & membership cards, up €17m (34%) from €49m to €66m.

However, the star of the show was marketing and advertising, which shot up €123m (46%) from €267m to a new club record €390m.

In contrast, broadcasting fell €34m (14%) from €250m to €216m, as the impact of paying a slice of TV income to investors began to bite. Other operating income dropped slightly to €10m.

As a technical aside, Barcelona’s definition of total revenue is much higher at €1,259m, which is an all-time high for the club, rising €242m (24%) from the previous year’s €1,017m.

This is different from the more commonly used international figure of €806m operating revenue, as it includes €399m rights sales, €15m gain on player sales and €39m from the reversal of impairment and other provisions.

Barcelona’s wage bill was up by more than a third (€169m) from €457m to €626m (football €571m, other sports €55m), though player amortisation (including impairment) was reduced by €25m (22%) from €119m to €94m.

There were big increases in the other cost categories: depreciation rose €9m (36%) from €26m to €35m; other expenses surged €123m (65%) from €189m to €312m; and other impairment and provisions swung €56m from a €16m credit to a €40m charge.

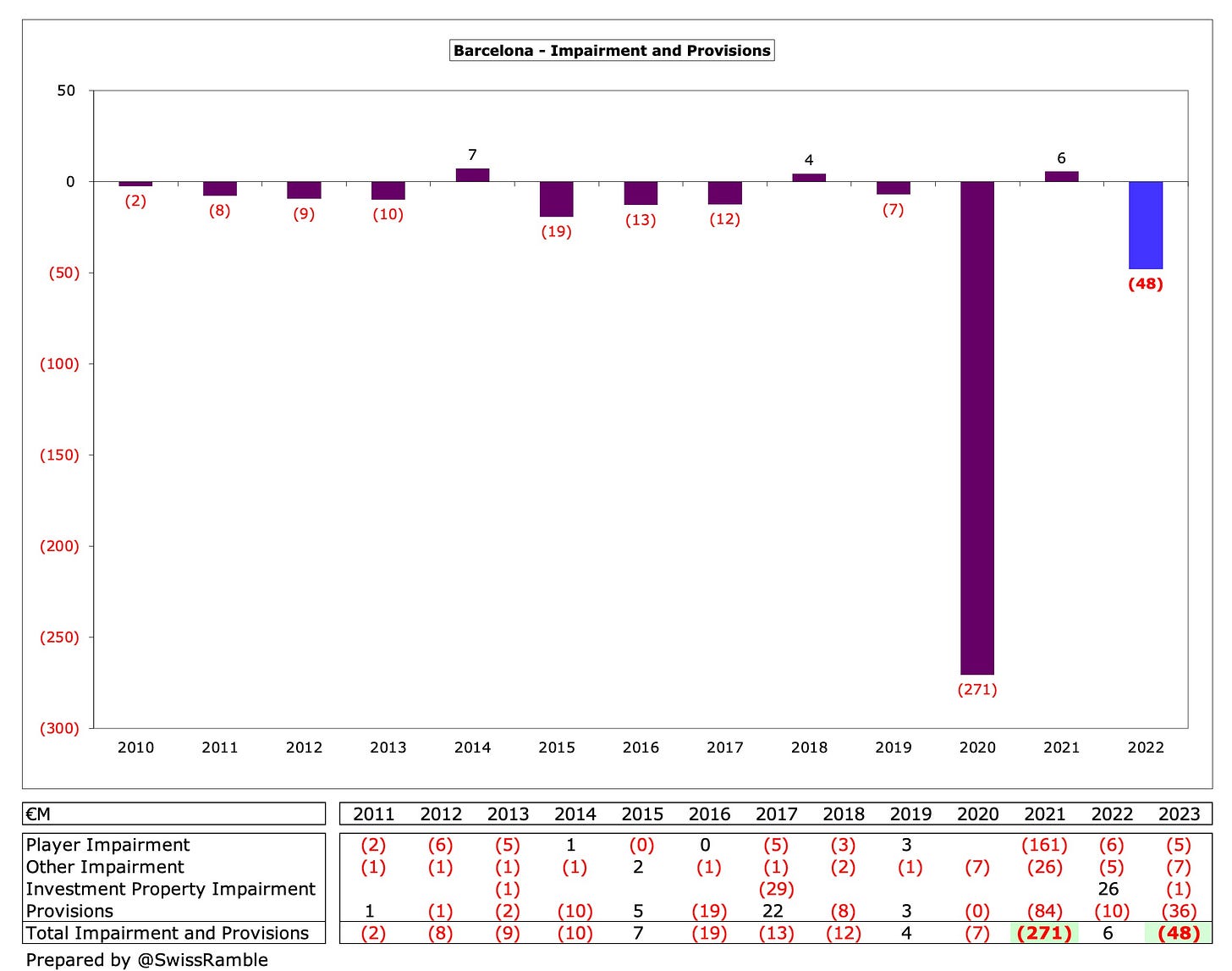

Provisions

Barcelona’s reported profit would actually have been even higher without consolidating the Espai Barca Securitisation Fund used to finance the new stadium development, which produced a €48m charge.

In fact, once-off movements in provisions have had a big impact on Barcelona’s bottom line in recent years, especially 2020/21 when the club booked €271m following its Due Diligence report, including €161m player impairment and €110m provisions (mainly law suits and tax cases).

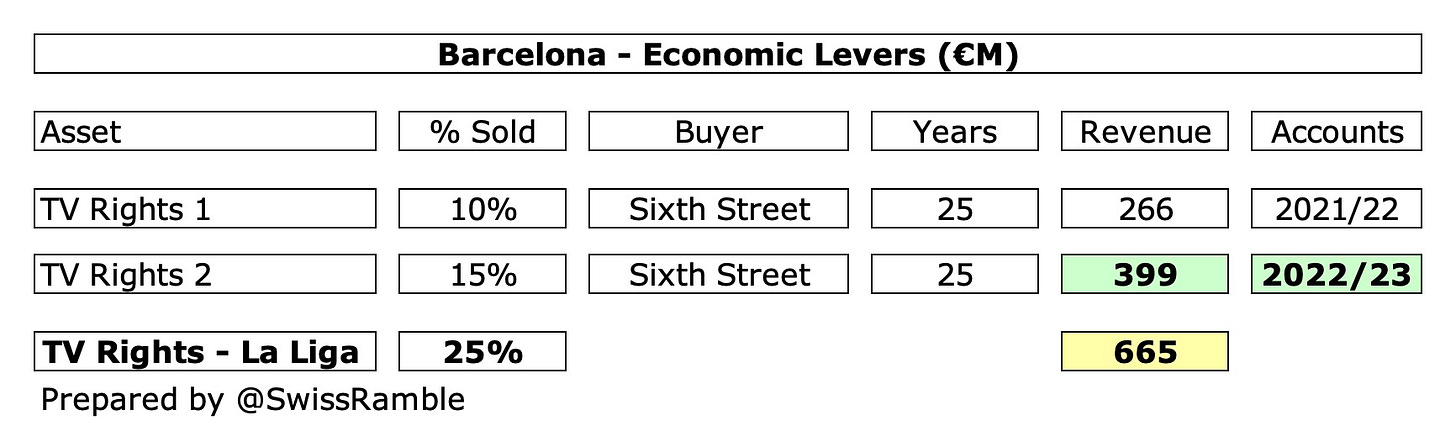

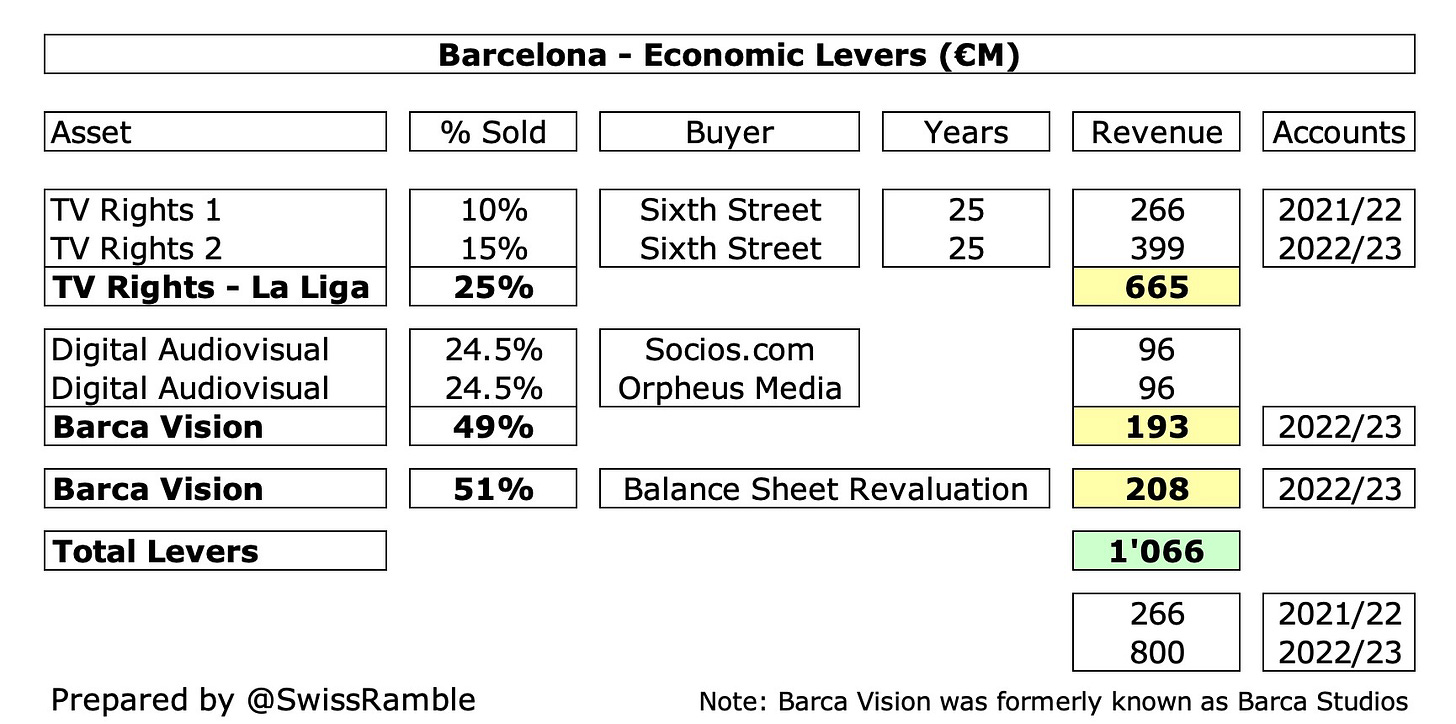

Financial Levers

These accounts clearly benefited from a near €400m gain from the sale of 15% of the Barcelona’s La Liga TV rights to Sixth Street. This followed a similar transaction in the previous year, when the club sold 10% of the rights for €266m.

In total, these sales have delivered €665m, but there’s no such thing as a free lunch, so the club will have to pay €41m per annum for 25 years.

That means that Barcelona will pay more than €1bln over the life of this agreement, but financial vice-president Eduard Romeu said that the deal was better than La Liga’s CVC agreement (reportedly 8.2% over 50 years), as that had no buyback option and prevented the club joining a future European Super League (remember that?).

In addition, Barcelona sold 49% of Barca Vision (formerly known as Barca Studio) to Socios.com and Orpheus Media for nearly €200m. The accounts were further boosted by a €208m revaluation of the remaining 51%, based on the price paid for the stake that was sold. As a result, this deal has improved the 2022/23 bottom line by around €400m in total.

However, there have apparently been delays in payments from the purchasers, so a large slice of the original sale has reportedly been “resold” to other investors, namely German company Libero and other parties advised by NIPA Capital.

To be clear, there is no additional benefit to the club here; indeed, there now has to be a question mark over the value of the sale booked in the accounts, though the club has advised that they do not foresee any problems.

As it stands, Barcelona have made nearly €1.1 bln from pulling these financial levers, split between €266m in 2021/22 and €800m in 2022/23.

The club’s auditors have noted that such gains are not recurring in nature, but Laporta explained why this innovative approach was necessary: “There was negative equity of €455m. In any private company, they would have started with bankruptcy proceedings. We made brave decisions and we saved the club from tragedy.”

Adjusted Profit

Without the benefit of the financial levers, Barcelona would have posted a €377m pre-tax loss in 2022/23, instead of the reported €423m profit. Over the last two years, they would have made a €519m loss, as opposed to the €547m profit.

Further adjusting for the Espai Barca €48m once-off provisions would give a smaller 2022/23 loss, albeit still a hefty €329m.

The Catalans are not alone in this strategy, of course, as their great rivals Real Madrid also made a €316m gain from their stadium revenue sale to Sixth Street in 2021/22. If this were excluded, their €20m profit would have become a €296m loss, though they also booked €169m provisions, so their adjusted loss would have been “only” €127m.

Reported Profit

Thanks to activating the levers, Barcelona’s reported €423m pre-tax profit is the highest in Spain by far, ahead of Real Madrid’s €20m in 2021/22. However, as we have seen, this is a highly misleading comparison.