Bristol City’s 2022/23 accounts cover a season when they finished 14th in the Championship, an improvement on the previous year’s 17th position. The board said that this “built on the work of the previous year as the club achieved a comfortable mid-table finish.”

Nevertheless, Nigel Pearson was relieved of his role as manager in October, replaced by Oxford United’s head coach Liam Manning.

The club added that the financial result was “disappointing, yet still within expectations after taking into account the current economic situation in respect of inflation and cost-of-living crisis.”

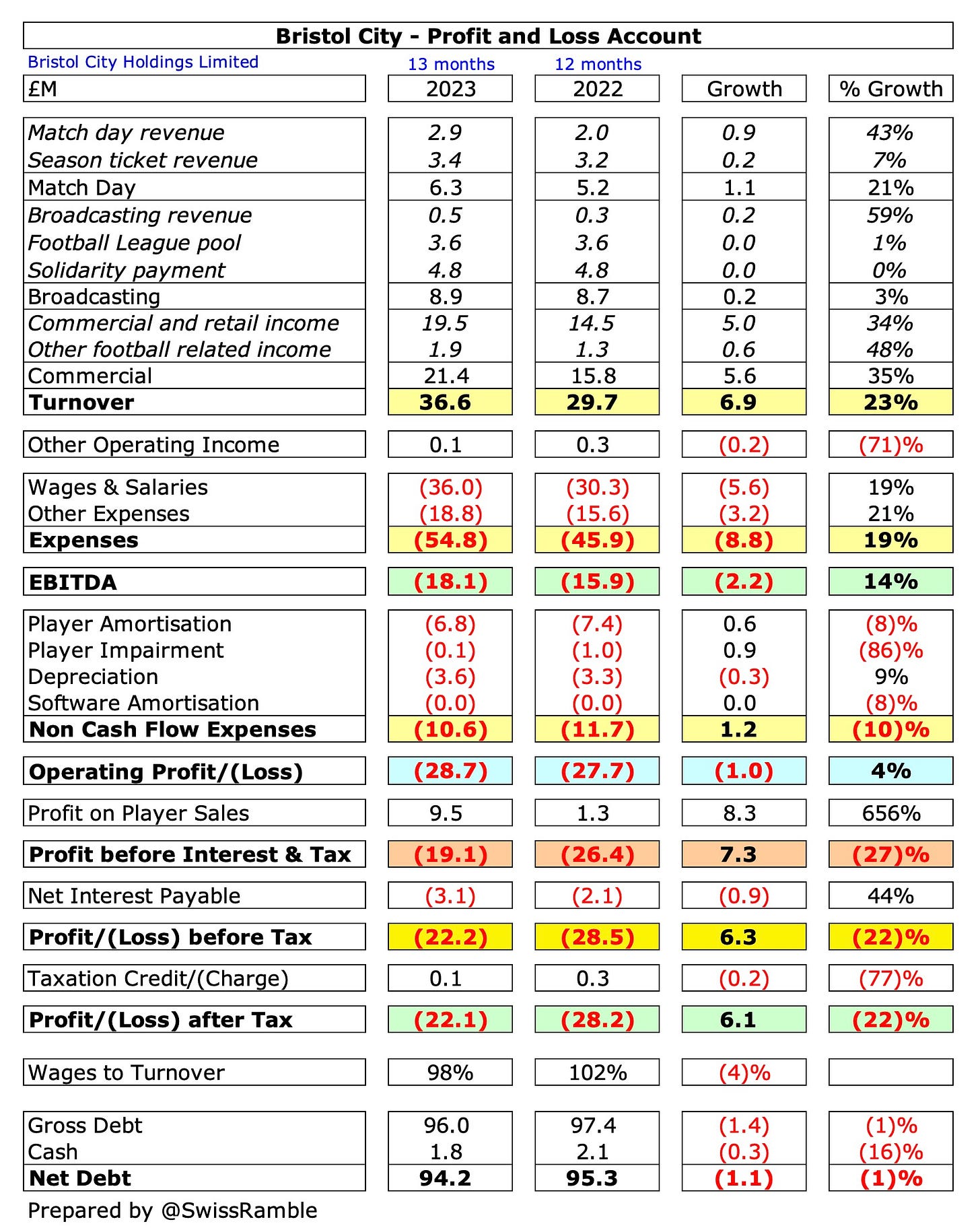

Profit/(Loss) 2022/23

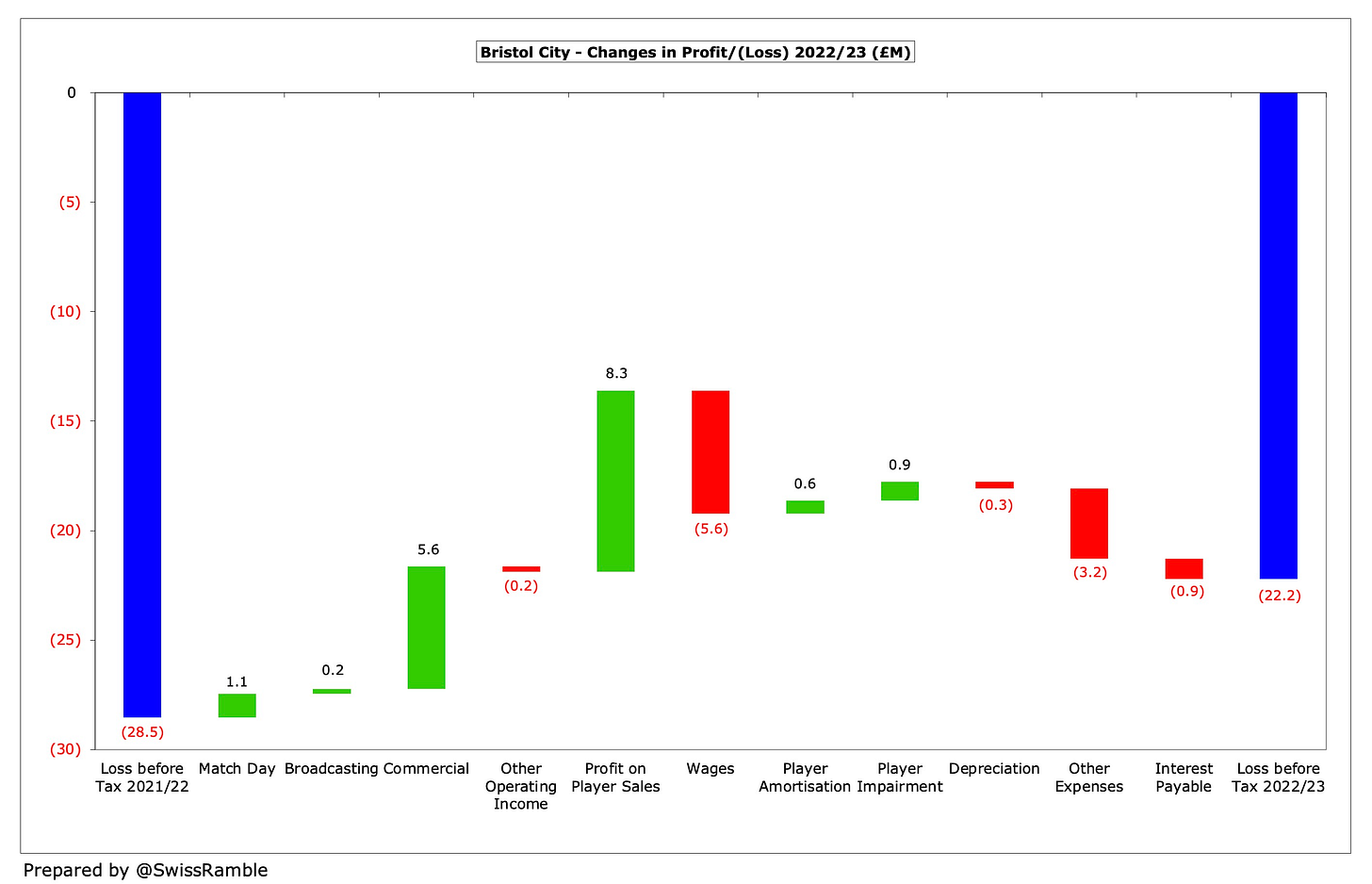

Bristol City’s pre-tax loss reduced by £6.3m from £28.5m to £22.2m (loss after tax £22.1m), as revenue rose £6.9m (23%) from £29.7m to a club record £36.6m and profit from player sales shot up from £1.3m to £9.5m.

On the other hand, operating expenses increased by £7.7m (13%) to £65.3m and net interest payable was up £0.9m (44%) to £3.1m.

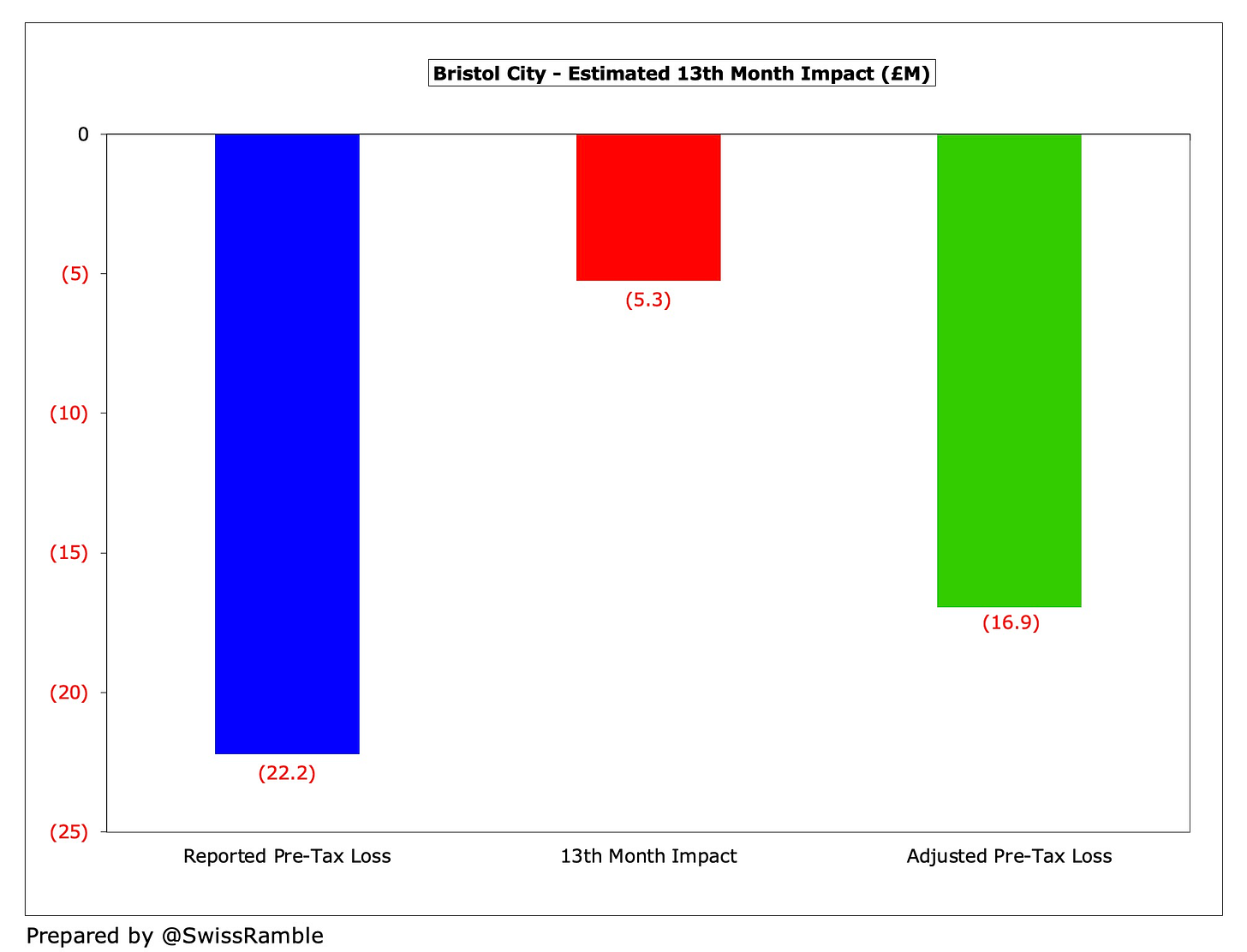

13th Month Impact

The improvement in the bottom line was achieved despite lengthening the reporting period by one month, as the club changed its year-end from May to June, so their 2022/23 accounts covered 13 months, compared to 12 months in the prior year.

This decision was taken “to better align with the financial reporting dates adhered to by the English Football League and the wider Bristol Sport Group”.

In financial terms, there was little impact on revenue, as there were no matches played in June, but the change resulted in an additional month of expenses.

On a simple pro-rate basis, this would mean that costs were around £5.3m higher in the reported accounts. Excluding this timing impact would give an underlying loss of £16.9m, i.e. £11.6m lower than the prior year.

The main reason for the higher income was commercial, which grew by more than a third (£5.6m) from £15.8m to £21.4m, but the other revenue streams also increased. Match day rose £1.1m (21%) from £5.2m to £6.3m, while broadcasting was £0.2m higher at £8.9m.

Partly due to the 13th month effect, the wage bill increased £5.7m (19%) from £30.3m to £36.0m, other expenses rose £3.2m (21%) from £15.6m to £18.8m and depreciation was up £0.3m (9%) to £3.6m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.