Former Wales international Gareth Bale is fronting a consortium of US investors that is reportedly looking to purchase Cardiff City. As well as being one of the greatest ever Welsh footballers, Bale is also famously a son of Cardiff, so this story ticks many boxes.

Bale said all the right things, “We are interested in getting Cardiff. It’s my home club, it’s where I grew up and my uncle used to play for them. To be involved with an ownership group would be a dream come true.”

He added, “It is a club close to my heart and I would love to be able to be a part of growing Cardiff and taking it to the Premier League where it belongs.”

The Times reported that the consortium would be prepared to offer £40m for Cardiff, though it is debatable whether such a price would be acceptable to current owner, Vincent Tan, who has ploughed much higher sums into the club since his arrival in 2010.

Front of House

Of course, if Bale does get involved, he would be the latest in a list of high-profile stars to front a takeover of a football club.

Cardiff fans do not have to look too far for similar examples, including Bale’s former Real Madrid and Spurs team-mate Luka Modric, who recently invested in South Wales rivals Swansea City.

Of course, very few fans would be unaware of the takeover of Wrexham by Hollywood’s Ryan Reynolds and Rob McElhenney, which has helped drive three promotions (and a successful documentary series).

What is it about Welsh clubs that attracts the stars?

In addition, NFL legends Ton Brady and JJ Watt have taken out minority stakes in Birmingham City and Burnley respectively.

It’s Always Darkest Before The Dawn

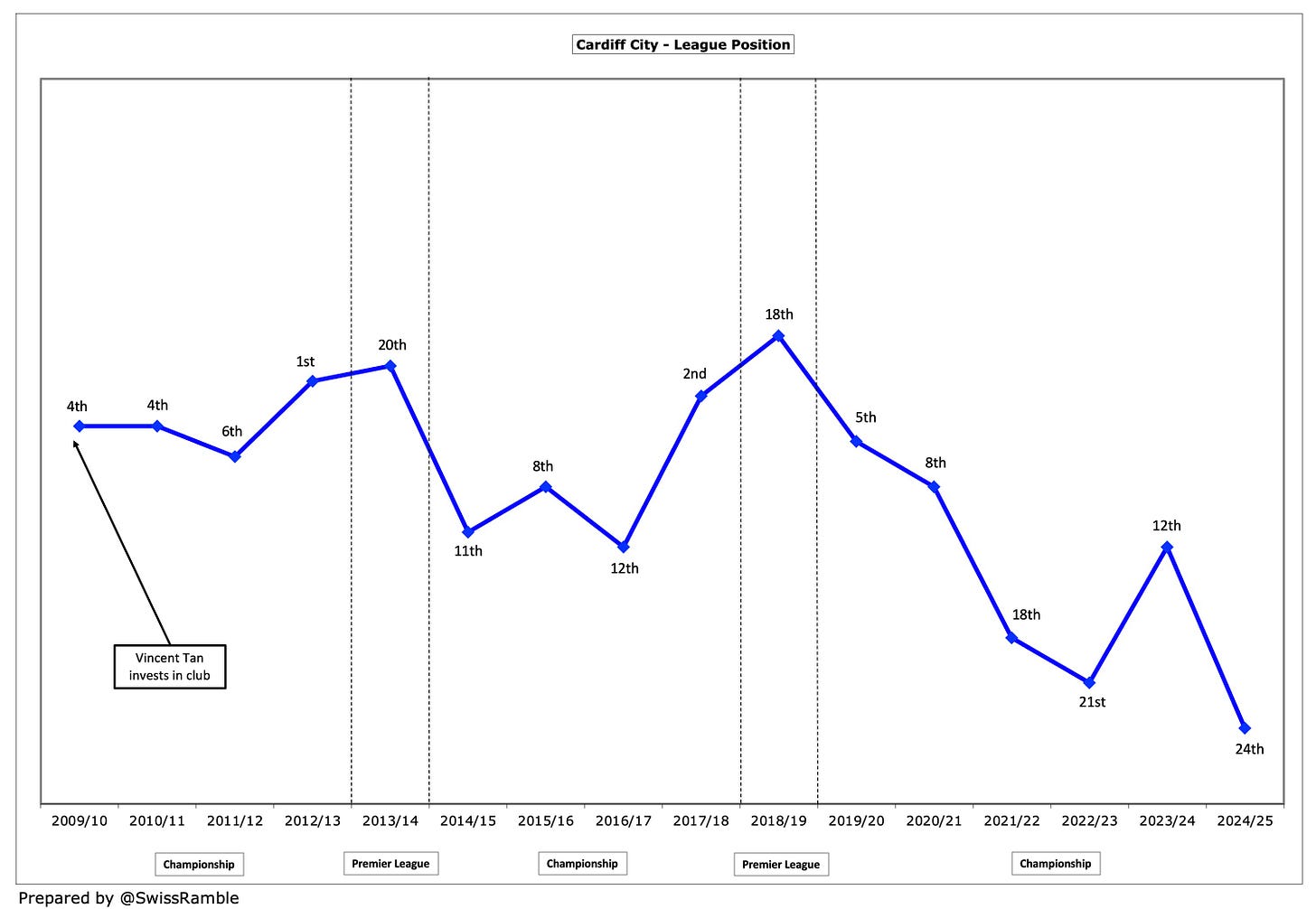

It’s fair to say that Cardiff City could do with a shot in the arm, as they have just been relegated to League One for the first time since 2003.

As Tan said, “'To lose our place in the Championship is upsetting. The important thing is that we regain it at the earliest opportunity and I would like to take this chance to tell you that I am committed to getting us back.”

However, the Supporters Trust clearly thinks that the owner shoulders much of the blame for the club’s current predicament, “Relegation in all honesty has been coming since the 2021/22 season and the failure to address fundamental required changes from the top down has now come home to roost.”

Strikingly, Cardiff were playing in the Premier League as recently as the 2018/19 season, but went straight back down after minimal investment in the squad. Last season they finished rock bottom in the Championship.

Managerial Changes

Cardiff have not helped mates by making by numerous changes in their manager. Turkish coach Erol Bulut was fired in September after the team lost six of its first seven matches, with the club noting, “football results and performances dictate actions.”

He was replaced on an interim basis by first team coach Omer Riza, who was then given the job permanently, despite his obvious inexperience at that level.

However, Riza only survived until April before he was relieved of his duties, leaving Welsh international Aaron Ramsey to take over for the final three games of the season.

As Tan wryly observed, “Not all decisions when it comes to the first team have worked as I had hoped for us.”

In advance of the forthcoming season, the poisoned chalice has been handed to Brian Barry-Murphy, the former head coach at Leicester City. Although the Foxes ended up being relegated, the Irishman had been rather more successful when he was in charge of Manchester City’s Academy.

Club Finances

So how do Cardiff City’s finances look for any potential investors?

The most recent accounts cover the 2023/24 season, when the club finished in a respectable 12th in the Championship, which was a big improvement over the 21st place in 2022/23. In fact, they only managed to avoid relegation that season after Reading were deducted six points for breaching an EFL business plan.

Profit/(Loss) 2023/24

There was “a small marginal increase” in Cardiff’s pre-tax loss from £11.4m to £11.7m in 2023/24. Revenue fell £3.5m (13%) from £26.7m to £23.2m, while profit from player sales dropped from £1.7m to just £0.8m.

Despite the lower revenue and player sales, operating expenses were up by more than a third, rising £13.8m from £37.9m to £51.7m, while net interest payable increased from £1.9m to £2.5m.

However, all these adverse movements were very largely offset by £18.4m of exceptional items, relating to the Emiliano Sala case.

Cardiff’s revenue decrease was almost entirely due to commercial, which fell £4.4m (39%) from £11.1m to £6.7m. The other revenue streams were actually higher, as match day rose £0.6m (11%) from £5.5m to £6.1m, while broadcasting was up £0.3m (4%) from £10.1m to £10.4m.

Other operating income was unchanged at £0.1m.

Cardiff greatly increased their staff costs, as the wage bill shot up £5.6m (25%) from £22.3m to £27.9m, while player amortisation was also up 25%, rising £0.8m from £3.4m to £4.2m.

In addition, other expenses were significantly higher, climbing £7.3m (76%) from £9.7m to £17.0m.

Cardiff’s reported £11.7m pre-tax loss was pretty much par for the course in the Championship, where the vast majority of clubs lose money. In fact, no fewer than ten clubs lost more than £15m in 2023/24, led by Leeds United £61m, Ipswich Town £39m and WBA £34m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.