Chelsea’s 2023/24 accounts cover the second full season under the ownership of the consortium led by Behdad Eghbali’s Clearlake Capital and Todd Boehly. It’s fair to say that this has been a rollercoaster period, especially off the pitch, where the club’s finances have attracted attention left, right and centre.

On the pitch, Chelsea improved their position in the Premier League from 12th to 6th, while also reaching the final of the Carabao Cup, losing to Liverpool after extra time, and the FA Cup semi-finals, where they lost out to Manchester City.

However, the season was blighted by not playing in Europe, the first time that the Blues had missed out since 2016/17.

Despite the improvement in form, head coach Mauricio Pochettino left the club by mutual consent at the end of the season after just one year in charge. He was replaced by Italian coach, Enzo Maresca, who had led Leicester City to the EFL Championship title.

Chelsea’s women’s team (more of them later) won the Women’s Super League for the fifth time in a row, while they also reached the semi-finals of the Women’s Champions League for the second consecutive year.

Profit/(Loss) 2023/24

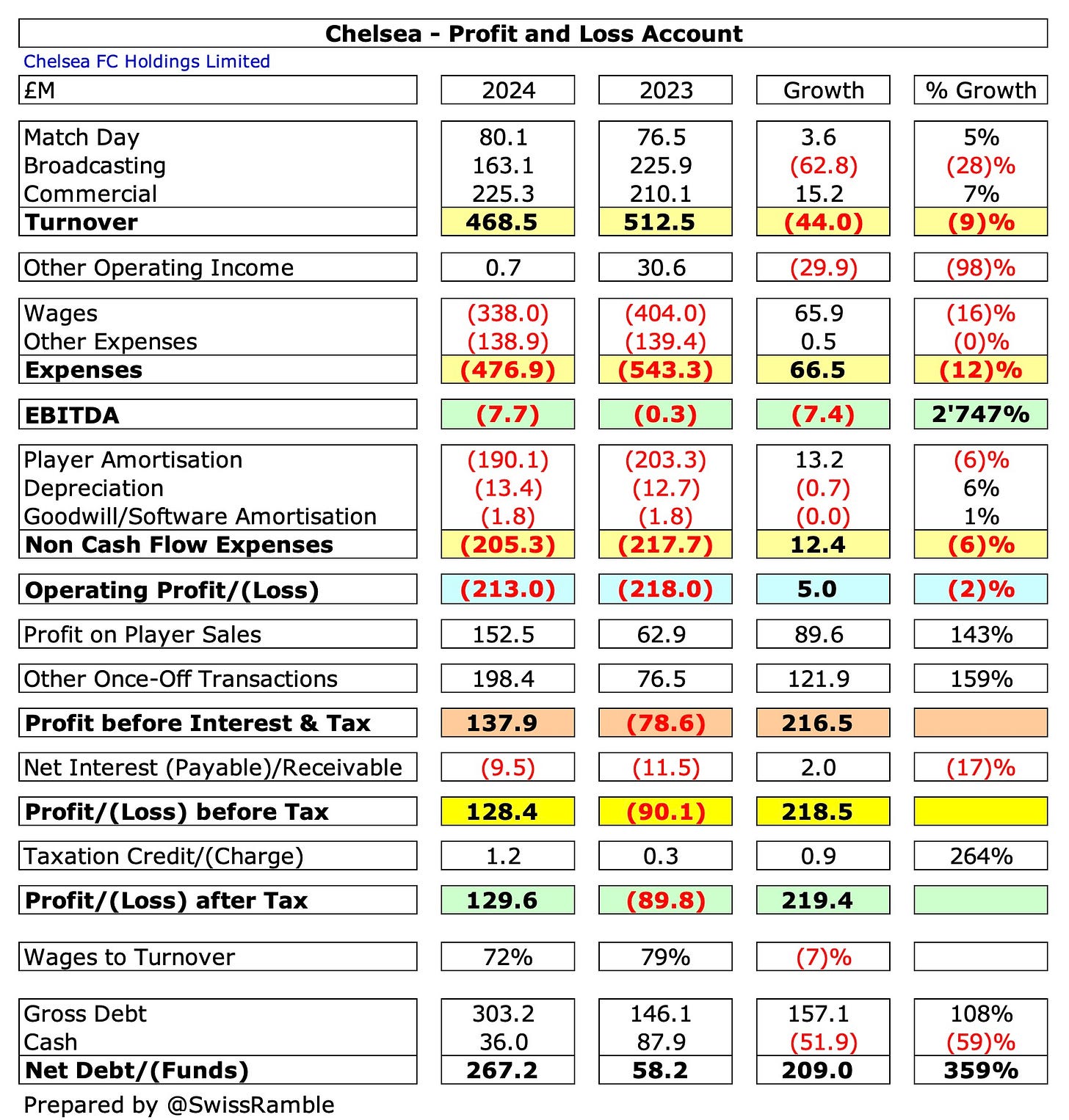

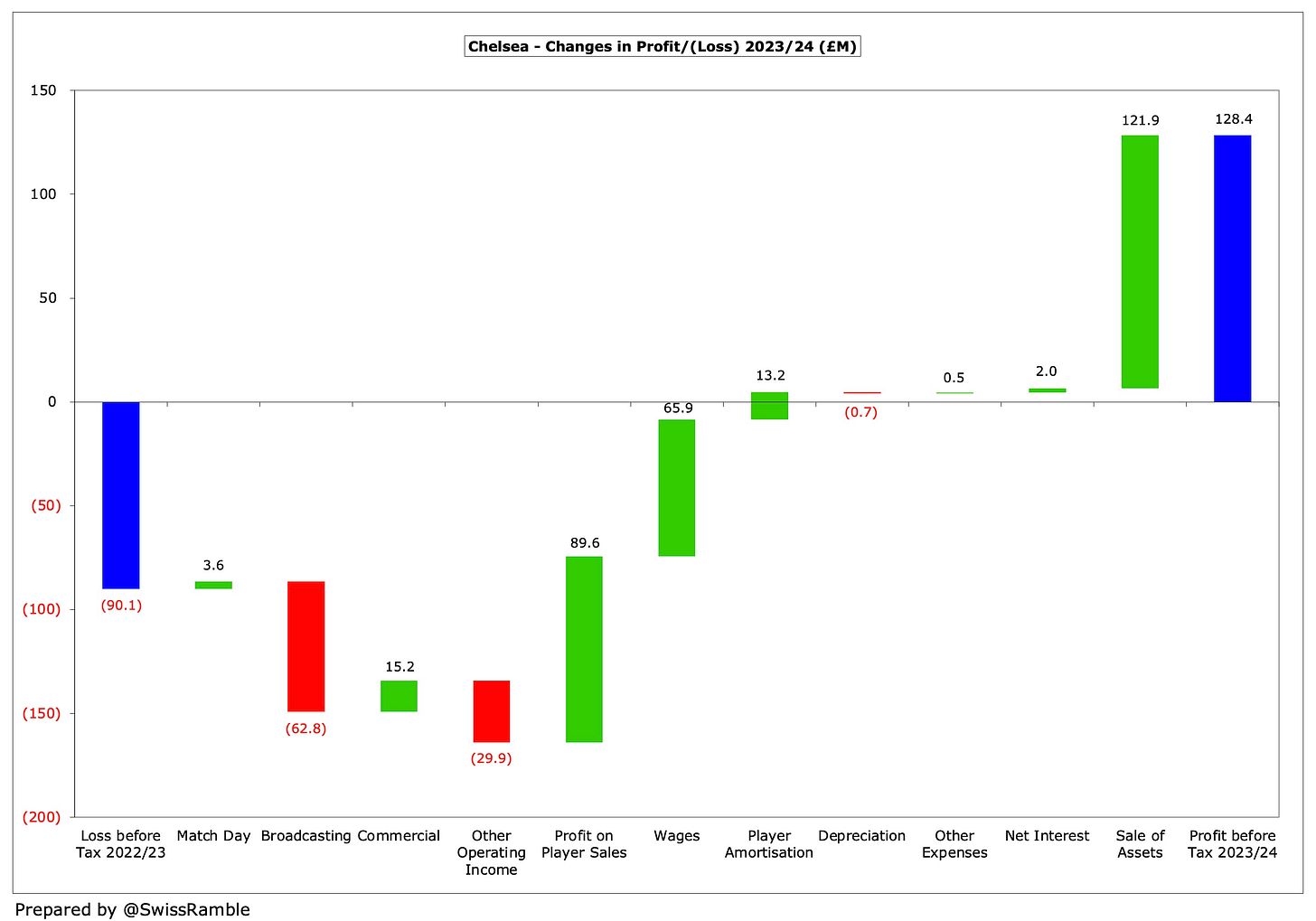

Chelsea reported a £128m pre-tax profit, which represented an enormous £218m improvement over the previous year’s £90m loss, despite revenue falling £44m (9%) from £512m to £468m and other operating income dropping from £31m to just £1m.

The revenue fall was covered by a steep reduction in operating expenses, which were cut £79m (10%) from £761m to £682m, but that still led to a huge £213m operating loss.

However, this was offset by profit from player sales, which more than doubled from £63m to an English record of £152m, while there was once again significant benefit from asset sales, as the women’s football team was sold to another group company for £200m.

The net £198m profit from the disposal of the subsidiary was actually £121m more than the prior year’s £77m gain from the inter-company sale of hotel buildings.

The main reason for Chelsea’s revenue decline was the lack of European football, which led to broadcasting falling £63m (28%) from £226m to £163m.

This was partially offset by growth in the other two revenue streams, as commercial rose £15m (7%) from £210m to £225m, while match day was up £4m (5%) from £76m to £80m. Both of these established new club records.

In response to the lower revenue, Chelsea reduced staff costs with large cuts in wages, down £66m (16%) from £404m to £338m, and player amortisation, down £13m (6%) from £203m to £190m.

Other operating expenses were flat at £139m, though net interest payable fell £2.0m from £11.5m to £9.5m.

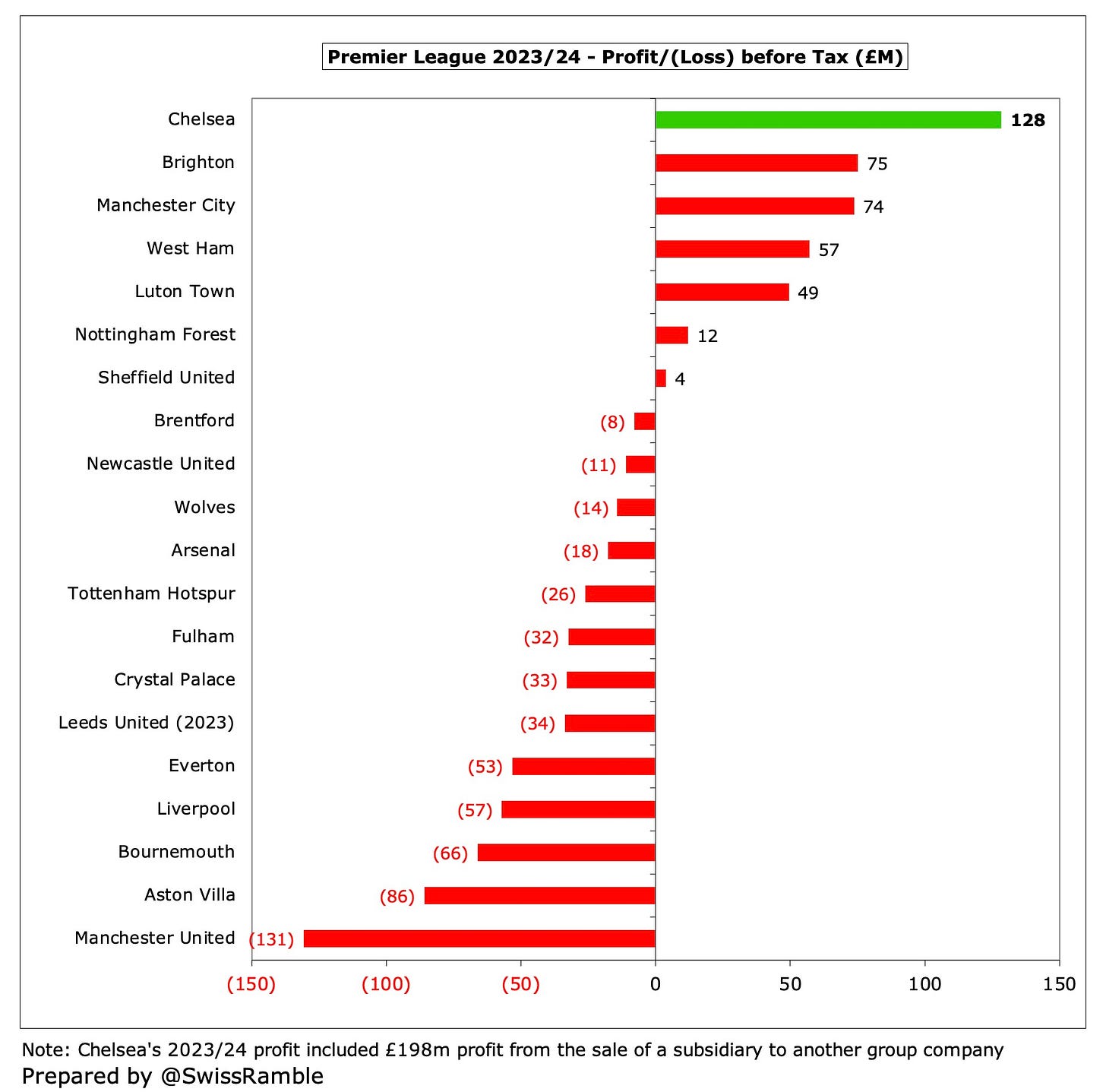

Chelsea’s reported £128m profit before tax is the best result in last season’s Premier League by some distance, though a few other clubs also generated sizeable profits, especially Brighton £75m, Manchester City £74m, West Ham £57m and Luton Town £49m.

In contrast, five clubs lost more than £50m, led by Manchester United £131m, Aston Villa £86m and Bournemouth £66m.

However, this picture is a little misleading, as Chelsea’s huge profit in the books was only thanks to the £198m gain on asset disposals. If this once-off factor were excluded, they would actually have lost £70m, which would be the third worst performance in the top flight.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.