Crystal Palace’s dazzling victory in the FA Cup semi-final against Aston Villa will give them a chance to win their first ever major honour. It’s fair to say that most neutrals will wish the South London club well against Manchester City, as the Citizens have collected a shedload of trophies in the last few years.

Either way, this season looks like it will end up as a decent one for Palace, as they currently sit in their customary mid-table position, which might not seem like anything to write home about, but represents a distinct upturn in their fortunes after an awful start in the league, when they only won one of their first 13 games.

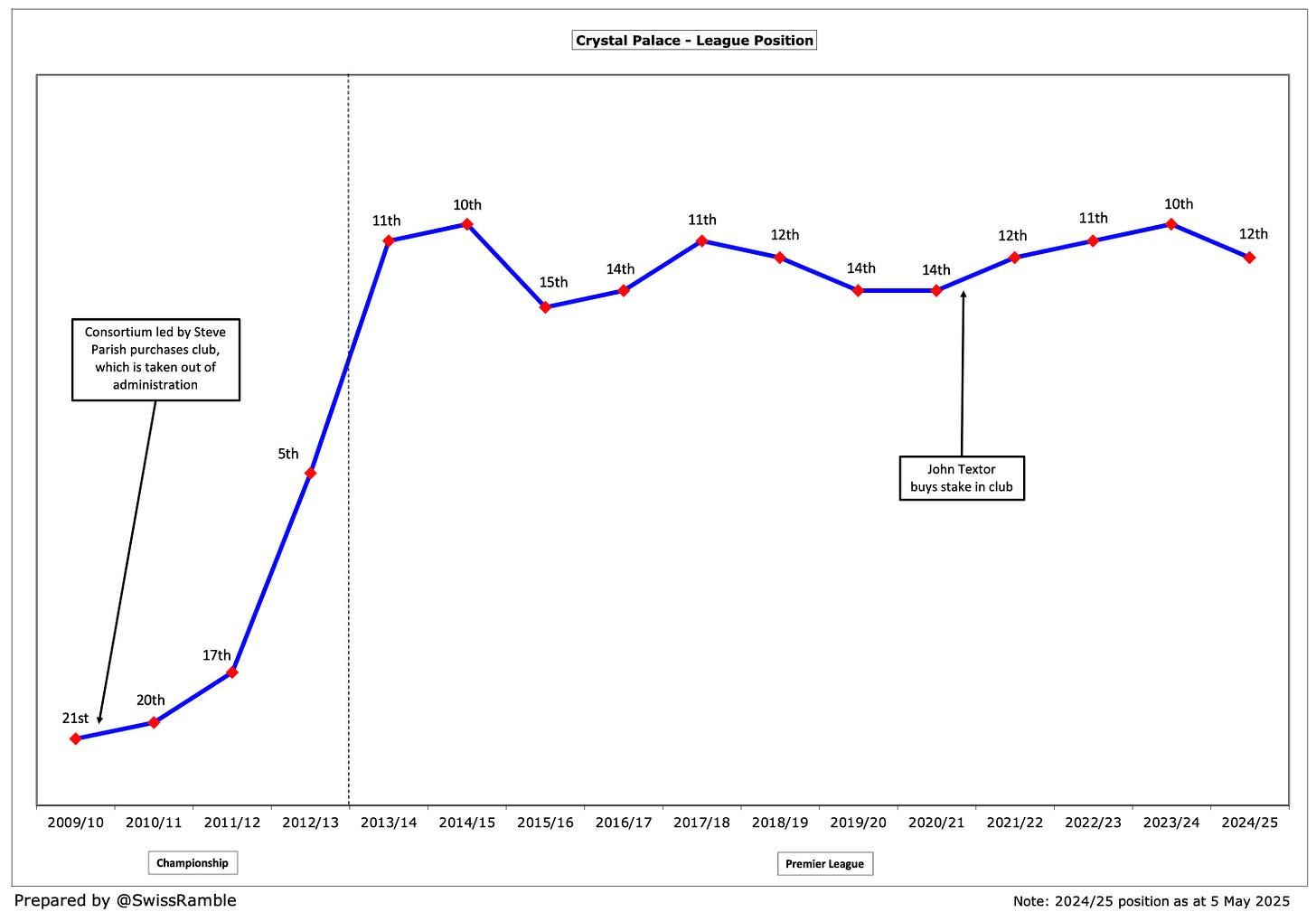

League Position

Palace’s consistency is fairly remarkable, especially for a club with relatively limited resources, as they have finished between 10th and 15th eleven years in a row following their promotion to the Premier League in 2012/13.

This is even more impressive, given that the club has emerged from some dark days financially, as was noted by chairman Steve Parish, “This club’s been in administration twice (in 1999 and 2010) – that’s an overriding concern, always. We need to make sure the club will be OK.”

In fact, Palace’s “excellent 10th place” last season actually equalled the club’s highest ever position in English football’s “elite competition”, thanks to “an outstanding end” to 2023/24.

Much of the improvement came after the arrival of coach, Oliver Glasner, who replaced the veteran Roy Hodgson in February 2024, with the club playing some dynamic, exciting football, as the Austrian implemented a marked switch in tactics.

Last season also saw Crystal Palace Women win the Championship title, thus gaining promotion to the Women’s Super League for the very first time.

So what can other similar sized clubs learn from Palace’s business model? Let’s take a detailed look at the club’s 2023/24 accounts to see whether these contain any pointers.

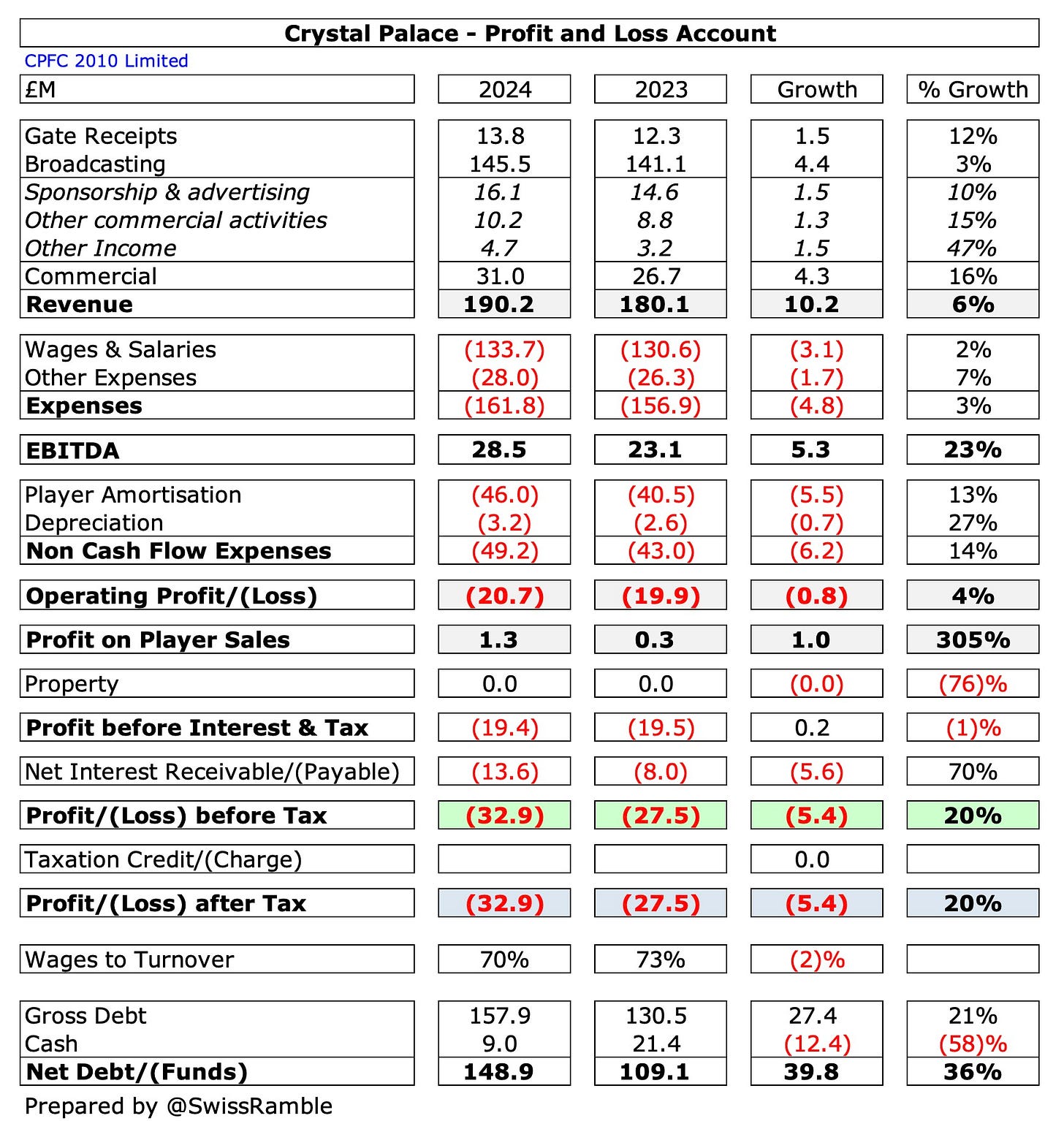

Profit/(Loss) 2023/24

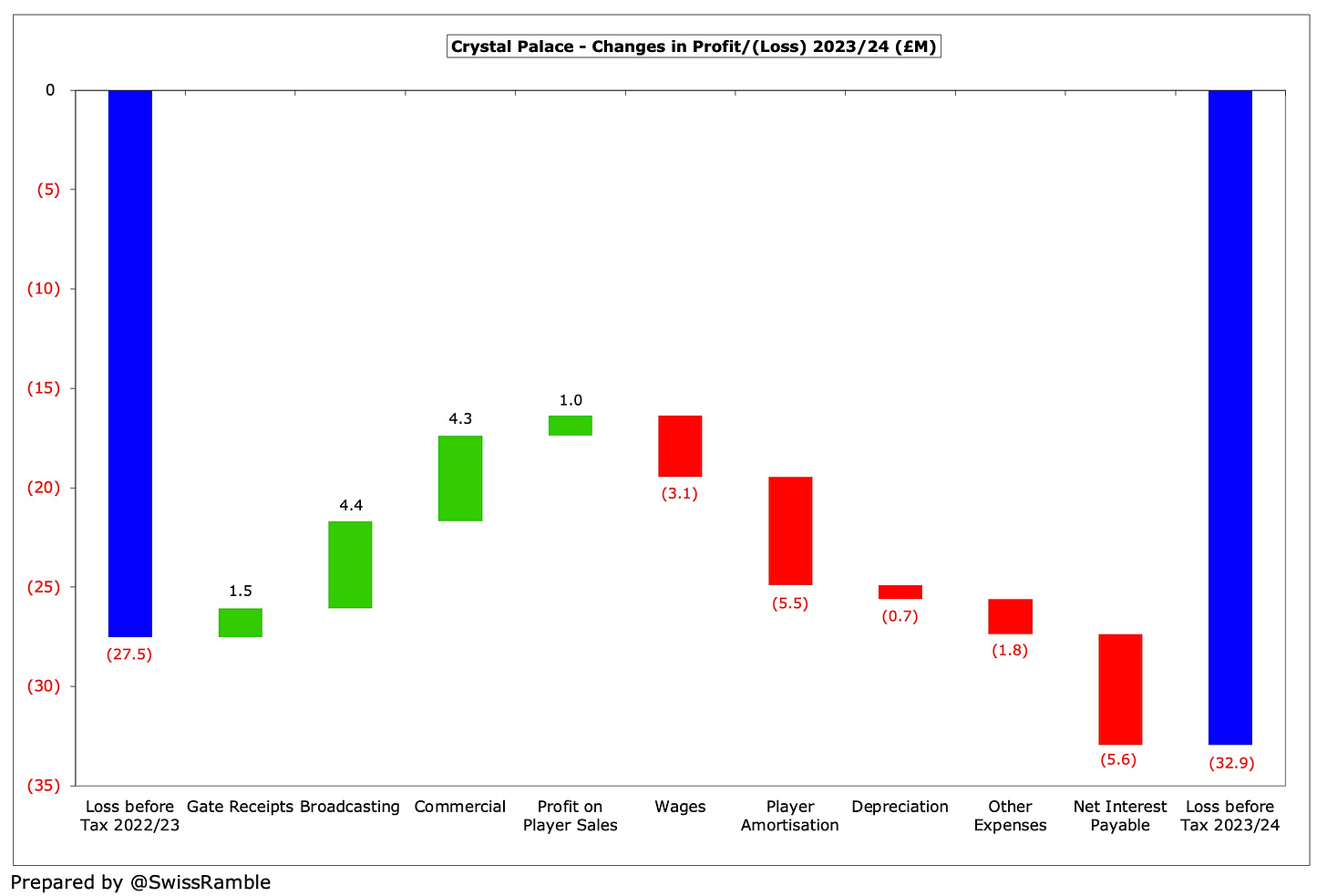

Palace’s pre-tax loss widened from £28m to £33m, despite revenue rising £10m (6%) from £180m to a new club high of £190m, though this was wiped out by operating expenses also increasing £11m (5%) from £200m to £211m, while net interest payable was up £6m (70%) from £8m to £14m.

Profit from player sales remained very low, only rising slightly from £0.3m to £1.3m.

All three revenue streams were higher in 2023/24, setting new club records in the process.

Broadcasting rose £4m (3%) from £141m to £145m, while commercial increased £4m (16%) from £27m to £31m and match day was up £1.5m (12%) from £12.3m to £13.8m.

Staff costs also increased, but not by a huge amount (at least by Premier League standards). The wage bill rose £3m (2%) from £131m to £134m, while player amortisation was up £6m (13%) from £40m to £46m. In addition, other expenses were £2m (7%) higher, rising from £26m to £28m.

Palace’s £33m pre-tax loss was firmly in the bottom half of the Premier League with only five clubs doing worse last season, though three of these lost more than twice as much as the Eagles, namely Manchester United £131m, Aston Villa £86m and Bournemouth £66m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.