Everton’s 2023/24 financial results covered a fairly momentous season, when they ended up 15th in the Premier League, though they would finished three places higher if they had not received an 8-point deduction for breaching the Premier League’s Profitability and Sustainability Regulations (PSR).

It was a worrying time for Everton fans, as the club faced a “perfect storm” of issues, including large financial losses, an ever increasing debt burden, a challenging stadium build and the tortuous sale of the club. There were even reports that the club faced a threat of going into administration.

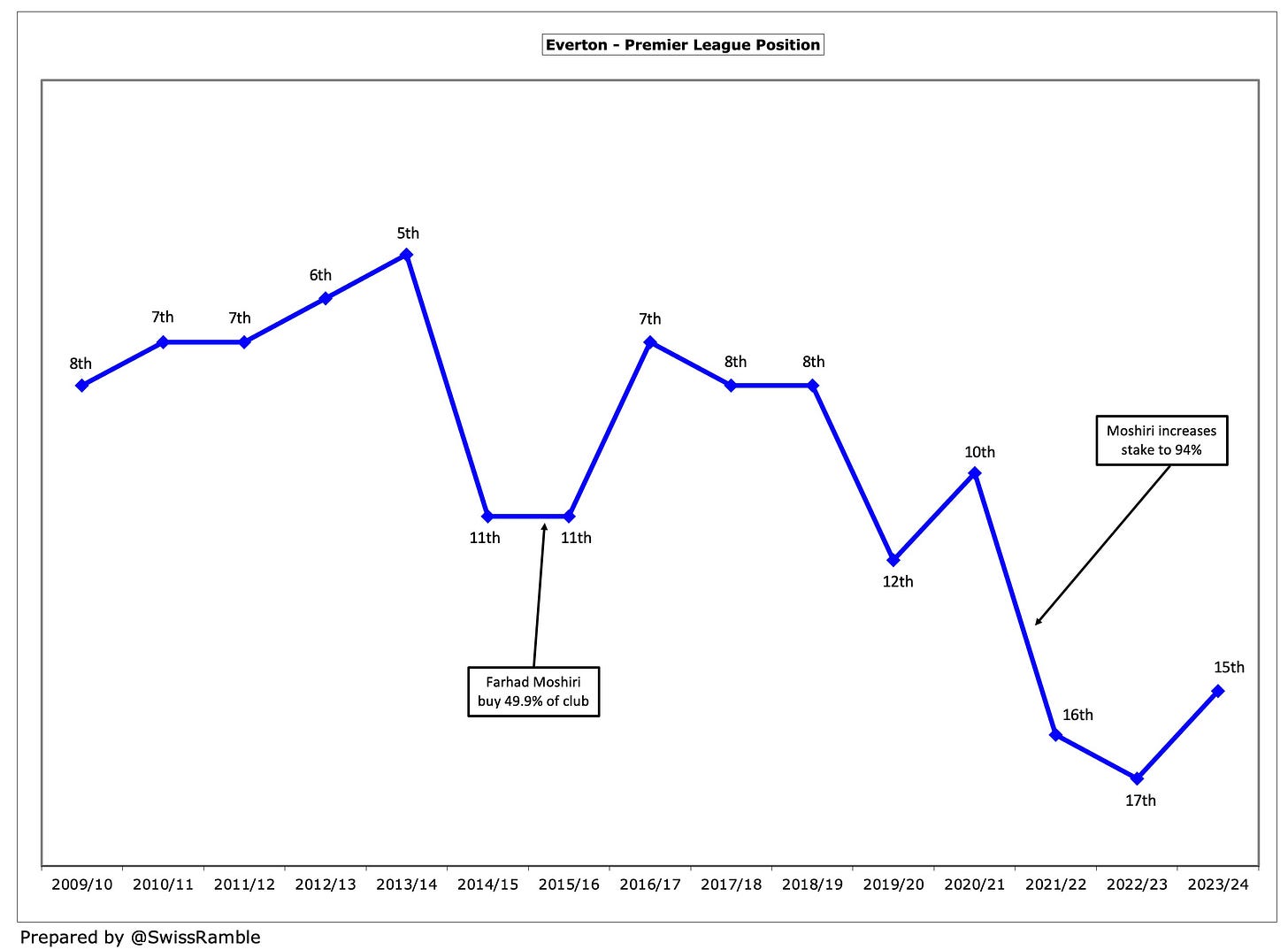

On the pitch, the club had also steadily declined from an impressive fifth place in 2013/14 to only just avoiding relegation in 2022/23.

Ownership

Farhad Moshiri bought just under 50% of the club in February 2016, then increased his stake to 94.1% in January 2022. While the signs looked promising in the early days of his tenure, it’s fair to say that things did not go so well in the latter stages of his ownership.

However, there’s a new sheriff in town now, after The Friedkin group bought out Moshiri with the Premier League confirming regulatory approval in December 2024.

Friedkin initially purchased Moshiri’s 94.1% stake, then converted the £451m shareholder loan into equity, raising the stake to 97.2%, while finally making an additional equity injection to repay third party debt and satisfy working capital requirements, giving a total shareholding of 99.5%.

This followed lengthy discussions with 777 Partners, before Moshiri belatedly realised that his choice as preferred purchaser did not actually have the funds to complete the deal. Not only did this cost Everton a lot of time, but it also led to steep increases in the debt burden, along with associated interest charges.

Similarly, the dalliance with Crystal Palace part owner, John Textor, never seemed likely to end up in a transaction.

However, Dan Friedkin is clearly cut from different cloth, having already demonstrated his willingness to invest a great deal of money into AS Roma. In fact, the American businessman has to date provided more than €700m to the Serie A side.

The other important recent change was the decision to bring back David Moyes as manager, after Sean Dyche had been sacked with Everton sitting dangerously close to the drop once again. However, the “Moyesiah” has now succeeded in steering the club to safety, thus confirming that the first season of the new stadium will be in the top flight.

Let’s take a look at the most recent accounts, running up to 30 June 2024, to see exactly what sort of financial situation Friedkin has inherited (and how things have changed since his arrival).

Profit/(Loss) 2023/24

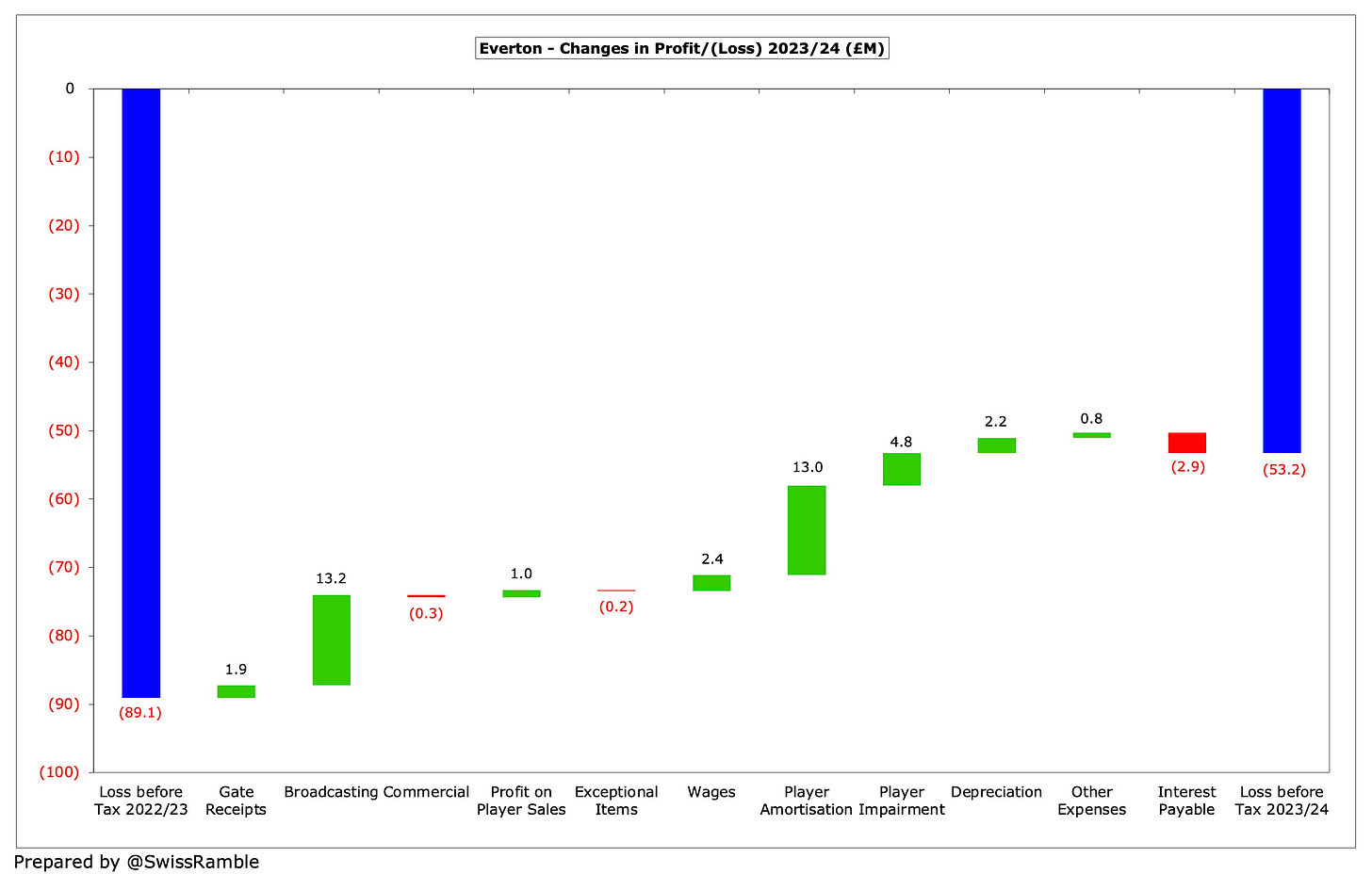

Everton’s pre-tax loss reduced by £36m (40%) from £89m to £53m, which the club said represented “a year of financial progress”.

Revenue rose £15m (9%) from £172m to £187m, while profit from player sales was slightly up from £48m to £49m. In addition, operating expenses were cut £23m (8%) from £303m to £280m, though net interest payable climbed from £6m to £9m.

The revenue increase was driven by broadcasting, which rose £13m (11%) from £116m to £129m, though gate receipts also increased by £1.8m (11%) from £17.3m to £19.1m. Commercial was slightly lower, falling £0.4m (1%) from £38.9m to £38.5m.

Everton reduced staff costs, as the wage fell £2m (2%) from £159m to £157m, while player amortisation was slashed £13m (17%) from £78m to £65m and there was no repeat of the prior year’s £5m player impairment.

Other expenses were down £1m (2%) from £45m to £44m, while exceptional charges were unchanged at £10m.

Despite the improvement, Everton’s £53m pre-tax loss was still one of the largest in the Premier League with only four clubs doing worse last season, namely Manchester United £131m, Aston Villa £86m, Bournemouth £66m and Liverpool £57m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.