The surprise story in European football this season has undoubtedly been Girona, who have featured prominently at the top of La Liga, battling with the traditional elite like Real Madrid, Barcelona and Atleti in only their second season back in Spain’s top flight.

The club’s own aspirations after promotion were relatively modest, as summarised by chief executive Ignasi Mas-Bagà, “The goal was non-relegation. That has been the target since we arrived. Leading the table is like a dream for us. But it’s not an obsession. The focus is long-term stability.”

His surprise at Girona’s extraordinary success was echoed by sporting director Quique Cárcel, “What is happening is not normal. It is a moment of excitement, of being amazed by what is happening.”

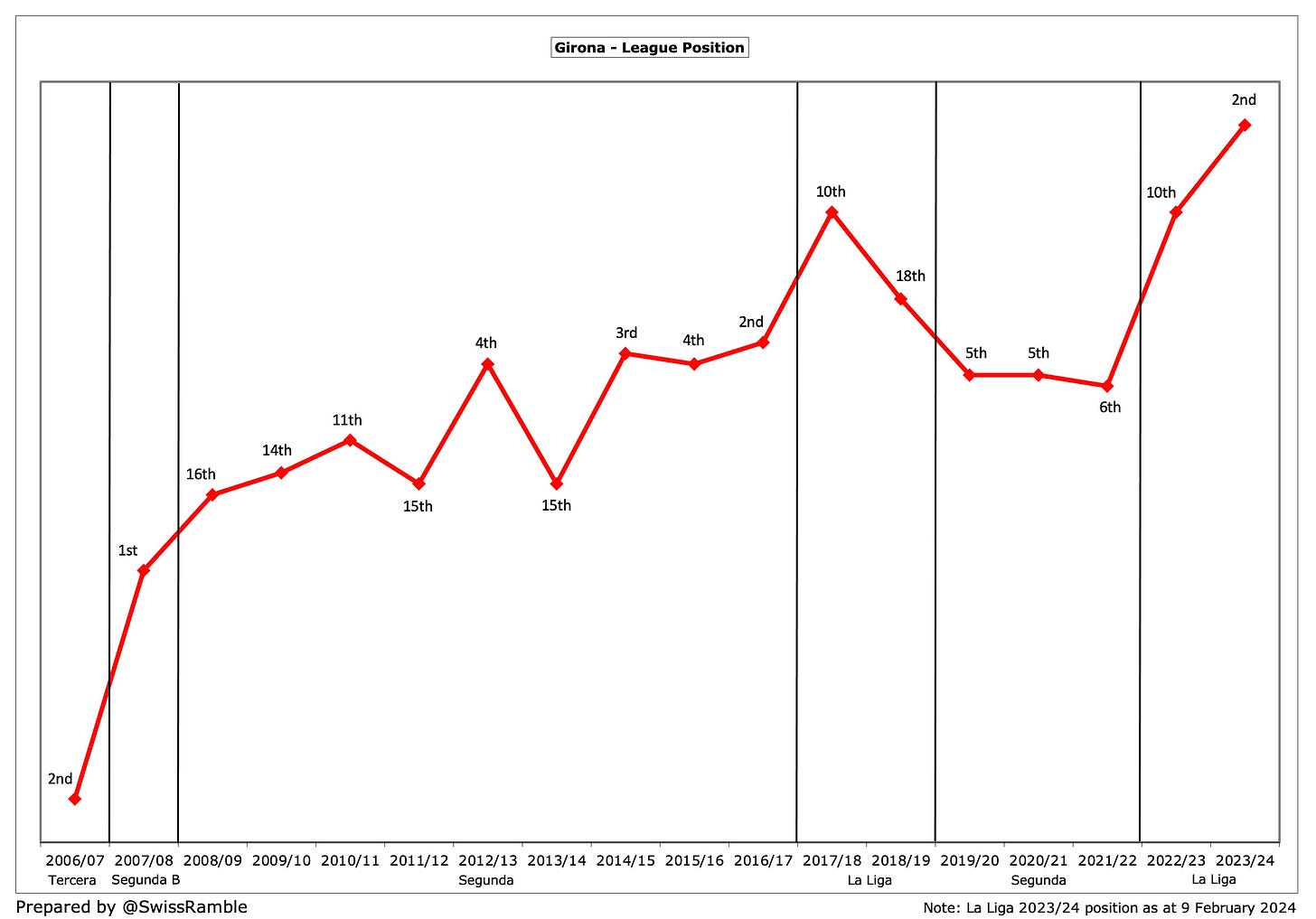

Progress through the Leagues

This reaction was understandable, given that Girona’s promotion in 2021/22 was only secured via the play-offs after the club finished sixth in the Segunda division. In fact, this was only the second time that the club from Northern Catalonia had reached La Liga, having spent two years in the top flight after promotion in 2016/17.

Ten years before that they had been playing in the lower leagues, the Segunda B and even the Tercera, so it’s clear that Girona have come a very long way in a relatively short period.

They will be disappointed by Saturday’s heavy defeat at the hands of Real Madrid, but the fact is that they still sit proudly in second place at the time of writing.

The obvious question is how they have managed to achieve this?

CFG Benefits

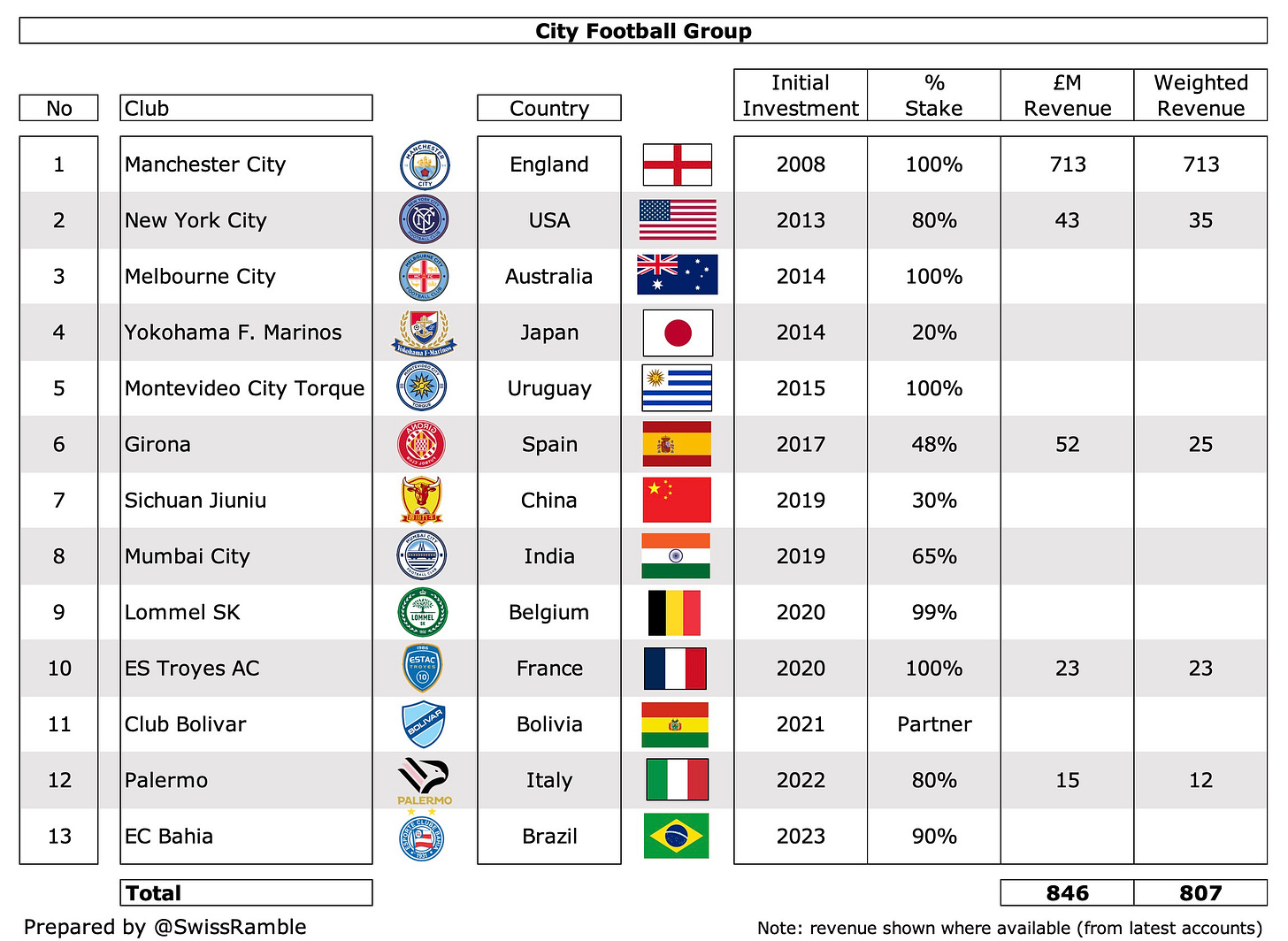

Of course, many will point to the fact that Girona are a part of the City Football Group (CFG), who are probably the most successful example of multi-club ownership in the world of football. Largely owned by Abu Dhabi United Group, they first acquired Manchester City in 2008, but have significantly expanded their empire since then after investing in another 12 clubs all around the world.

CFG bought a 44.3% stake in Girona in August 2017 with the same amount held by a consortium led by Pere Guardiola, whose more famous brother is the Manchester City manager, Pep Guardiola.

According to Girona's official statement at the time, the club was looking to “benefit from the knowledge and proven experience of the City Football Group, as well as its extensive network of infrastructure, technical teams, talent acquisition, development of young players and executive leadership, along with its global media, marketing and commercial potential.”

Mas-Bagà added, “We are a fully international and global football club platform, something unique in the world. The synergies are very positive in many ways, both in a sporting sense and in a business sense.”

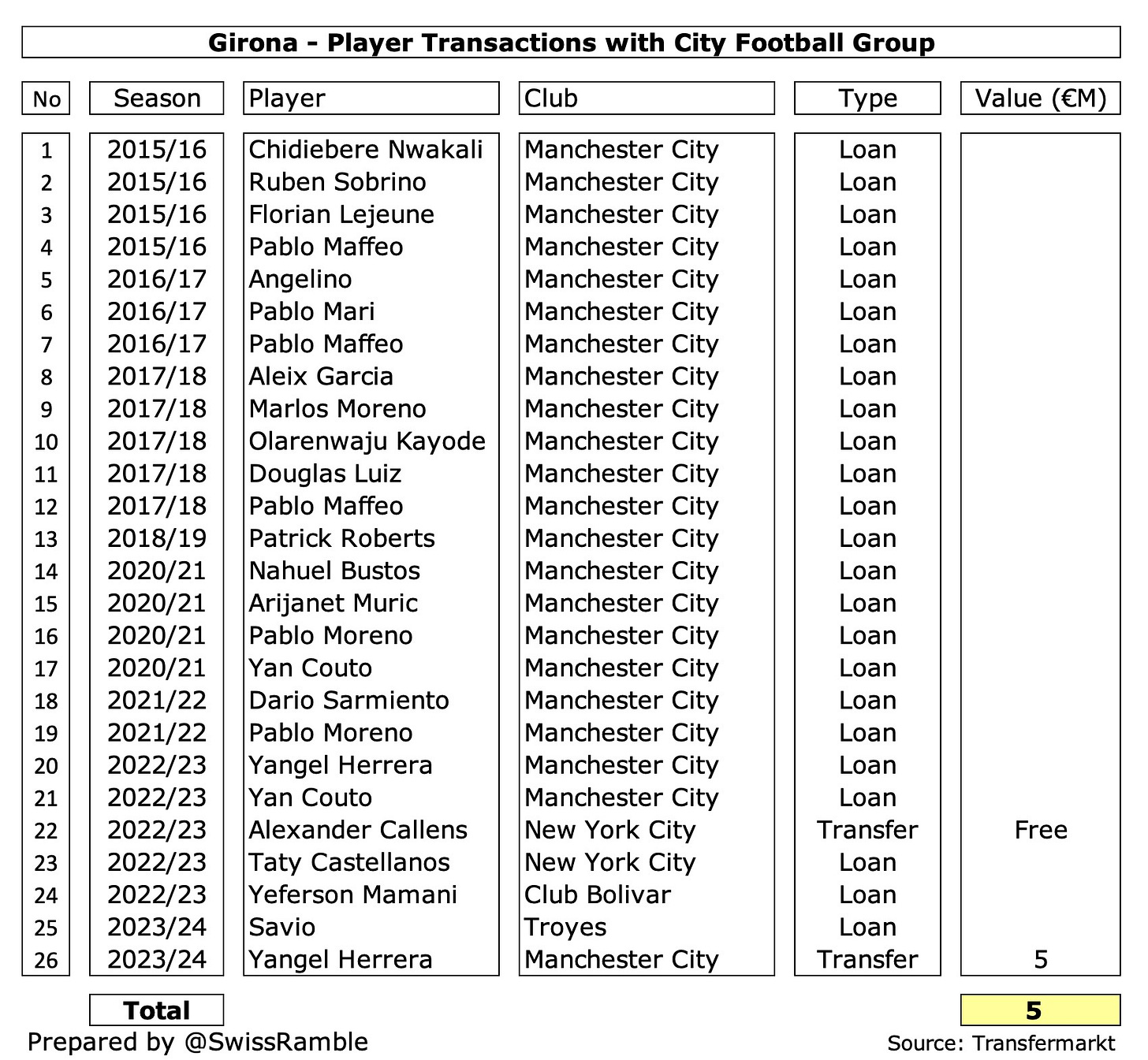

CFG Transfers

One of the major advantages of being part of CFG is that it makes it a more attractive proposition for good players. As Pere Guardiola said, “Linking to a brand like City means that Girona can attract much more talent.” This was surely one of the factors that helped bring Ukrainian internationals, Artem Dovbyk and Viktor Tsyhankov, to the Montilivi.

Mas-Bagà agreed, “It gives us opportunities to look for potential players that can come here on loan.” In this way, Girona have been boosted by numerous arrivals from CFG over the years, largely on loan from the “mother ship”, i.e. Manchester City.

There have only been a couple of permanent transfers in this time, though this does include the important acquisition of Venezuelan midfielder Yangel Herrera for a very reasonable €5m.

Thanks to being part of CFG’s empire, Girona not only offer a player the possibility of playing in one of the best leagues in the world, but also a clear career development plan.

A recent example is Sávio, who was bought by Troyes, another CFG member, for a club record €6.5m, but was then loaned to Girona without playing a single game for the French team. After scoring some important goals this season, the Brazilian winger has just signed a deal to join Premier League champions Manchester City in the summer.

All that being said, Girona’s current squad only includes two loan players who are currently part of CFG’s empire, namely Sávio and fellow Brazilian Yan Couto, though it does also feature three players who have been on Manchester City’s books at some stage (Herrera, Aleix Garcia and Eric Garcia).

Other Owners

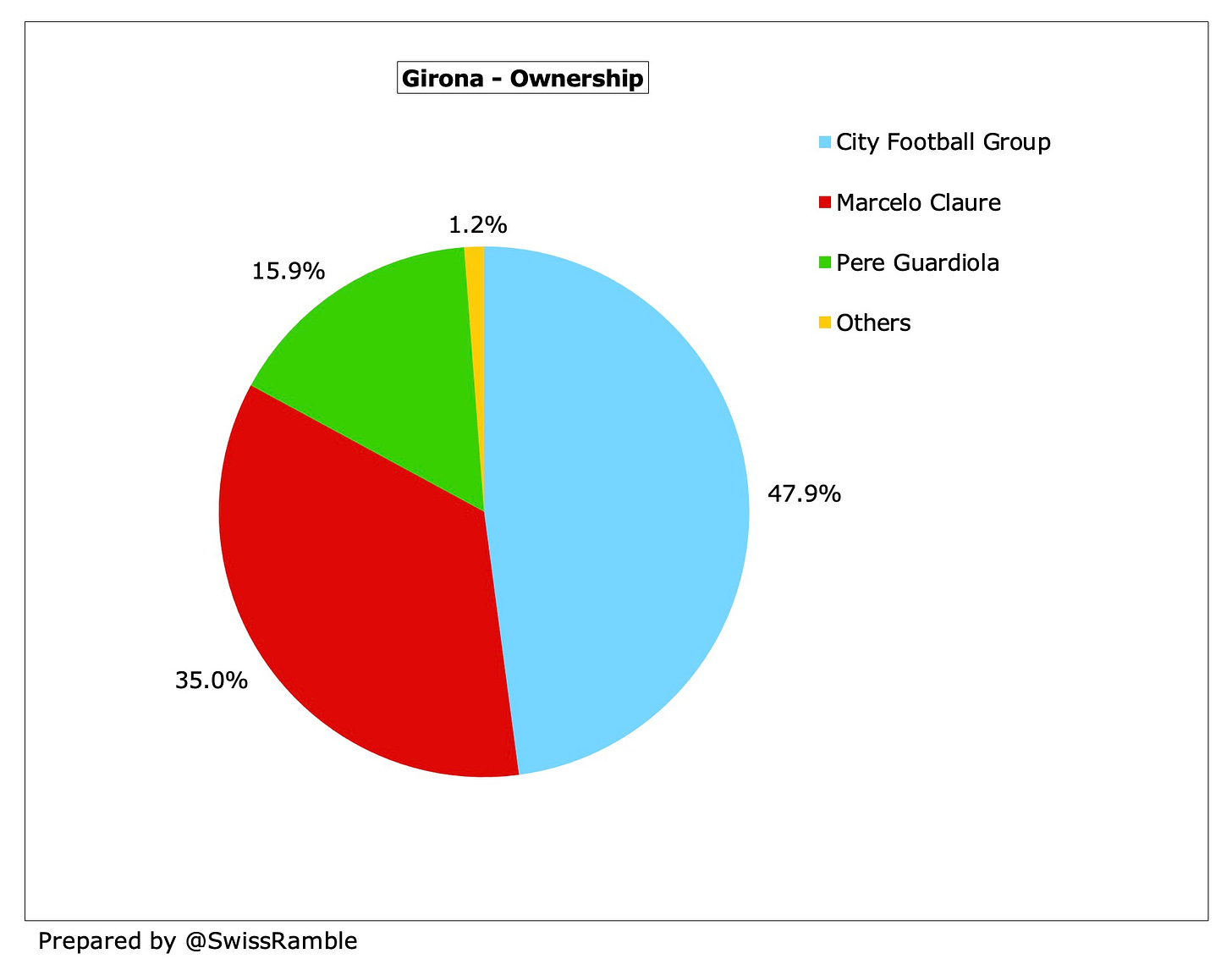

Since August 2002 Girona have had another powerful shareholder in the shape of highly successful businessman Marcelo Claure, founder of Brightstar and COO of Softbank, who bought a 35% stake in the club. The American-Bolivian is also the president of CFG partner Bolivar, the most popular club in Bolivia, and was a joint founder of MLS club Inter Miami.

As a result of this transaction and other deals, Guardiola’s shareholding reduced to 15.9%, while CFG’s increased to 47.9%.

The club’s executive management is at pains to emphasise that, while they have certainly benefited from being part of CFG, Girona are far more than just a Manchester City subsidiary. Guardiola argued, “We have run the club from here since day one.”

Mas-Bagà confirmed this point, “Girona is managed from Girona. This is important to make clear. Nobody tells us what, how and why in an authoritarian way. It’s important to note that the day-to-day running of the club is carried out from Girona.”

Whatever people might believe about the level of Girona’s independence, there is no doubt that the club has punched well above its weight, as its financial resources are much smaller than its Spanish rivals, as can be seen by reviewing the financial results for the 2022/23 season.

Profit/(Loss) 2022/23

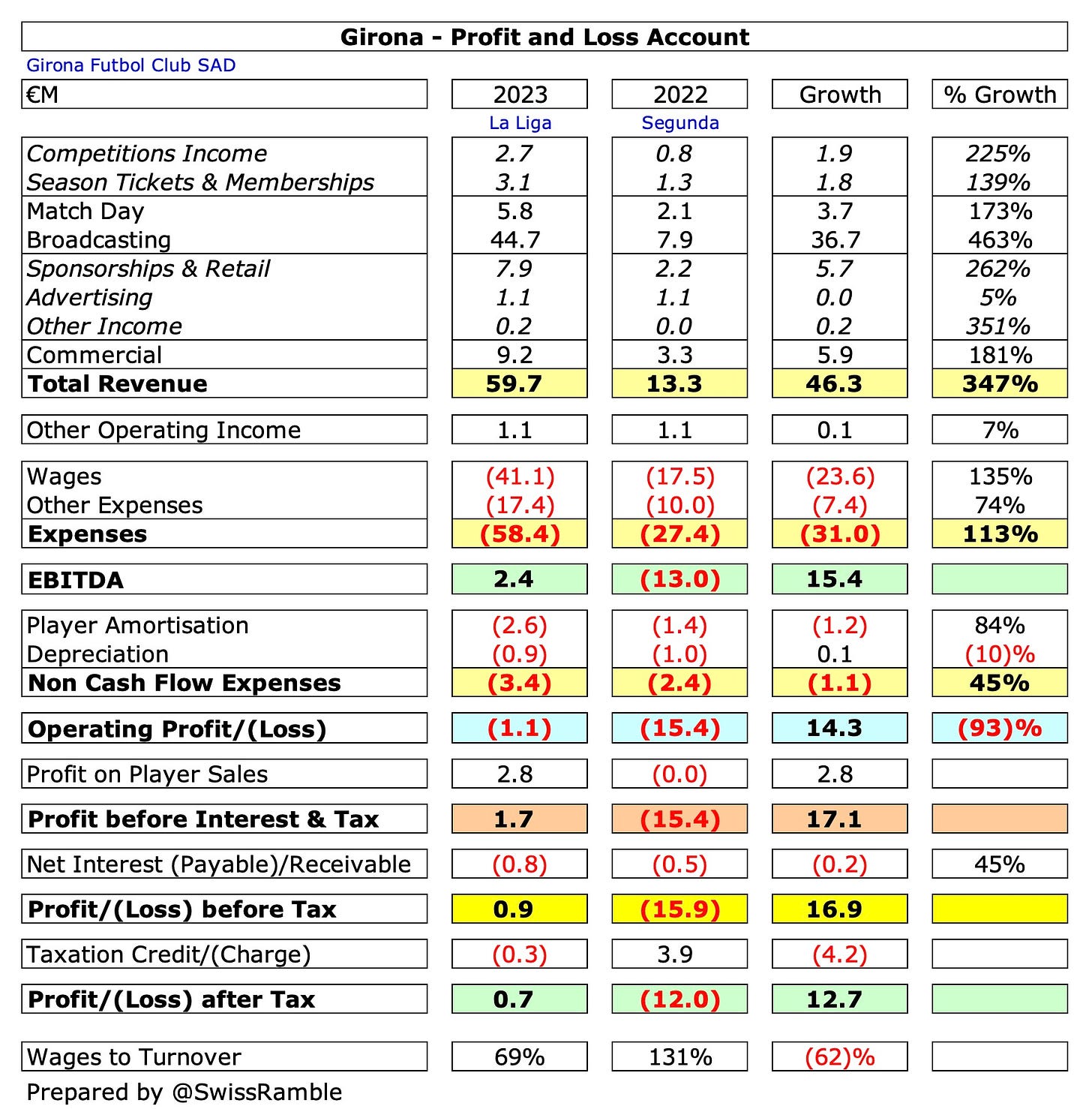

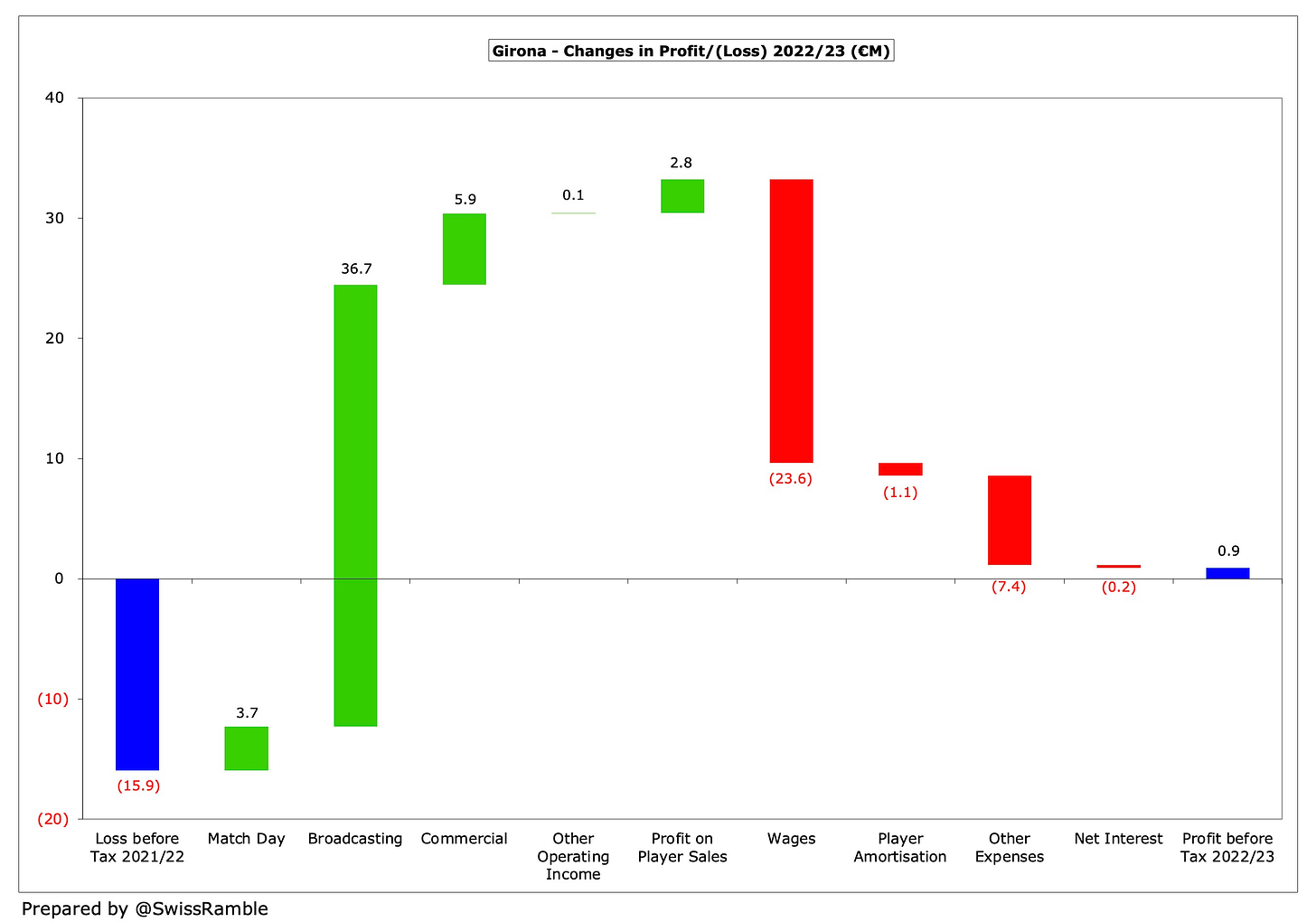

Girona managed to generate a small €0.9m pre-tax profit in their first season back in La Liga in 2022/23, which was a lot better than the €15.9m loss they made the previous season in the Segunda division, though that was partly driven by a promotion bonus.

Revenue more than quadrupled from €13.3m to €59.7m and profit from player sales was up from basically nothing to €2.8m, though this was partly offset by operating expenses more than doubling from €29.8m to €61.9m.

After tax Girona swung from a €12.0m loss to a €0.7m profit. The year-on-year improvement was smaller, as the previous season benefited from a €3.9m tax credit.

Following promotion, there were increases in all three revenue streams, though broadcasting led the way, thanks to the much better TV deal in La Liga, rising by €36.8m from €7.9m to €44.7m. Commercial nearly tripled, rising €5.9m from €3.3m to €9.2m, as did match day, up €3.7m from €2.1m to €5.8m.

As would be expected, Girona’s budget was much bigger in a higher division, as wages increased by €23.6m (135%) from €17.5m to €41.1m, and player amortisation nearly doubled from €1.4m to €2.6m. In addition, other expenses shot up €7.4m (74%) from €10.0m to €17.4m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.