Inter’s 2023/24 accounts cover a season when they won Serie A, the second time that they had secured the league title in four years, and beat Napoli to win the Supercoppa Italiana, though they were beaten by Bologna in the last 16 of the Coppa Italia.

They also reached the last 16 of the Champions League before being eliminated by Atletico Madrid, which was a decent performance, but could not match the previous season, when the Nerazzurri got as far as the final, where they were narrowly defeated by Manchester City.

Ownership

Despite the success on the pitch, Inter’s ownership changed hands in May 2024, when Oaktree Capital Management became the new majority shareholder, increasing the number of American owners in Italy.

This was because the previous owners, the Chinese conglomerate Suning Group, had failed to repay a loan from Oaktree by the agreed deadline. Suning president, Steven Zhang, had been attempting to negotiate a loan with US fund Pimco in order to pay off the debt, but the talks came to nothing.

In May 2021 Oaktree had provided what it described as “rescue capital” to stabilise Inter’s financial situation, as it was confronted by huge losses, exacerbated the onset of the COVID pandemic.

This enabled the club to pay its players and staff, but this lifeline came at a price in the form of a €275m 3-year loan at 12% interest, which had grown to a hefty €395m at maturity. In the event of default, Oaktree would get their hands on the club, which is exactly what happened.

Suning had acquired their majority share (68.6%) in June 2021 for around €270m at a time of much Chinese investment into European football clubs. However, the Chinese government subsequently imposed restrictions on overseas spending, leading to problems for the club owners.

In Inter’s case, this has resulted in the exit of Suning and arrival of Oaktree, so what sort of financial situation has been inherited by the new owners?

Profit/(Loss) 2023/24

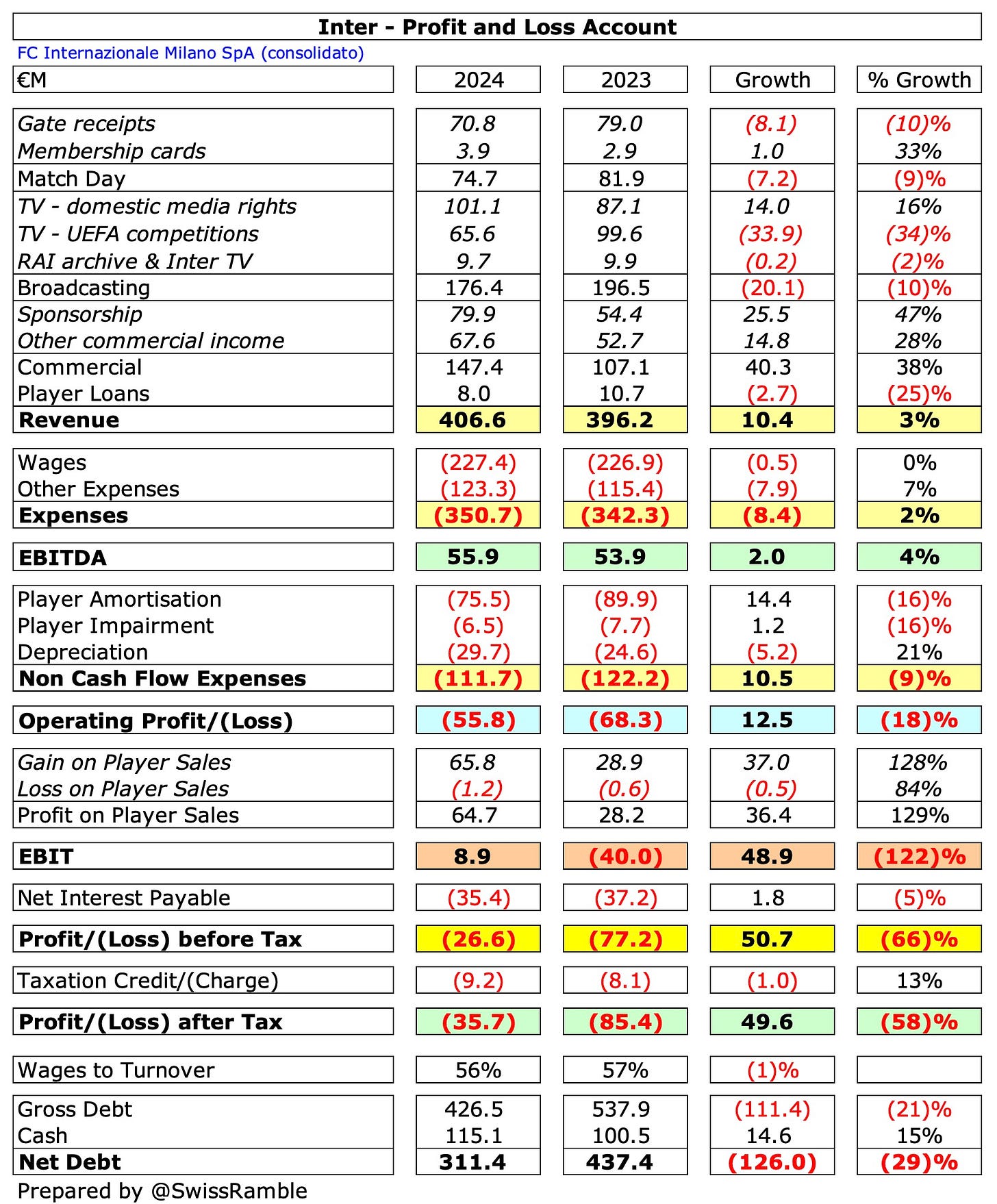

There was a significant improvement in Inter’s bottom line last season, as the pre-tax loss reduced by around €50m from €77m to €27m (€36m after tax).

The improvement was largely driven by higher profit from player sales, which more than doubled from €28m to €65m. Revenue also rose €11m (3%) from €396m to €407m, a new club record, while operating expenses were €2m lower at €462m.

Net interest payable also fell €2m (5%) from €37m to €35m, though this is still a huge interest burden, taking the club into a loss-making position. Indeed, it’s worth underlining the fact that Inter were actually profitable before charging interest.

The club said that the “positive sporting results” had contributed to the revenue growth, particularly in commercial, which rose €40m (38%) from €107m to €147m.

However, less progress in the Champions League led to falls in both broadcasting, down €20m (10%) from €196m to €176m, and match day, down €7m (9%) from €82m to €75m. Player loans and other income from player management also decreased from €11m to €8m.

As a technical aside, this international definition of Inter’s €407m revenue is different to the one used in the club accounts, which also includes the €66m gain on player sales plus €1m capitalisation of youth programmes.

That gives a total revenue of €473m, which was €48m (11%) higher than the prior year’s €425m, due to the sharp increase in player sales. Looking at revenue on this basis, this was another all-time high for the club.

Inter’s wage bill was virtually unchanged at €227m, though player amortisation dropped by €15m (16%) from €90m to €75m, while player write-downs were slightly down from €8m to €7m.

On the other hand, other expenses grew €8m (7%) from €115m to €123m, while depreciation increased by €5m (25%) from €25m to €30m.

Despite the big improvement, the harsh reality is that Inter still posted a €27m pre-tax loss in 2023/24, though this was much better than Juventus’ enormous €196m deficit. In contrast, Milan made a €12m profit, while Lazio did even better last season with a €41m surplus.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.