Juventus’ 2023/24 accounts cover a season when they finished third in Serie A and won the Coppa Italia after defeating Atalanta in the final.

However, they did not play in Europe for the first time since 2011/12, which really hurt the club’s finances.

This was because UEFA punished Juventus for breaches of the August 2022 FFP settlement agreement by excluding them from Europe, while also fining them €20m (though €10m was conditional, depending on whether they met future financial targets).

Juve waived their right of appeal, which made sense from a financial perspective, as they only lost money from the Europa Conference League, as opposed to potentially missing out on the far more lucrative Champions League.

As a result of their various legal issues, Juventus had been given a 10-points penalty by the Italian authorities, which was enough to drop them from third to seventh in Serie A in 2022/23, meaning that they only qualified for the Conference League (before the ban).

League Position

In truth, Juventus were already struggling on the pitch (by their own high standards). Having won the league nine seasons in a row, they dropped down to fourth place in both 2020/21 and 2021/22.

The partial recovery to third place last season was important, as it meant that Juventus are back in the Champions League this season.

Eve so, Massimiliano Allegri was “relieved of his position” towards the end of last season, replaced by Thiago Motta after his fine achievements at Bologna.

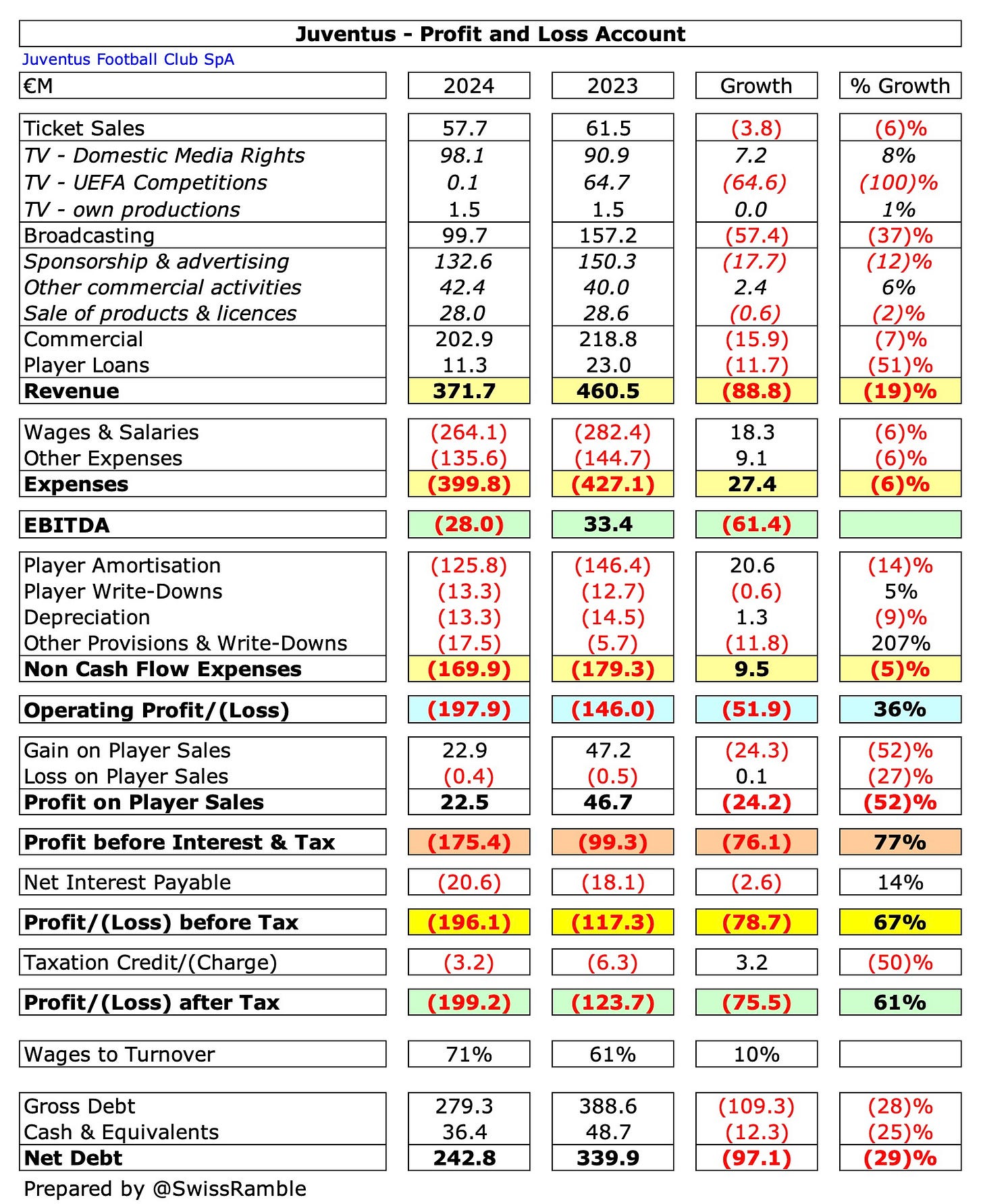

Profit/(Loss) 2023/24

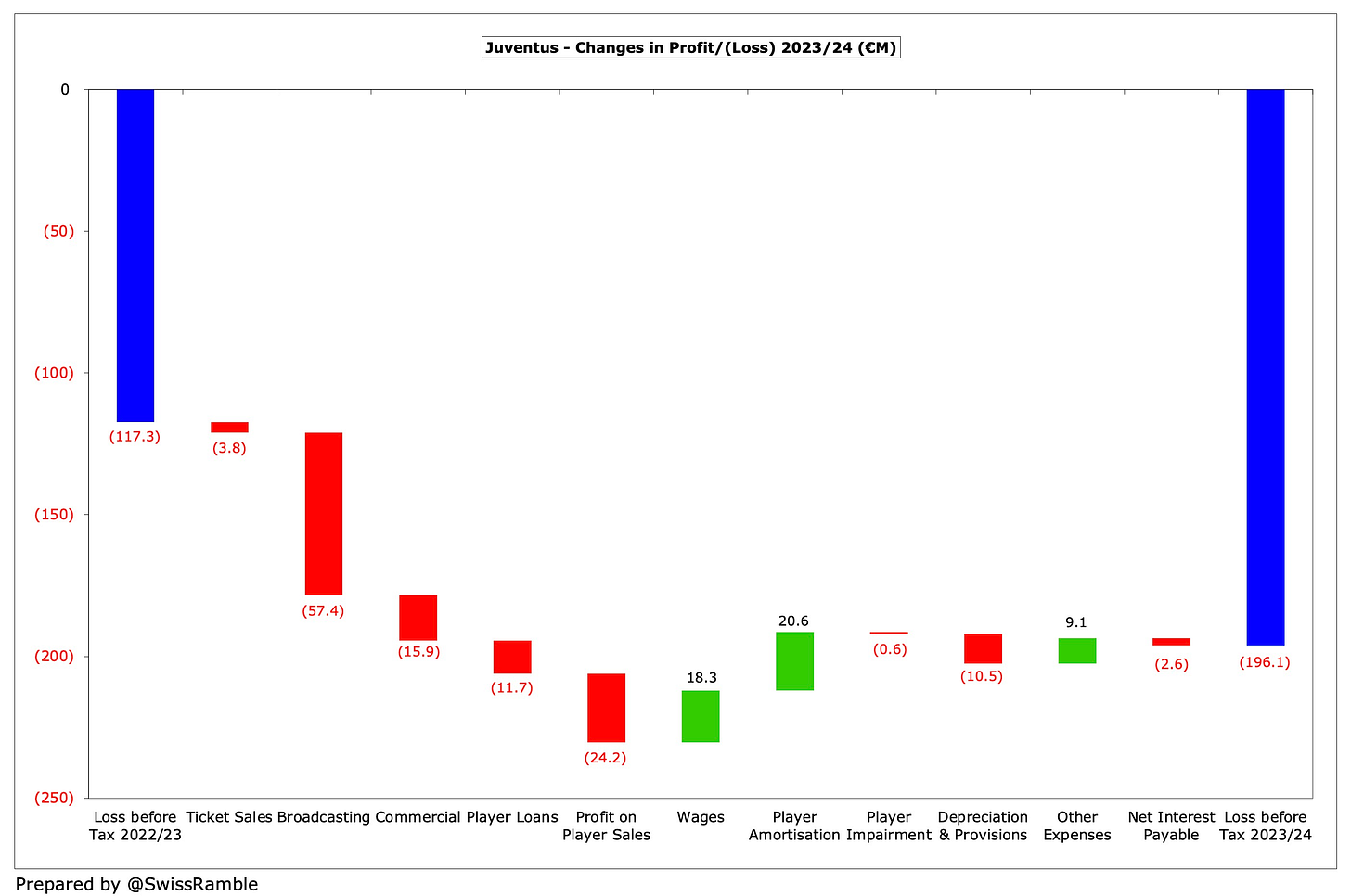

Juventus’ pre-tax loss significantly increased from €117m to €196m (€199m after tax), which the club said was “heavily influenced by the non-participation in UEFA competitions”, as well as €36m of non-recurring costs.

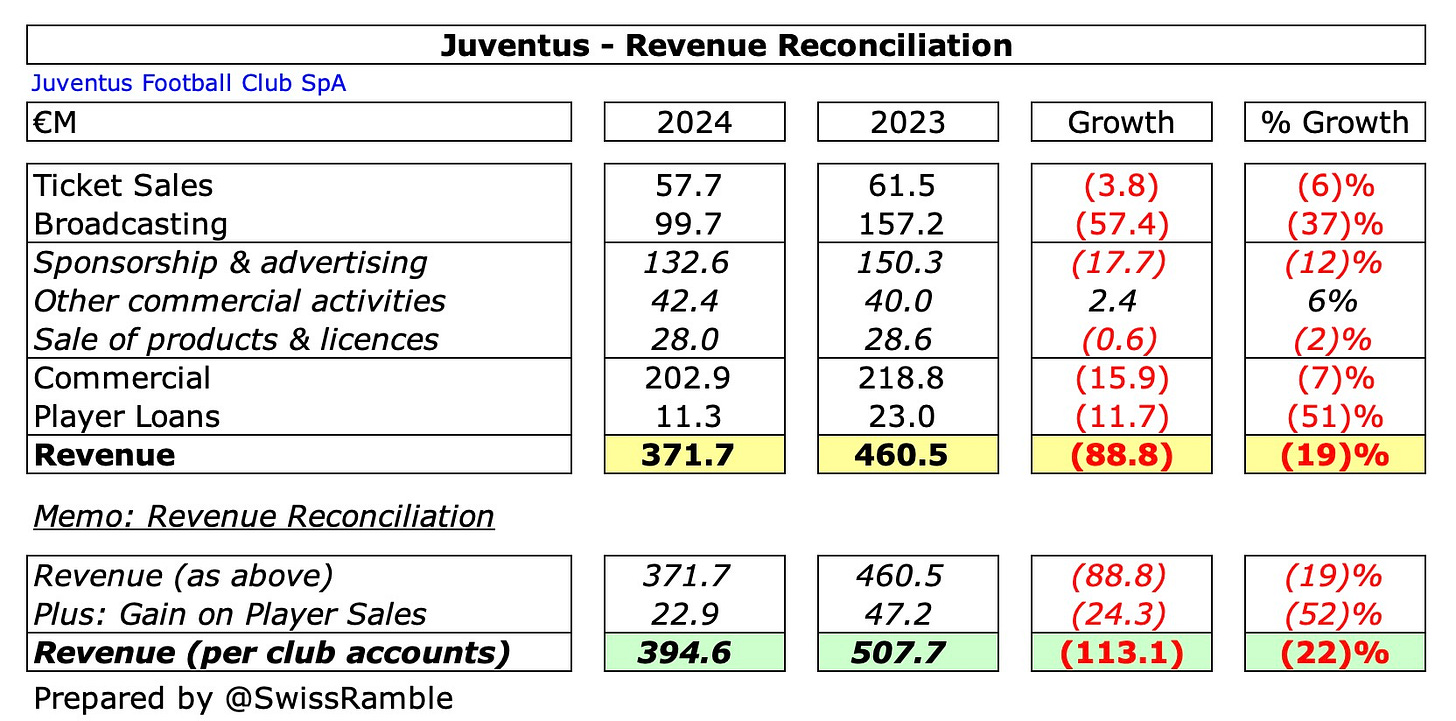

Revenue fell €89m (19%) from €461m to €372m, while profit on player sales more than halved from €47m to €22m.

This was partly offset by a reduction in operating expenses, which were cut by €37m (6%), though net interest payable increased by €3m (14%) to €21m.

The main driver for the steep revenue decrease was broadcasting, which dropped €57m (37%) from €157m to €100m. entirely due to the lack of European TV money.

The other revenue streams were also impacted by not playing in Europe, as ticket sales fell €4m (6%) from €62m to €58m, while commercial decreased €16m (7%) from €219m to €203m.

In addition, player loans were down more than 50% from €23m to €11m.

As a technical aside, this international definition of Juventus’ €372m revenue is different to the one used in the club accounts, which also includes a €23m gain on player sales, giving total revenue of €395m. This was €113m (22%) lower than the prior year’s €508m.

Juventus said that they had benefited from “the decisive actions taken in recent years to structurally rationalise costs”.

As a result, their wage bill dropped €18m (6%) from €282m to €264m, while player amortisation (including write-downs) fell €20m (13%) from €159m to €139m. In addition, other expenses decreased €9m (6%) from €145m to €136m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.