These are heady times for Liverpool fans with the Reds 13 points clear in the Premier League, having also finished top of the sexy new league phase in the Champions League.

They may have been concerned after the departure of the hugely charismatic Jürgen Klopp, but Arne Slot has proved an inspired choice as his replacement, having been brought in from Feyenoord.

So it probably came as something of a surprise last week when the club announced a massive loss for the 2023/24 season, though this did reflect results on the pitch, as they only played in the Europa League, where they reached the quarter-finals, as opposed to the far more lucrative Champions League.

They finished third in the Premier League, two places better than the previous season, while they won some silverware after beating Chelsea in the Carabao Cup final, though they were eliminated in the FA Cup quarter-finals by Manchester United.

The women’s team finished in an encouraging 4th place in the WSL, up from the prior year’s 7th.

Profit/(Loss) 2023/24

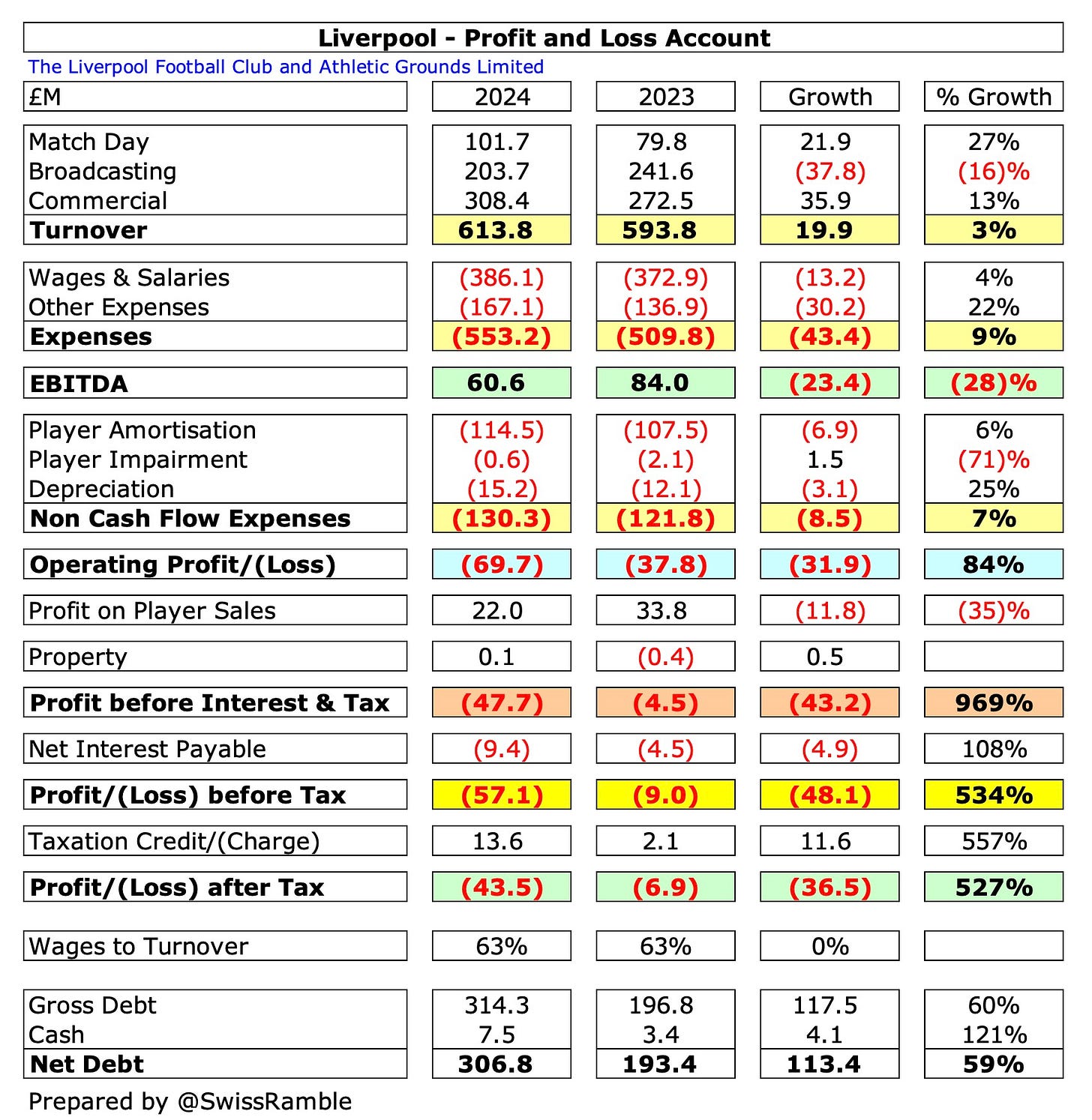

Liverpool’s pre-tax loss significantly widened from £9m to £57m, which is not only the largest under FSG, but is actually the club’s highest ever.

Despite missing out on the Champions League, Liverpool still managed to increase revenue by £20m (3%) from £594m to £614m, a new club record, though profit from player sales fell £12m from £34m to £22m.

However, there was steep growth in operating expenses, which shot up £52m (8%) from £632m to £684m, while net interest payable more than doubled from £4.5m to £9.4m.

The loss after tax was smaller at £43m, thanks to a £14m tax credit.

As a result of only playing in the Europa League, Liverpool saw a drop in broadcasting, which fell £38m (16%) from £242m to £204m.

However, this was more than compensated by growth in both commercial, up £36m (13%) from £272m to £308m, and match day, up £22m (27%) from £80m to £102m. Both these revenue streams established new club highs.

The main reason for Liverpool’s higher loss was the sharp increase in the cost base. Wages rose £13m (4%) from £373m to £386m, another club record, while player amortisation was up £7m (6%) from £107m to £114m.

Depreciation grew £3m (25%) from £12m to £15m, but the largest increase was in other operating expenses, which surged £30m (22%) from £137m to £167m.

Although a loss is rarely good news, especially if it’s as much as £57m, Liverpool’s deficit is actually only mid-table in the Premier League, where nearly half of the clubs lost more than £50m, led by Manchester United’s awful £131m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.