Manchester United have published their financial results for the 2022/23 season. These covered a promising first season under manager Erik ten Hag, as United ended a six-year trophy drought by winning the Carabao Cup, while they also reached the final of the FA Cup, though they were eliminated in the quarter-finals of the Europa League by eventual winners Sevilla.

Most importantly from a financial perspective they finished third in the Premier League, thus securing a return to the lucrative Champions League in 2023/24.

Profit/(Loss) 2022/23

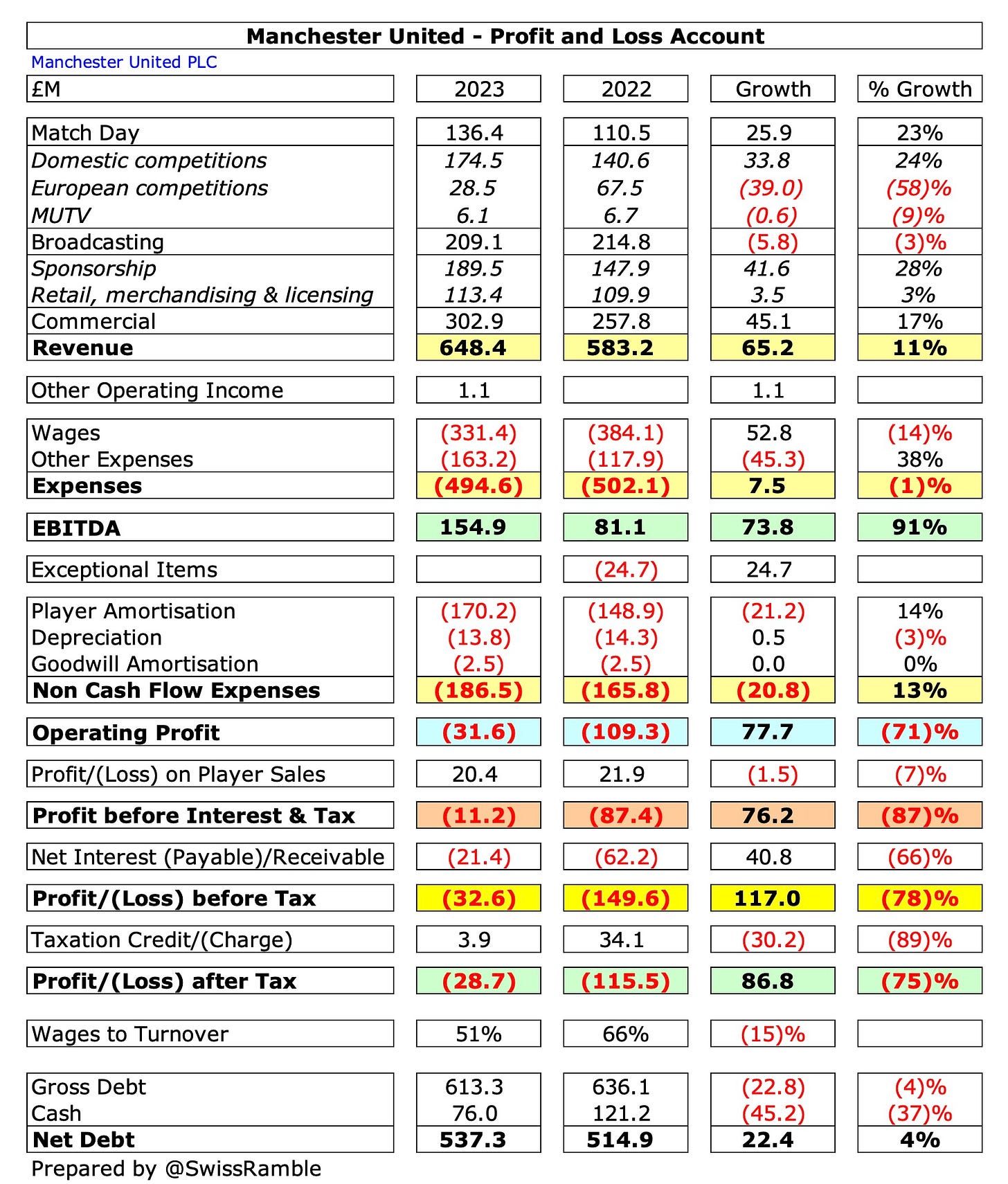

Manchester United significantly reduced their pre-tax loss by £117m from £150m to £33m, as revenue rose £65m (11%) from £583m to £648m, which was not only a new club record, but the highest ever reported in England.

That was obviously good news, especially in a year when United did not participate in the lucrative Champions League, but it’s worth remembering that the club still posted a loss, despite all the impressive revenue progress.

Profit from player sales fell £2m from £22m to £20m. However, operating expenses were cut by £11m (2%) to £681m, while net interest payable decreased by nearly two-thirds from £62m to £21m.

The loss after tax also reduced by £87m from £116m to £29m, though the decrease was not as much as with the pre-tax result, due to the tax credit falling from £34m to £4m.

United’s revenue growth was driven by new club records for both commercial, which shot up £45m (17%) from £258m to £303m, and match day, up £25m (23%) from £111m to £136m. On the other hand, broadcasting slightly dropped by £6m (3%) from £215m to £209m.

United’s wages decreased £53m (14%) from £384m to £331m, though player amortisation grew £21m (14%) from £149m to £170m and other expenses shot up £45m (38%) from £118m to £163m. In addition, this year benefited from no repeat of the previous year’s £25m exceptional charge for management changes.

The impact of interest payable on United’s accounts continues to be very evident, falling by £41m (66%) from a very high £62m in 2021/22 to “only” £21m last season, which was more in line with previous years.

The significant swings arise largely because the majority of the club’s debt is denominated in USD and unhedged, so the favourable movement in the exchange rate for the Pound against the Dollar has led to lower interest charges in the club’s accounts, which are reported in Sterling.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.