Manchester United have published their financial results for the 2023/24 season, which even their most fervent supporters would admit was not a great success on the pitch.

They finished eighth in the Premier League, the club’s worst position since 1989/90, even ending up with a negative goal difference. In addition, they finished rock bottom in their Champions League group with just four points.

The one bright point last season came when United deservedly defeated Manchester City at Wembley to win the FA Cup for a 13th time, thus qualifying for the Europa League.

This period also included the official confirmation of the deal whereby Sir Jim Ratcliffe’s INEOS acquired a 27.7% stake in United via Trawlers Limited.

Although this is only a minority stake, Ratcliffe now has charge of the football operations, leading to many changes in the leadership team, including a new chief executive Omar Berrada, who has moved from rivals Manchester City, and a new CFO Roger Bell, who has held the same role at INEOS.

Closer to the pitch, Dan Ashworth has been snapped up from Newcastle United as sporting director, while Jason Wilcox has been brought in from Southampton as technical director.

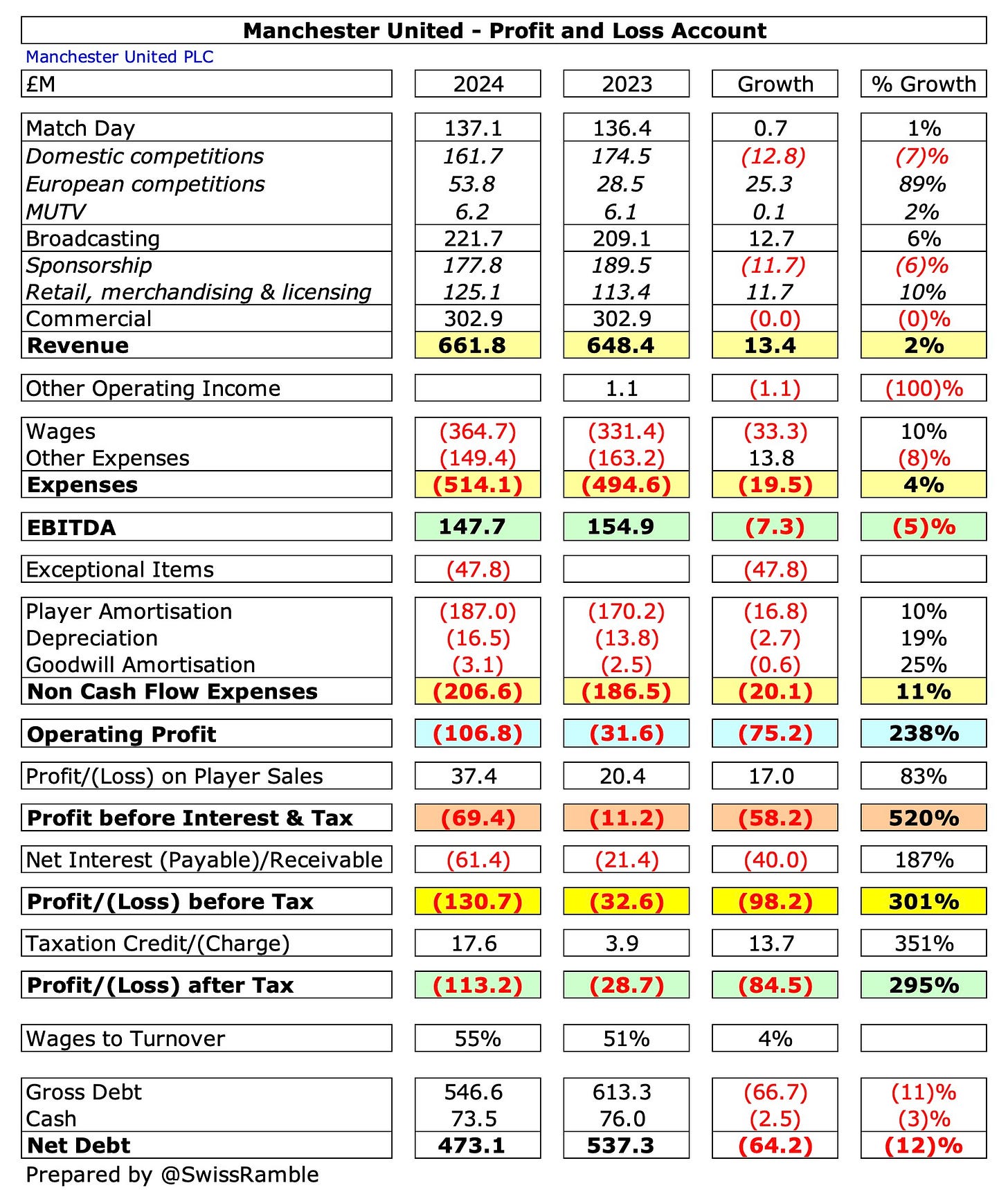

Profit/(Loss) 2023/24

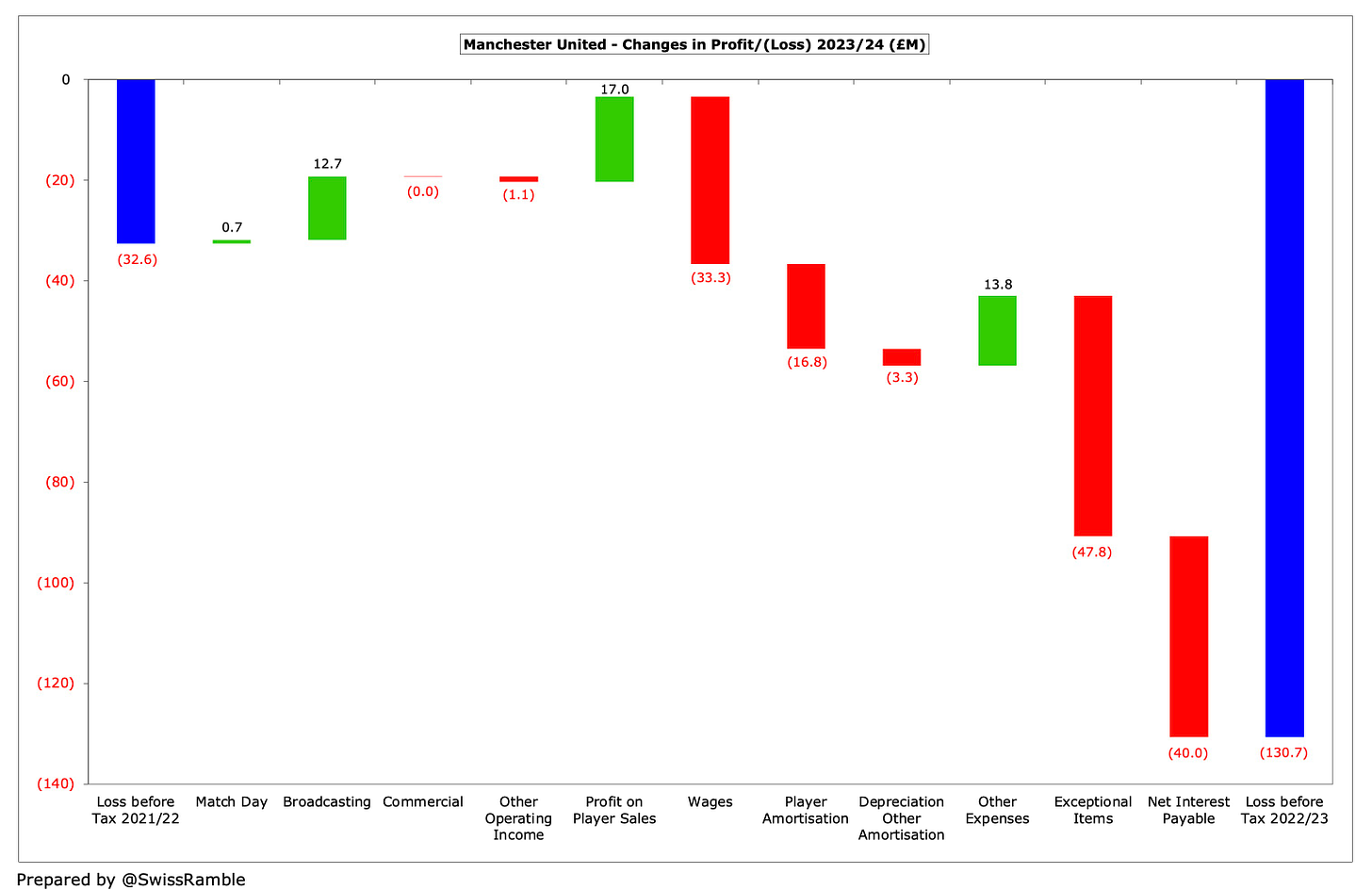

Manchester United’s results were a mixed bag. On the plus side, revenue rose £14m (2%) from £648m to a new club record of £662m, and profit from player sales increased by £17m from £20m to £37m, their best result for 15 years.

However, the good news ends there, as the pre-tax loss quadrupled, widening by £98m from £33m to £131m, the second worst in United’s history.

Operating expenses grew £40m (6%) to £721m, while net interest payable almost tripled, rising by £40m from £21m to £61m.

In addition, the club booked £48m of exceptional charges, mainly related to the strategic review and share sale agreement with Sir Jim.

The loss after tax also increased by £84m from £29m to £113m. This was a bit better than the pre-tax result, as there was an £18m tax credit.

The revenue growth was driven by the return to the Champions League, which led to an increase in broadcasting, up £13m (6%) from £209m to £222m, while match day was slightly up from £136m to £137m, though this was a new high for the club. Commercial was flat at £303m.

Investment in the squad led to steep 10% increases in both wages, up £34m from £331m to £365m, and player amortisation, which rose £17m from £170m to £187m.

In contrast, other expenses fell £14m (8%) from £163m to £149m, though depreciation was up 19% to £17m.

Clearly, costs were impacted by the £48m of exceptional items. Nevertheless, even if these once-off charges were excluded, United’s pre-tax loss would still have significantly widened from £33m to £83m.

Interest Payable

The impact of interest payable on United’s accounts is also clearly evident, amounting to a hefty £61m in 2022/23, which represents a significant increase over the prior year.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.