Milan’s 2022/23 financial results cover a season when they finished fourth in Serie A and were eliminated in the last 16 of the Coppa Italia, but most impressively they got as far as the semi-finals of the Champions League, where they lost out to city rivals Inter.

Ownership

These were the first accounts reported under the ownership of US investment company RedBird Capital Partners, who purchased the club from Elliott Management in August 2022 in a €1.2bln deal that included a minority stake for Major League Baseball club, the New York Yankees.

RedBird already had some experience in the world of football via their controlling interest in French club Toulouse and an 11% stake in Fenway Sports Group, Liverpool’s owners.

Profit/(Loss) 2022/23

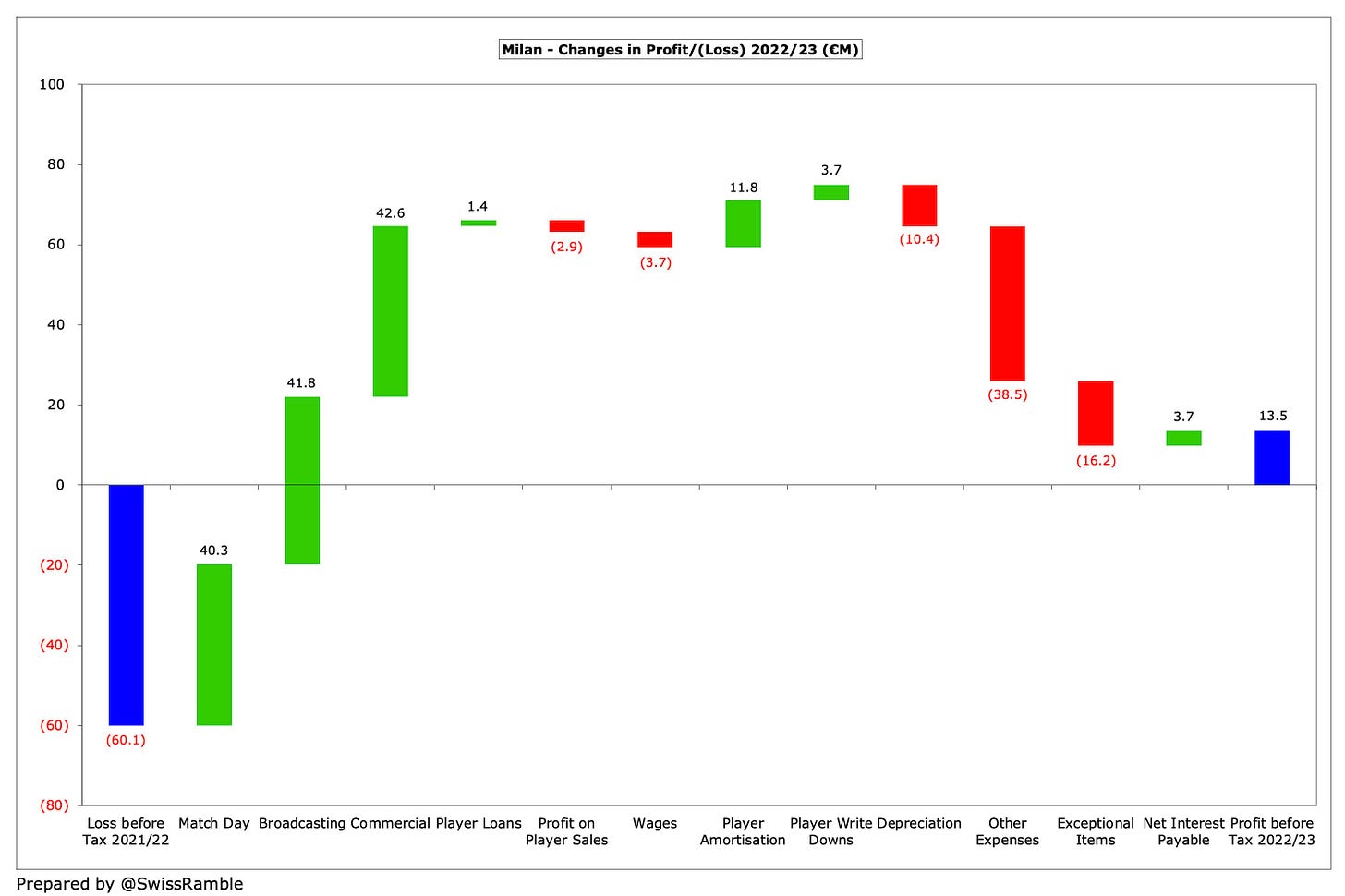

Milan’s success on the pitch helped them return to profit for the first time in 17 years, as they swung from a €60m pre-tax loss to a €14m profit, which chairman Paolo Scaroni described as an “important step”.

Scaroni added, “Combining sporting performance, global competitiveness and financial sustainability in football, when on a virtuous path, is possible.”

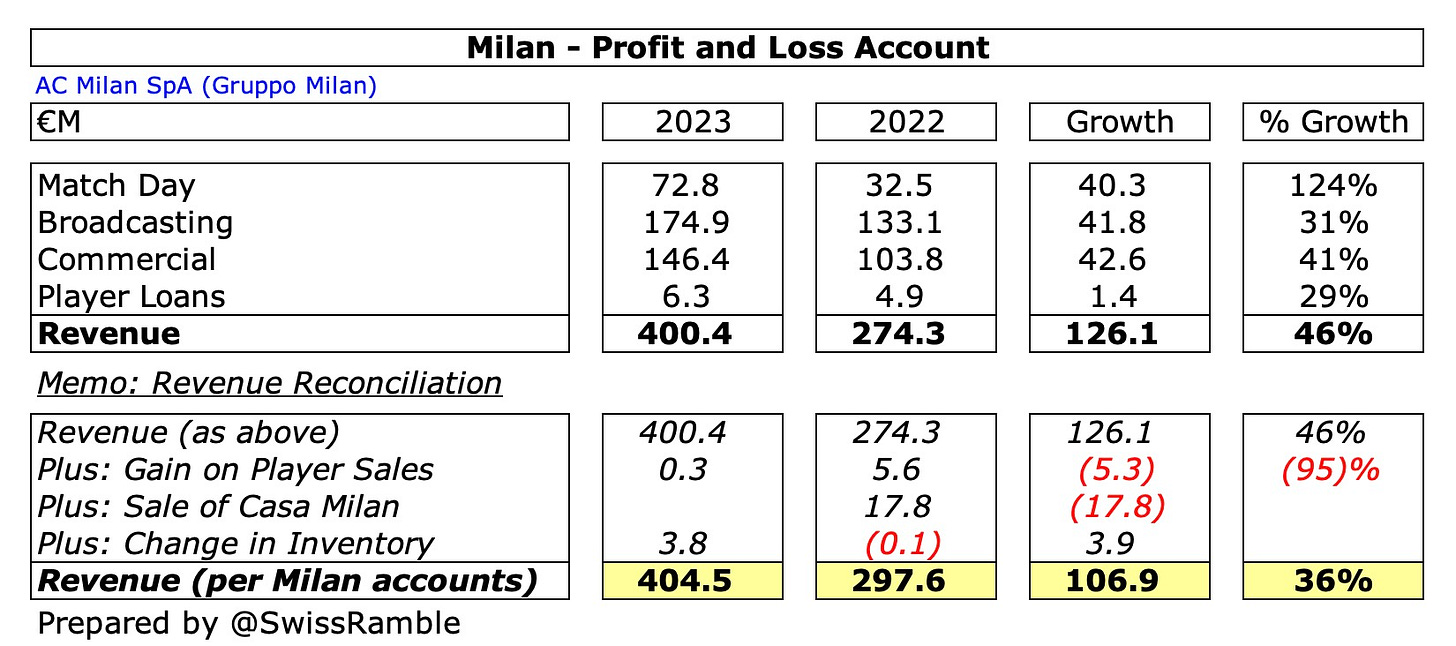

Revenue rose €126m (46%) from €274m to a club record €400m, slightly offset by profit from player sales falling from €3m to almost nothing.

Operating expenses increased by €36m (10%) to €386m, but net interest payable dropped €4m to only €1m. In addition, there was no repeat of the previous season’s €18m profit from the exceptional sale of Casa Milan.

Profit after tax was €6m, compared to prior year’s €67m loss.

All of Milan’s revenue streams experienced significant growth under the new ownership with each of them setting new club highs. Match day more than doubled from €33m to €73m; commercial rose 41% (€42m) from €104m to €146m; and broadcasting increased 31% (€42m) from €133m to €175m.

In addition, player loans income was up 29% to €6m.

As a technical aside, this international definition of Milan’s €400.4m revenue is different to the one used in the club accounts, which also includes the €0.3m gain on player sales and a €3.8m change in inventory. That gives total revenue of €404.5m, which has increased by €106.9m (36%) over prior year €297.6m.

Milan’s costs also increased, but at nowhere near the same rate as revenue. Wages slightly increased by 2% (€4m) from €170m to €174m, while player amortisation fell €12m (5%) from €63m to €51m and player write-downs halved from €8m to €4m.

On the other hand, other expenses grew €38m (40%) from €96m to €134m and depreciation nearly tripled from €6m to €16m.

Milan’s €14m pre-tax profit was the second highest in Serie A last season, albeit it was over €100m lower than Napoli’s €118m, though in fairness that was an Italian record. Both these results were in stark contrast to the large losses posted by the likes of Juventus €117m, Roma €99m and Inter €77m.

It was much the same story for the net figures after tax, though Milan’s €6m profit was also behind Cremonese €7m, as the Grigiorossi benefited from a smaller tax charge. Losses were even larger than before tax at Juventus €124m, Roma €103m and Inter €85m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.