Of all the compelling stories in French football this season perhaps the one that has left most observers scratching their head the most is the decline of Olympique Lyonnais, who are battling relegation and currently bottom of Ligue 1.

This disastrous start to the season seems almost unthinkable for a team that defeated the mighty Manchester City to reach the Champions League semi-final just three years ago, but in truth the club has been on a steady downward trend since then.

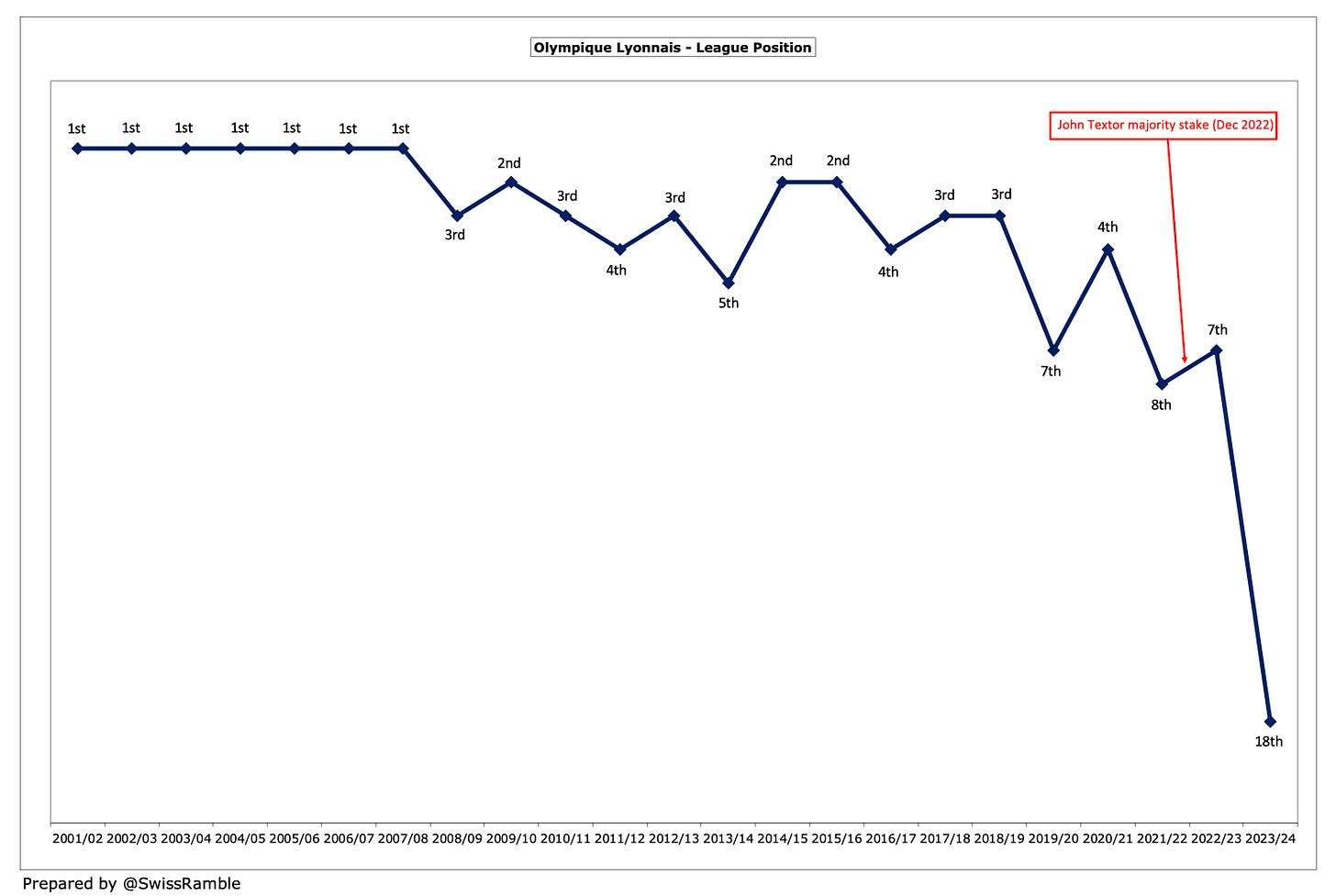

League position

After all, this is a club that won seven consecutive league titles in the early 2000s, but those heady heights are a distant memory now. Lyon finished in seventh place in Ligue 1 last season, once again failing to qualify for Europe, while their current league position is a lowly 18th.

In contrast, Lyon’s famous women’s team continues to shine, winning their 16th title in 17 years in 2022/23.

Managerial changes

Lyon have not helped themselves with a veritable managerial merry-go-round, as they have employed no fewer than six managers in the last four years, including Bruno Genesio, Sylvinho, Rudi Garcia and Peter Bosz. Most recently, Lauren Blanc was replaced by Fabio Gross. No matter whether they hired an old stager or an inexperienced coach, nobody has managed to reverse the club’s direction.

Takeover

Of course, that is not the only major change in recent times, as American investor John Textor bought a controlling stake in the club in December 2022 in a deal valuing Lyon at €884m. Following more share purchases, his holding is now up to around 88%. As a result, Jean-Michel Aulas, one of the most well-known owners in French football, relinquished control after 36 years in charge.

In May 2023 Textor was appointed chairman and also replaced Aulas as interim chief executive. The new owner was initially bullish about the club’s prospects, “I think over the next few years we want to go after PSG. We want to win titles here. We are going to show up and we are going to spend.”

It’s fair to say that things have not exactly worked out to plan, so Lyon’s fans are still waiting for the good times to roll, though various protests suggest that their patience is wearing thin.

Multi-club ownership

Textor purchased Lyon through his Eagle Football company, which also has investments in a few other football clubs: he owns around 46% of Premier League side Crystal Palace, has a majority shareholding in Brazilian club Botafogo and controls Belgian club RWD Molenbeek.

The ownership’s global strategy is “to further develop its capabilities, benefitting in particular from the resources and synergies (such as operational synergies between the aforementioned football clubs, notably relating to player transfers or player loans between such clubs, and the sharing of administrative and sport best practices), while retaining its identity, heritage and community base.”

Others have benefited from similar multi-club ownership models, most notably City Football Group and Red Bull, but it looks like Eagle’s operation will take a bit longer to bear fruit.

DNCG Transfer Restrictions

Lyon faced an additional hurdle this summer, when French football’s financial watchdog (the DNCG) insisted upon monitoring the club’s transfer activities and then restricting what Lyon could do in the transfer market, after it ruled Lyon “did not provide sufficient financial guarantees despite Textor’s financial arguments.”

Textor said that this had significantly damaged the club’s prospects: “It’s a terrible feeling to be going into this mercato with one hand tied behind our backs. We have the investment scale to position ourselves on players valued at €30m-€50m, but we can’t spend that money.”

The new owner further vented his spleen in a press release sarcastically entitled “Welcome to France”, when his frustrations were laid bare, “We were invited to purchase one of the true treasures of football in France. We were invited to pay out cash of nearly €400m to its long-time shareholders, pay €65m in cash to its interested public shareholders, pay down bank debt by €50m, then fund another €60m in cash (on short notice) just for cushion…but we are not yet invited to execute a business plan based on our beliefs, with a free hand, for the benefit of the community we serve.”

So let’s take a look at the club’s finances to try to understand: (a) how these might have contributed to Lyon’s issues; (b) the impact of the team’s deteriorating performances on the pitch. It’s not a simple case of “cause and effect”, but more of a vicious cycle.

Profit/(Loss) before Tax 2022/23

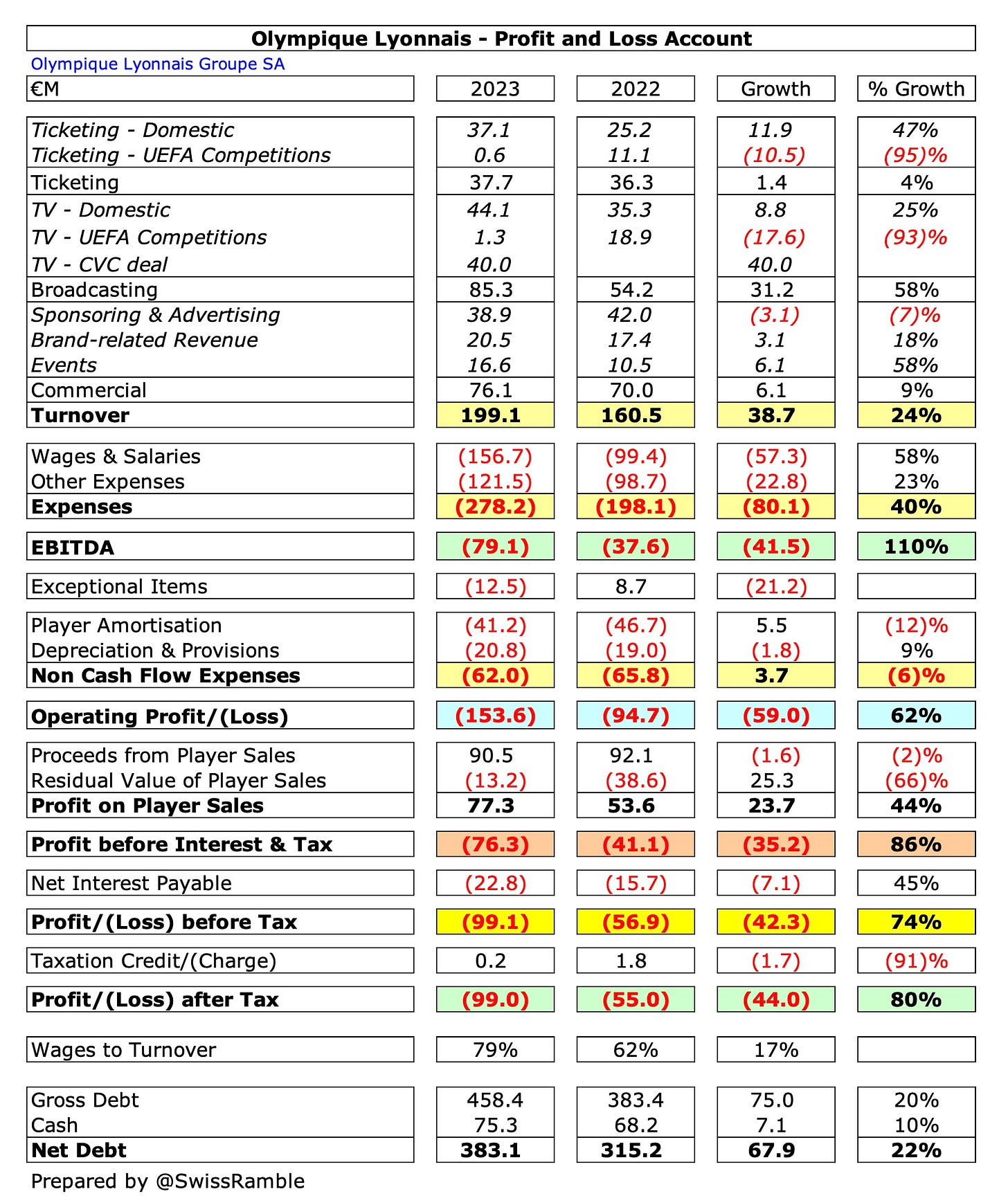

Lyon’s pre-tax loss significantly widened from €57m to €99m, despite revenue rising €39m (24%) from €160m to €199m and profit from player sales increasing from €54m to €77m. The worsening in the bottom line was driven by steep growth in operating expenses, which rose €76m (29%) from €264m to €340m, while net interest payable climbed €7m (45%) from €16m to €23m.

There was also a €21m adverse swing in exceptional items from prior year’s €9m credit, including €10m subsidies, to €12m charges, mainly €10m leaving compensation to Aulas.

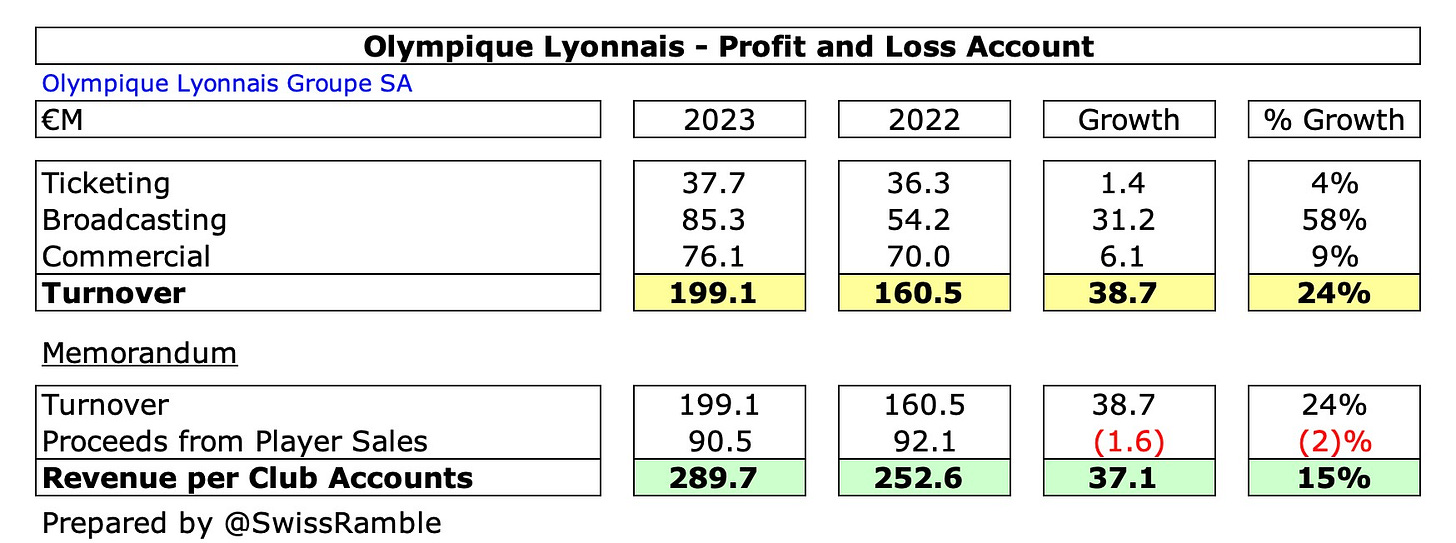

All three of Lyon’s revenue streams increased in 2022/23 with broadcasting leading the way, rising €31m (58%) from €54m to €85m, though this included €40m from the Ligue 1 CVC private equity deal, which disguised the impact of not playing in Europe. Commercial grew €6m (9%) from €70m to €76m, while ticket income was up €1.4m (4%) from €36.3m to €37.7m.

As a technical aside, Lyon’s press release refers to a 15% increase in revenue from €253m to €290m, as the club also includes €91m proceeds from player sales.

However, despite the poor displays on the pitch, Lyon’s wages shot up €58m (58%) from €99m to €157m, though this was mainly because the prior year benefited from state aid for companies impacted by COVID. In addition, other operating expenses surged €23m (23%) from €99m to €122m. On the other hand, player amortisation dropped €6m (12%) from €47m to €41m.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.