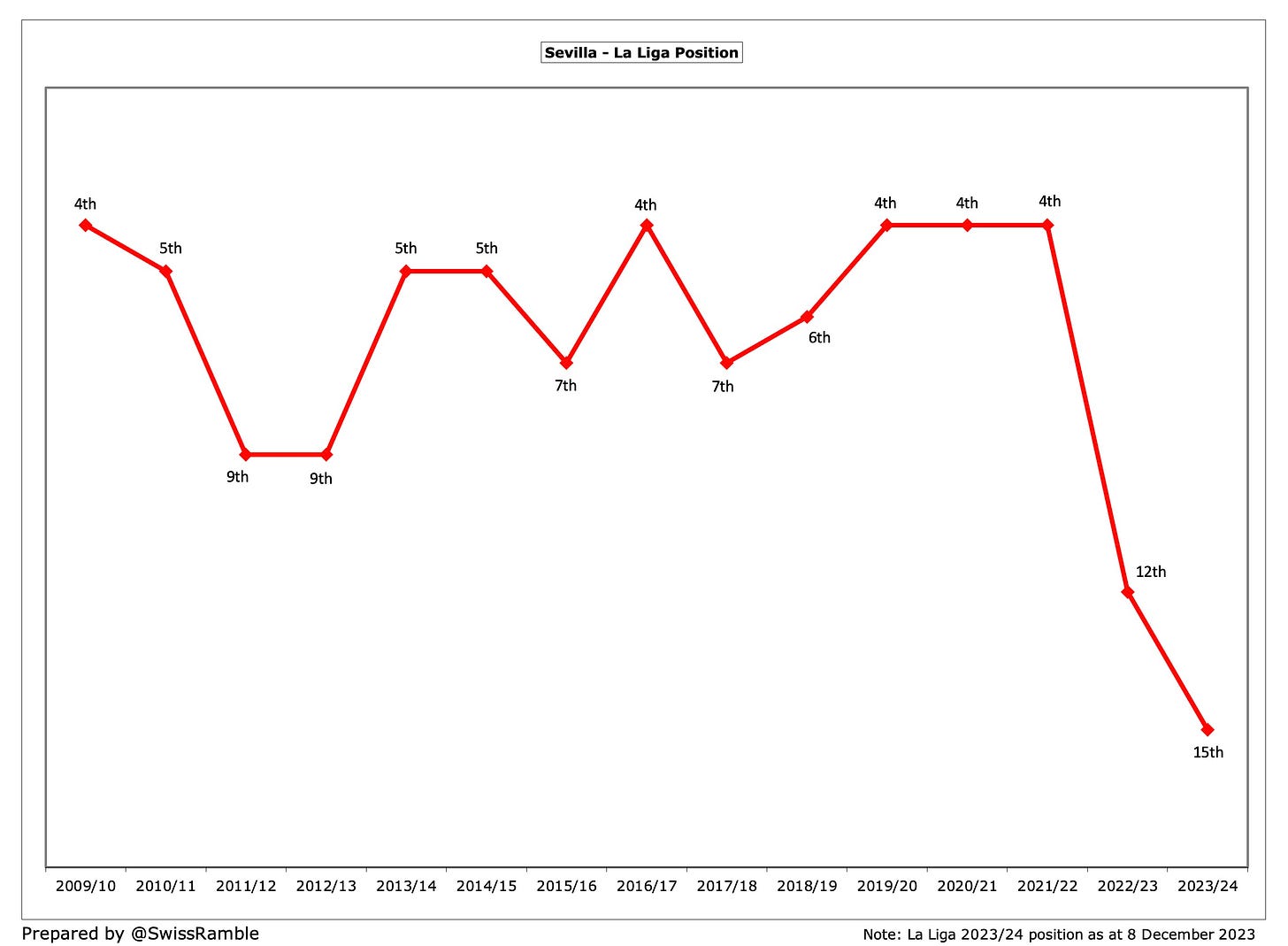

Not so long ago Sevilla were mounting a genuine challenge for the title in La Liga, before falling away towards the end of the 2021/22 season, though they still finished in a highly creditable fourth.

Poor form in La Liga

Since then, the Andalusians have struggled, so much so that they were involved in a relegation battle last season before eventually finding some form that enabled them to pull away from the drop zone. However, their 12th place was still the first time that Sevilla had finished outside the top half of the league since their return to the top flight in 2001. Their performances have been just as poor this season, so they currently find themselves in a lowly 15th.

To highlight Sevilla’s consistent record up to this point, last season was only the second time since 2003 that they had failed to qualify for Europe via their league position.

Another triumph in the Europa League

Of course, despite all the domestic problems, Sevilla still won the Europa League, defeating Jose Mourinho’s Roma on penalties in the final, which granted them access to this season’s Champions League.

Sevilla have become synonymous with the Europe League, having won it no fewer than five times in the last decade and seven times in total. Even when they have not performed well in Spain, they have invariably managed to find something extra in “their” competition.

As club president Jose Castro explained, “For us, it’s made to measure, a place where we are able to do incredible things, knocking out incredible teams, and not once, but again and again and again.” To prove his point, on their way to victory last season, they overcame both Manchester United and Juventus, two clubs with a significantly higher budget than Sevilla.

Managerial changes

The issues at Sevilla have resulted in numerous changes of their head coach, with three being employed in 2022/23 alone. After a poor start they sacked Julen Lopetegui, the man who had qualified them for the Champions League three years in a row, but things only got worse under Jorge Sampaoli, so they then turned to Jose Luis Mendilibar in March.

His brand of direct football did the trick, as they climbed the table, but the honeymoon period did not last very long, as he was dismissed after winning just two of eight league matches this season. He was replaced by Diego Alonso, the former manager of the Uruguay national team, though results have hardly improved since his arrival.

Ownership disputes

Matters have clearly not been helped by the bitter power struggle off the pitch at Sevilla. Former president Jose Maria Del Nido Benavente is pushing to reclaim control of the club from the current incumbent Jose Castro, who is supported by Jose Maria Del Nido Benavente, who just happens to be the son of Castro’s bitter rival.

Del Nido senior had become club president in 2002, leading Sevilla during a very successful period, though he had to step down in 2013, when he was imprisoned for the misappropriation of public funds. He was succeeded by Castro, who refused to step aside when the former president was released from jail in 2017.

The acrimony has been evidenced by the annual general meeting rejecting the club accounts for the last two years.

So there is no clear leadership at the top, which is never a good thing for a football club. Del Nido reportedly has the largest shareholding with 24%, with Castro’s group owning 21% and Rafael Carrion, another former president, having 15%.

The situation has been further complicated by the arrival of 777 Partners, an American private investment company, who purchased a minority stake in 2018. To date, they have invested around $25m for “over 13%” of Sevilla.

This is part of 777’s multi-club ownership stable, which also includes stakes in Everton, Genoa, Vasco da Gama, Standard Liège, Hertha Berlin, Melbourne Victory and French club Red Star.

777 arrived with grand plans to improve Sevilla’s revenue (outside of UEFA prize money), but to date the Americans have seen little reward for their investment.

Player trading

Much of Sevilla’s success in the past was down to their player trading model, where they would buy talented players cheaply, develop them (while benefiting from their skill on the pitch), then sell them for a good profit.

777 Partners identified this as a clear differentiator for Sevilla under their famous sporting director, Monchi. The strategy did mean that the team would regularly see its top players move on, but Sevilla managed to repeat the trick time and time again, allowing them to frequently outperform better resourced clubs.

However, the club changed the winning formula a couple of years ago when it saw an opportunity to win the league, which would have been only Sevilla’s second La Liga title. The last time they were officially the best club in Spain was way back in 1946, so their enthusiasm was understandable to some extent.

So, instead of buying players with an eye on future development, they opted to sign more experienced players, who would theoretically have an immediate beneficial impact. However, it’s fair to say that this has not exactly worked out, as the team has dropped down the table, leaving Sevilla with older players on high wages and little or no resale value.

Monchi

Monchi, or Ramón Rodríguez Verdejo to give him his full name, is something of a legend at Sevilla, regarded by many as the brains behind the operation after his nearly two decades as sporting director. There is no doubt that he has been responsible for building a number of successful teams during his lengthy tenure.

He left for Roma in 2017, which could not be described as an unqualified success, while his return to Sevilla just two years later was also a bit of a mixed bag. Nevertheless, Monchi did help his old team win its seventh Europa League last summer, before reuniting with former Sevilla manager Unai Emery in June at Aston Villa, where things are currently going very well.

He was replaced by Victor Orta, the former director of football at Leeds United, who previously worked at Sevilla and under Monchi for more than a decade.

Transfer list

There were rumours that Monchi’s departure was partly due to Sevilla’s financial challenges, which some claimed resulted in every single player being considered to be for sale during the summer transfer window. Indeed, quite a few players did exit stage left, though many of these were either on loan or went on free transfers.

So let’s take a look at Sevilla’s financial position, particularly whether anything has changed in the last few years (spoiler alert: it has).

Profit/(Loss) 2022/23

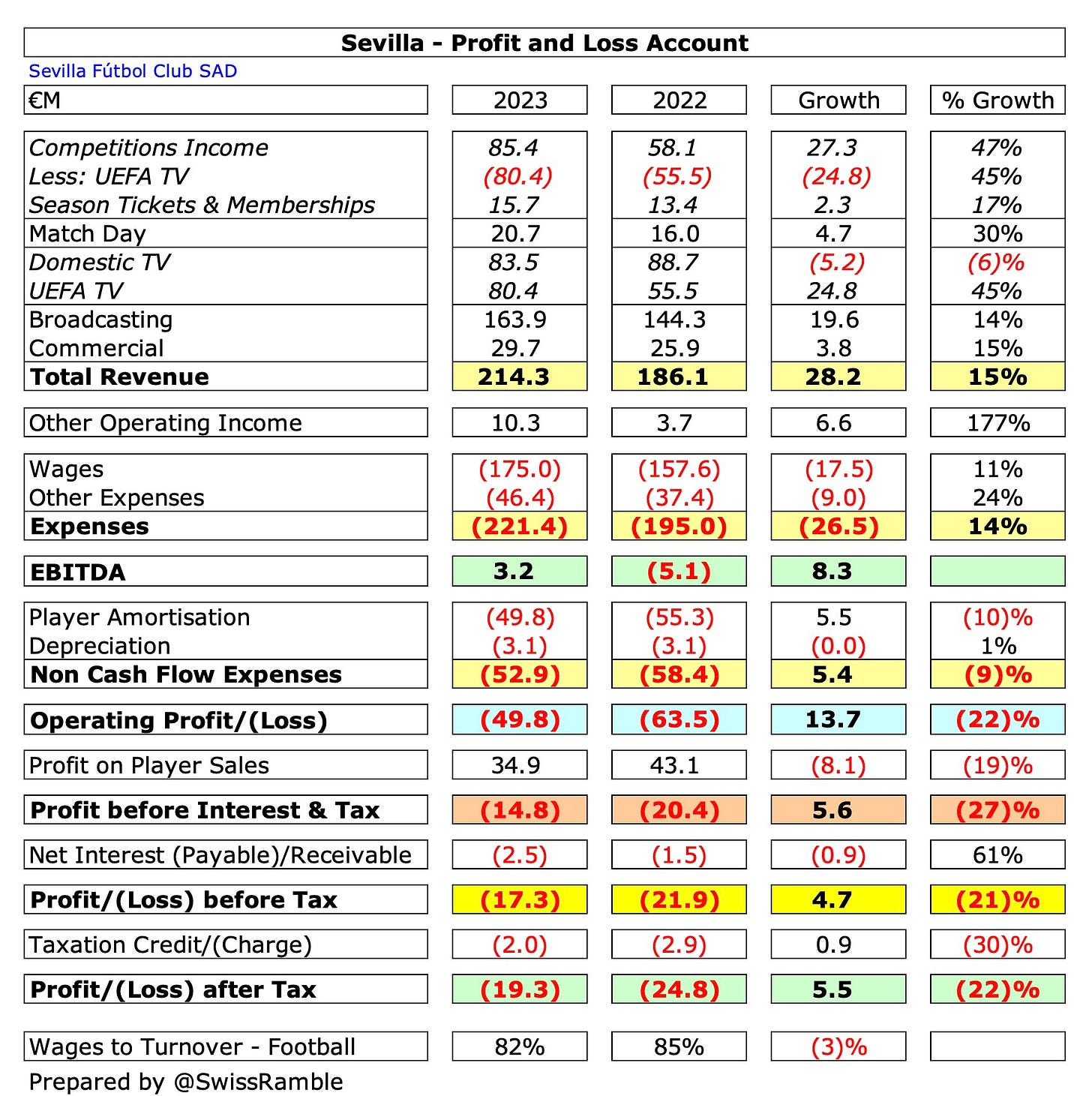

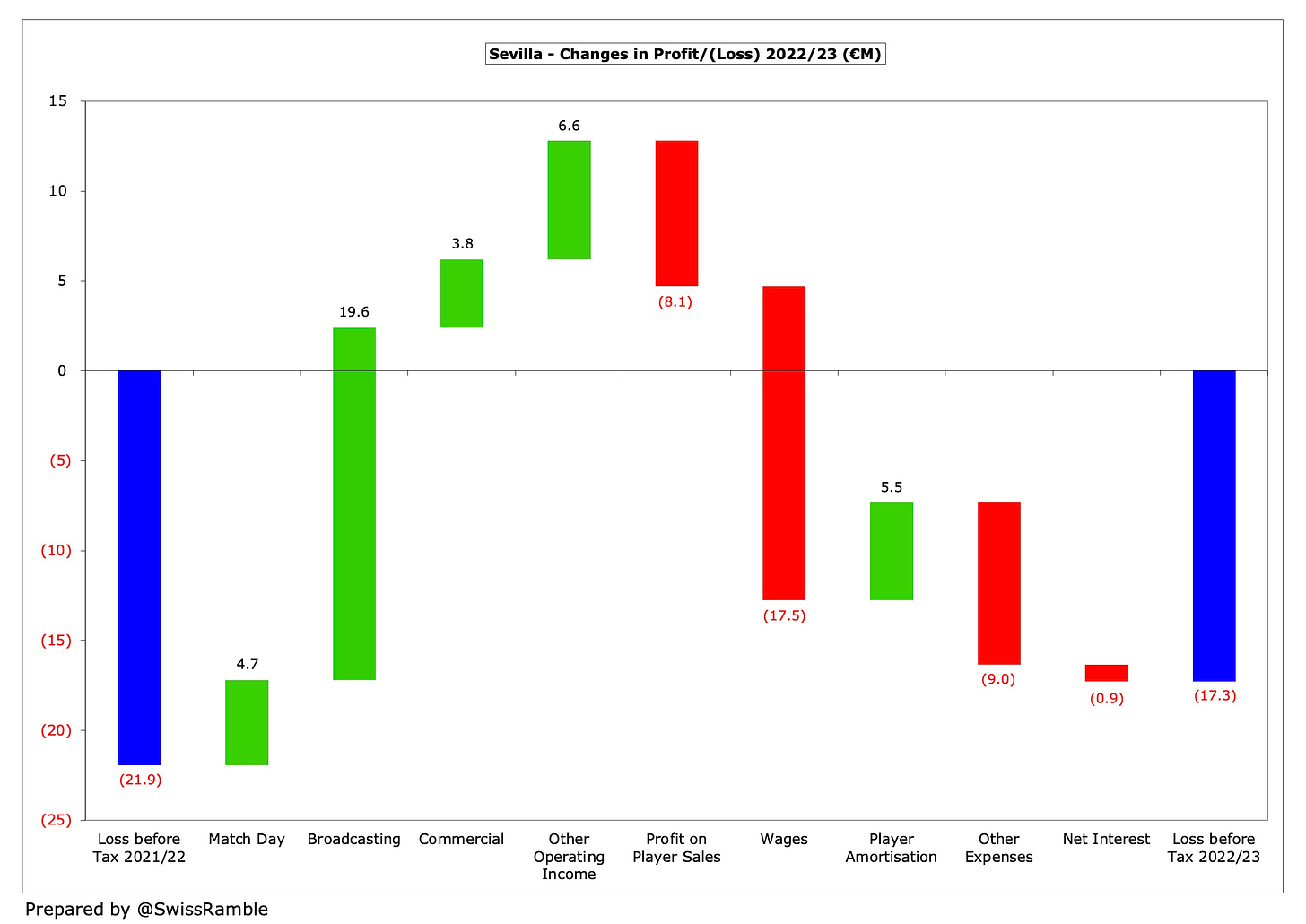

Sevilla’s pre-tax loss reduced from €21.9m to €17.3m in 2022/23, as revenue rose €28.2m (15%) from €186.1m to a club record of €214.3m, though this was partly offset by a €21.0m (8%) increase in operating expenses to €274.4m.

However, they still posted a large loss, which Sevilla said was driven by two factors: the high cost of the squad and lower profit from player sales, which fell €8m from €43m to €35m. The club added, “The problem is that we have been very ambitious in creating the squad and this has meant an extra cost.”

The loss after tax also narrowed from €24.8m to €19.3m, as tax payable fell from €2.9m to €2.0m.

All three revenue streams were higher, led by broadcasting, which rose €19.6m (14%) from €144.3m to €163.9m. However, there was also good growth in match day, up €4.7m (30%) from €16.0m to €20.7m, and commercial, up €3.8m (15%) from €25.9m to €29.7m.

In addition, other operating income nearly tripled from €3.7m to €10.3m.

As a technical note, I have reclassified €80.4m UEFA competitions revenue from match day to broadcasting.

The club record for revenue was matched by a new high for wages, which rose €17.4m (11%) from €157.6m to €175.0m, while other expenses shot up €9.0m (24%) from €37.4m to €46.4m and interest payable also increased from €1.5m to €2.5m. This was partially offset by a €5.5m (10%) reduction in player amortisation from €55.3m to €49.8m.

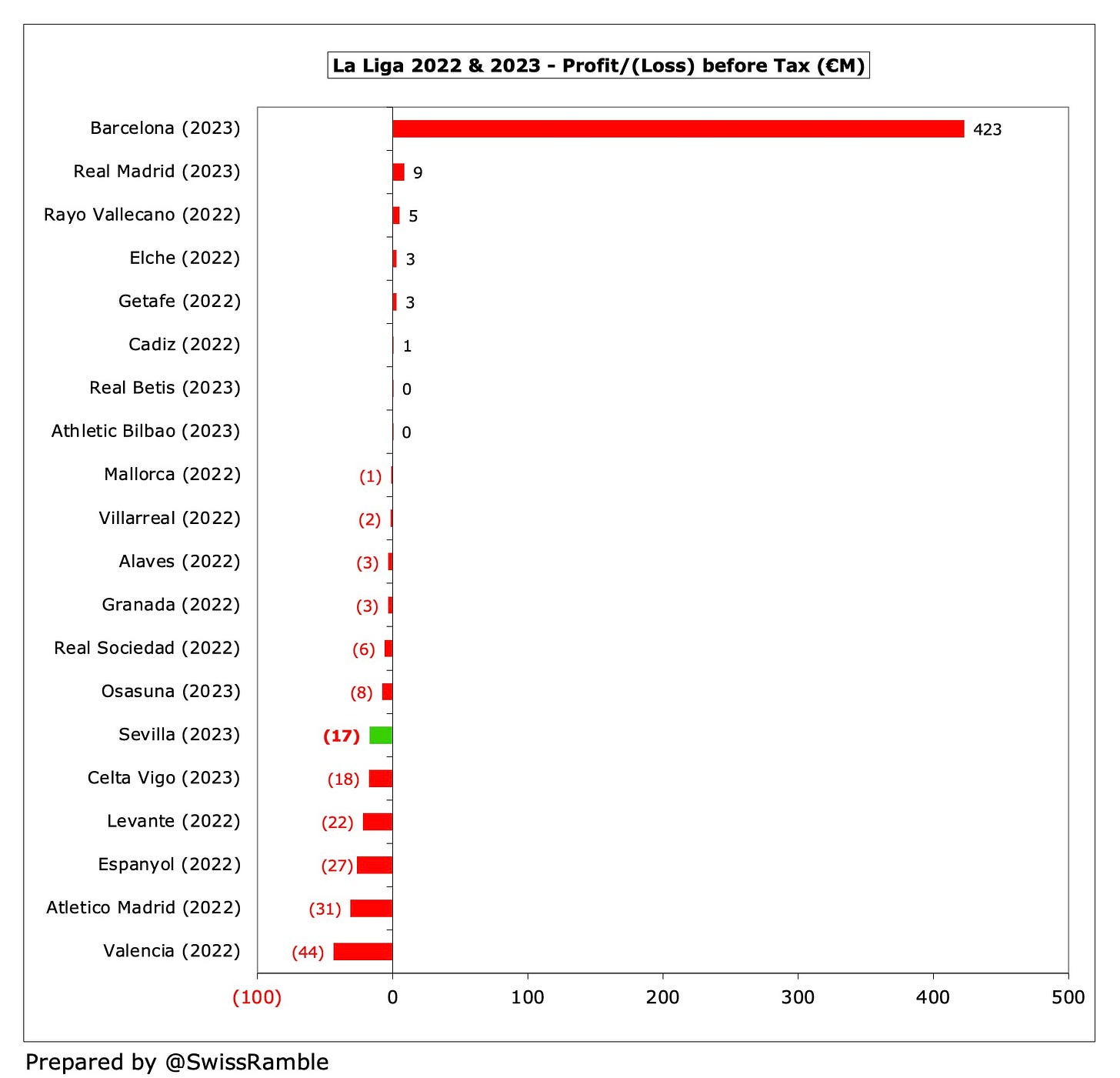

Most Spanish clubs are yet to publish accounts for the 2022/23 season, but Sevilla’s €17m loss is likely to be one of the highest in La Liga. Some of the losses in 2021/22 were bigger, but that season was still impacted by some COVID restrictions.

Barcelona’s reported €423m pre-tax profit was the best in Spain by far, but this is highly misleading, as it was only thanks to the Catalans activating €800m of once-off economic levers.

Profit from Player Sales 2022/23

Sevilla’s profit from player sales fell €8m (19%) from €43m to €35m, the club’s second lowest in the last nine years. The only season where they made less money from player trading was 2020/21, when COVID had deflated the transfer market.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.