Sunderland’s 2023/24 accounts cover their second season back in the Championship, when the club said that it “did not see an improvement in league position from the previous season”.

That’s an interesting way of putting it, given that they dropped to 16th place, compared to finishing 6th the year before, when they got to the play-offs, before losing to Luton Town in the semi-finals.

The team actually started last season well, but their form fell off a cliff, so much so that they lost 10 of their last 15 games, finishing just six points above the relegation places.

Of course, things look much better this season, but we’ll get to that later.

Changes in Manager

One obvious reason for Sunderland’s slump last season was the numerous changes in manager, starting with the sacking of the popular Tony Mowbray in December 2023, when the club was sitting pretty in ninth place.

He was replaced by Michael Beale, which always seemed a strange choice, given that he had been sacked by Rangers after less than a year in charge, while his departure from QPR left many fans questioning his integrity.

In any case, Beale only lasted 64 days at the Stadium of Light before being shown the door after “a series of underwhelming results”, replaced by Mike Dodds on an interim basis until the end of the season.

There then followed a lengthy delay before Sunderland hired Régis Le Bris, the former coach of French side Lorient, but he has done well since his arrival. In fact, he has guided the club to fourth place, so they look odds on for a place in the play-offs.

Ownership

Kyril Louis-Dreyfus has been Sunderland’s controlling shareholder since February 2021, when he bought 41% of the club, though the previous ownership group retained 59%: Stewart Donald 34%, Juan Sartori 20% and Charlie Methven 5%. Even though this was only a minority stake, the acquisition gave Louis-Dreyfus full control of the board.

This transaction made Louis-Dreyfus the youngest person to ever own an English football club and even now he is just 27 years old. That said, his late father Robert once owned French team Olympique de Marseille.

In June 2022 Louis-Dreyfus increased his stake to 51% after buying out Methven’s 5% and another 5% from Donald, who also sold 10% to Sartori, increasing the Uruguayan’s shareholding to 30%.

In May 2023 Louis-Dreyfus and Sartori acquired Donald’s remaining shares, so the current shareholding is 64% for KLD and 34% for Sartori, leaving 2% for others.

Strategy

Under KLD the club has “embarked on a strategy to create a sustainable business that aims to return to the Premier League”, though it was acknowledged that “this requires a long-term outlook”.

The club’s stated strategy is “to invest in a strong core of talented young players”, which should help with player trading profits in the future, but on the other hand a lack of experience on the pitch normally counts against teams in the ultra-competitive Championship.

This was one of the reasons why they appointed Le Bris, as his playing identity “matched and aligned to our pursuit of developing young talent while building an exciting product on the field for our fans”.

The sustainable approach clearly makes sense from a financial perspective, though it also has to be recognised that this model has rarely worked in the Championship, at least in terms of clubs securing promotion, though some have recently bucked this trend, such as Ipswich Town and Luton Town.

So let’s take a look at Sunderland’s latest financials to better understand the challenges that they are facing.

Profit/(Loss) 2023/24

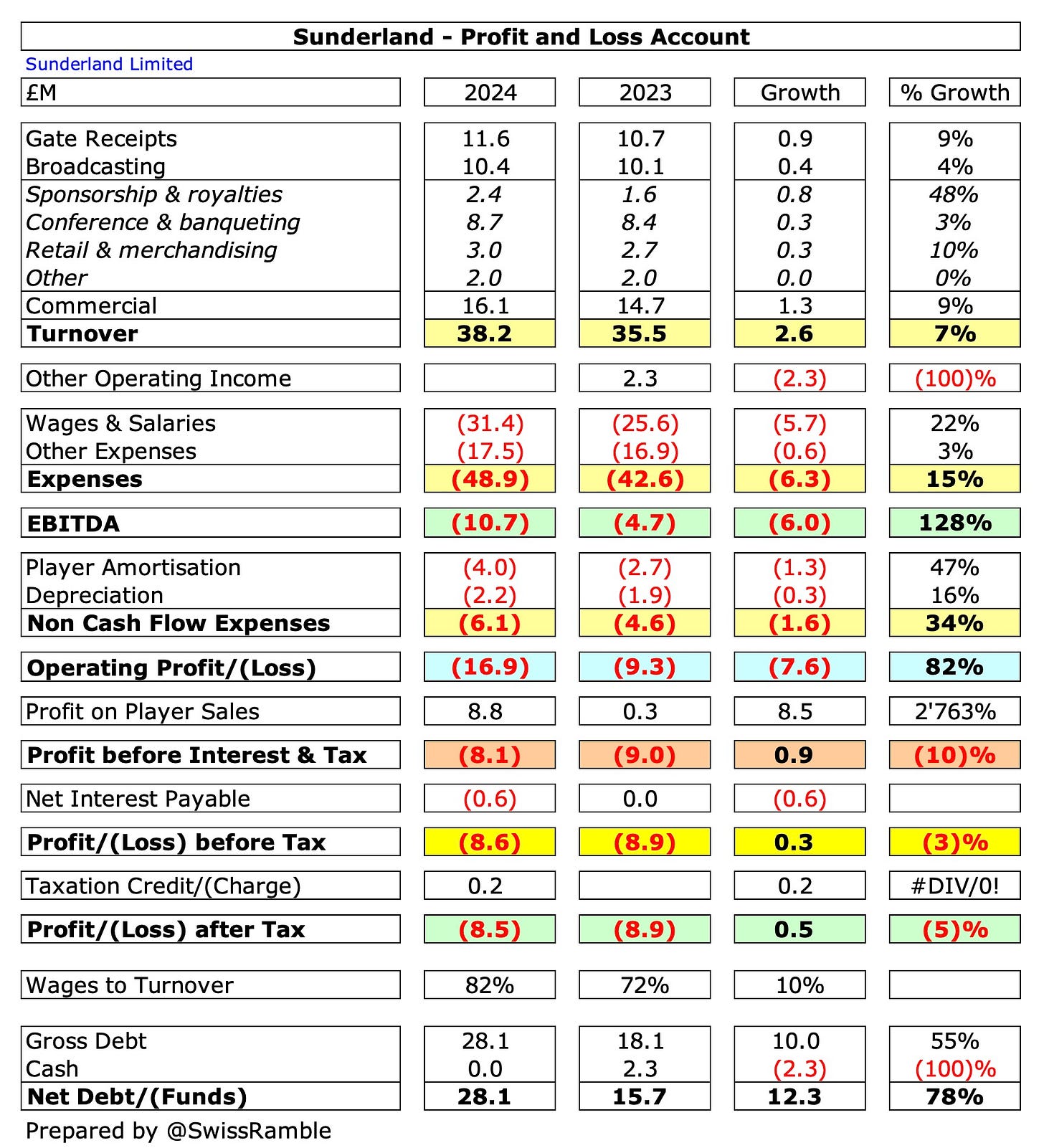

Sunderland’s £8.6m pre-tax loss was basically the same as the prior year’s £8.9m, but this disguised some large ups and downs.

Revenue rose £2.7m (7%) from £35.5m to £38.2m, but this was more than offset by operating expenses growing £7.9m (17%) from £47.1m to £55.0m. In addition, there was no repeat of the previous season’s £2.3m other operating income, while net interest payable increased from zero to £0.6m.

However, the net deterioration was compensated by profit from player sales, which shot up from just £0.3m to £8.8m.

The main driver of Sunderland’s revenue increase was commercial, which grew £1.4m (9%) from £14.7m to £16.1m, though the other two streams were also higher. Gate receipts rose £0.9m (9%) from £10.7m to £11.6m, while broadcasting was up £0.3m (4%) from £10.1m to £10.4m.

However, further investment in the squad was required to help compete in the Championship, which led to a steep increase in wages, up £5.8m (22%) from £25.6m to £31.4m, while player amortisation was up £1.3m (47%) from £2.7m to £4.0m. Other expenses also rose £0.6m (3%) from £16.9m to £17.5m, while depreciation increased £0.3m (16%) from £1.9m to £2.2m.

Although losing money is rarely good news, Sunderland’s £8.6m loss was actually one of the better results in the Championship.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.