Swansea City’s 2021/22 accounts covered a season when they finished 15th in the Championship, much worse than the previous season when they reached the play-offs by finishing 4th.

The club described it as “a year of change and consolidation”, as head coach Steve Cooper’s departure meant that Russell Martin was appointed just a few days before the new season commenced.

There is the risk that this will happen again, as it looks likely that Martin will soon join Southampton, following their relegation from the Premier League. It appears that the only reason that this has not yet happened is a dispute over the size of the compensation. Martin had led the Swans to an improved 10th place in 2022/23.

Ownership

Swansea have been owned by an American consortium since July 2016, when Jason Levien and Stephen Kaplan bought a controlling interest in the club. They were joined in August 2020 by Jake Silverstein. According to the club’s website, they owned around 80% between them.

Following the conversion of some debt into equity, the Supporters Trust stake was diluted to around 13%, including a protected 5% ownership position.

However, there has been a flurry of activity recently.

Last month Andy Coleman, an investor in MLS team DC United (where Levien is also involved), was appointed Swansea’s chairman, having acquired “a significant shareholding”.

Coleman, described as “a seasoned, successful business executive”, has assumed day-to-day responsibility for the running of the club, leading to the departure of chief executive Julian Winter.

And only this week Nigel Morris, the managing partner of QED Investors, also made an investment into the club and joined the board of directors.

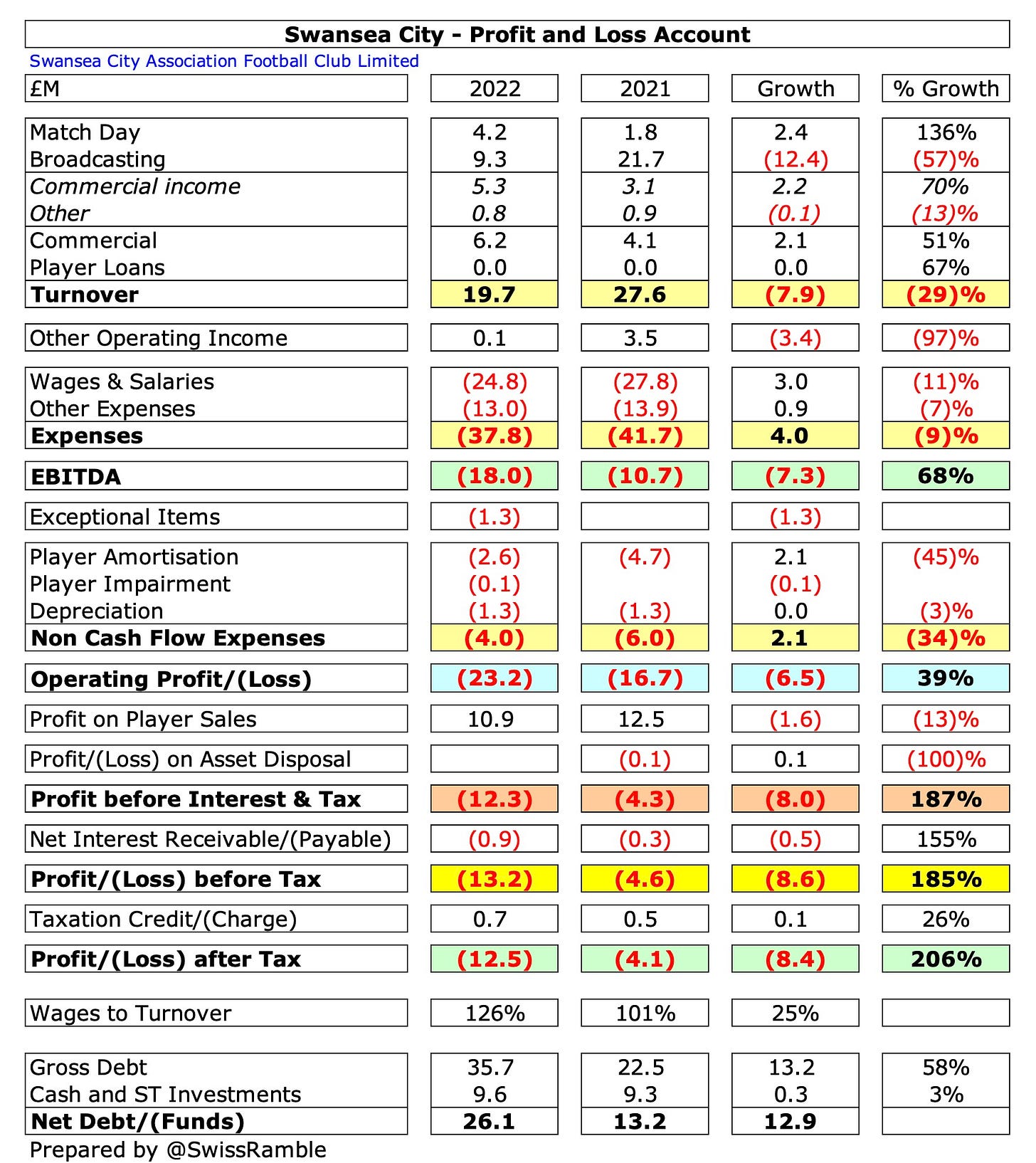

Profit/(Loss) 2021/22

Swansea’s pre-tax loss nearly tripled from £4.6m to £13.2m, mainly due to the ending of parachute payments in the fourth year after relegation from the Premier League, which contributed to revenue falling £7.9m (29%) from £27.6m to £19.7m.

Profit from player sales also dropped £1.6m from £12.5m to £10.9m, while there was no repeat of prior year’s £3.3m business interruption insurance claim.

This was partly offset by operating expenses being reduced by 10% (£4.7m) to £43.0m, though net interest payable rose £0.5m to £0.9m.

The loss after tax increased from £4.1m to £12.5m after considering tax credits.

The main reason why Swansea’s revenue was “considerably lower” was broadcasting income, which more than halved, falling £12.4m (57%) from £21.7m to £9.3m, due to no parachute payments.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.