The FIFA Women’s World Cup later this month will bring another great opportunity to boost women’s football. The game has already greatly benefited from the significant global exposure provided by the 2019 World Cup and particularly last summer’s UEFA Women’s Euros, which culminated in the Lionesses triumphing on home soil.

This growing interest has helped drive growth domestically, though the reality is that the FA Women’s Super League (WSL) had already shown signs of strong growth even before England defeated Germany in the Euros final.

Caveat

Before we get into the detailed review of WSL financials, we should note that the analysis is made more difficult by the fact that not all clubs publish detailed accounts. This means that we lack some information on revenue, expenses, wages and headcount. Nevertheless, there is enough data available to identify some common themes.

Revenue

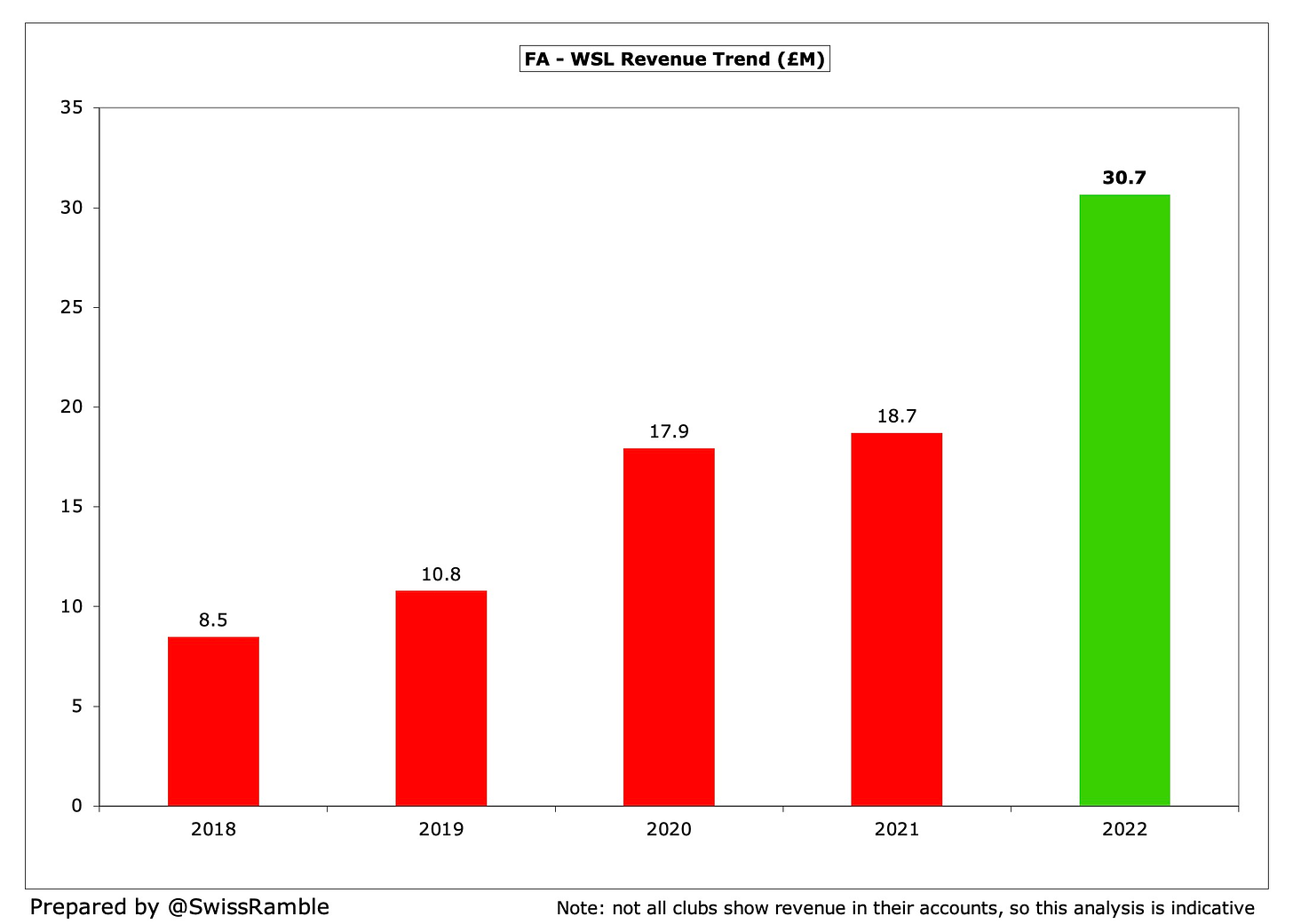

WSL total revenue rose £12.0m (64%) from £18.7m to £30.7m in 2021/22, though the previous season was adversely impacted by the COVID pandemic. More impressively, this means that revenue has nearly quadrupled in just four years from the £8.5m reported in 2017/18.

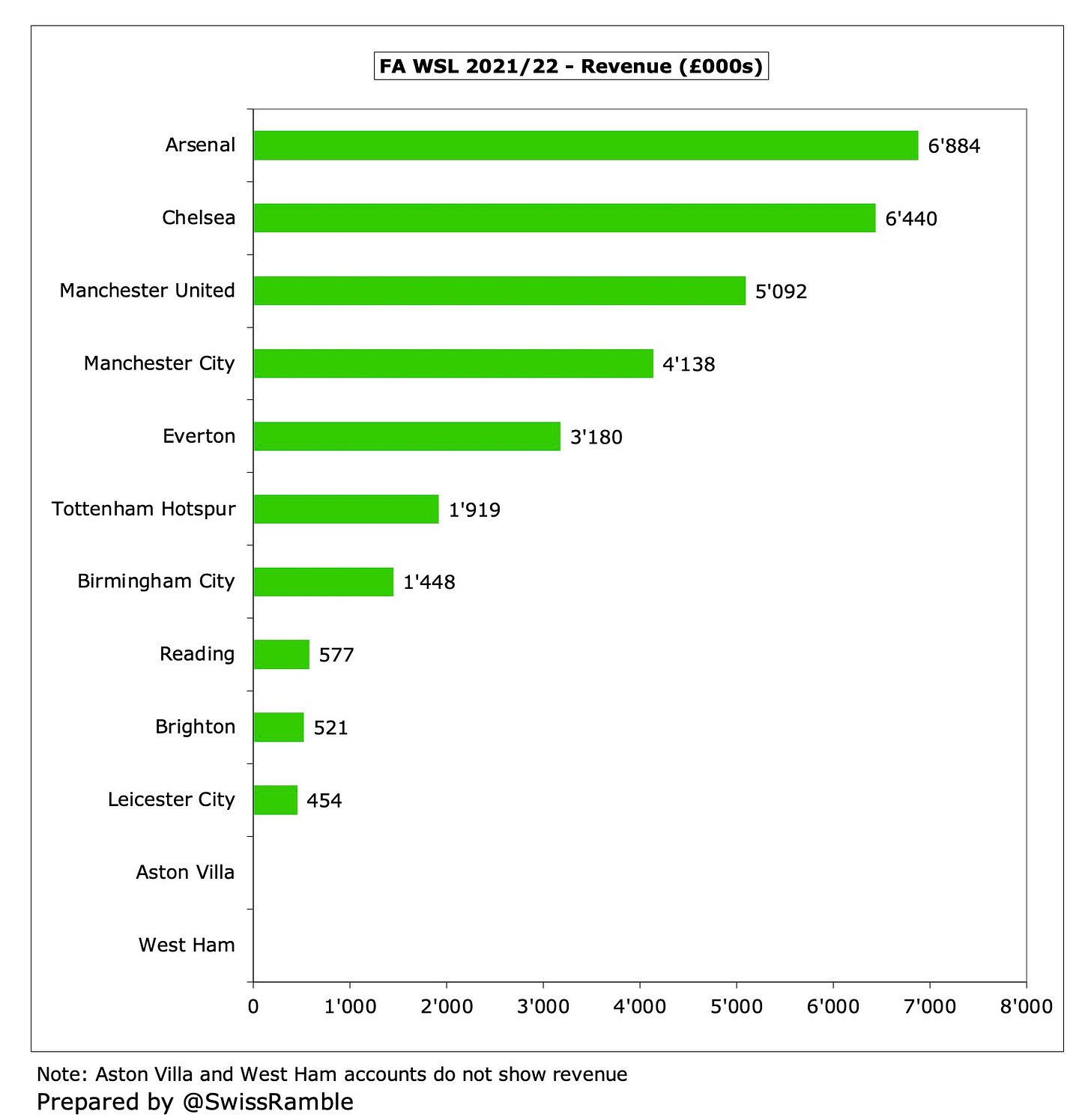

In fact, the total revenue in the WSL is even higher in reality, as neither Aston Villa nor West Ham separately divulge revenue in their accounts.

There is significant disparity in revenue in the WSL with the top four highest revenue-generating clubs accounting for around three-quarters of the published revenue.

The highest revenue comes from Arsenal £6.9m, followed by Chelsea £6.4m, Manchester United £5.1m and Manchester City £4.1m. In contrast, three clubs have revenue a lot less than a million: Reading £577k, Brighton £521k and Leicester City £454k.

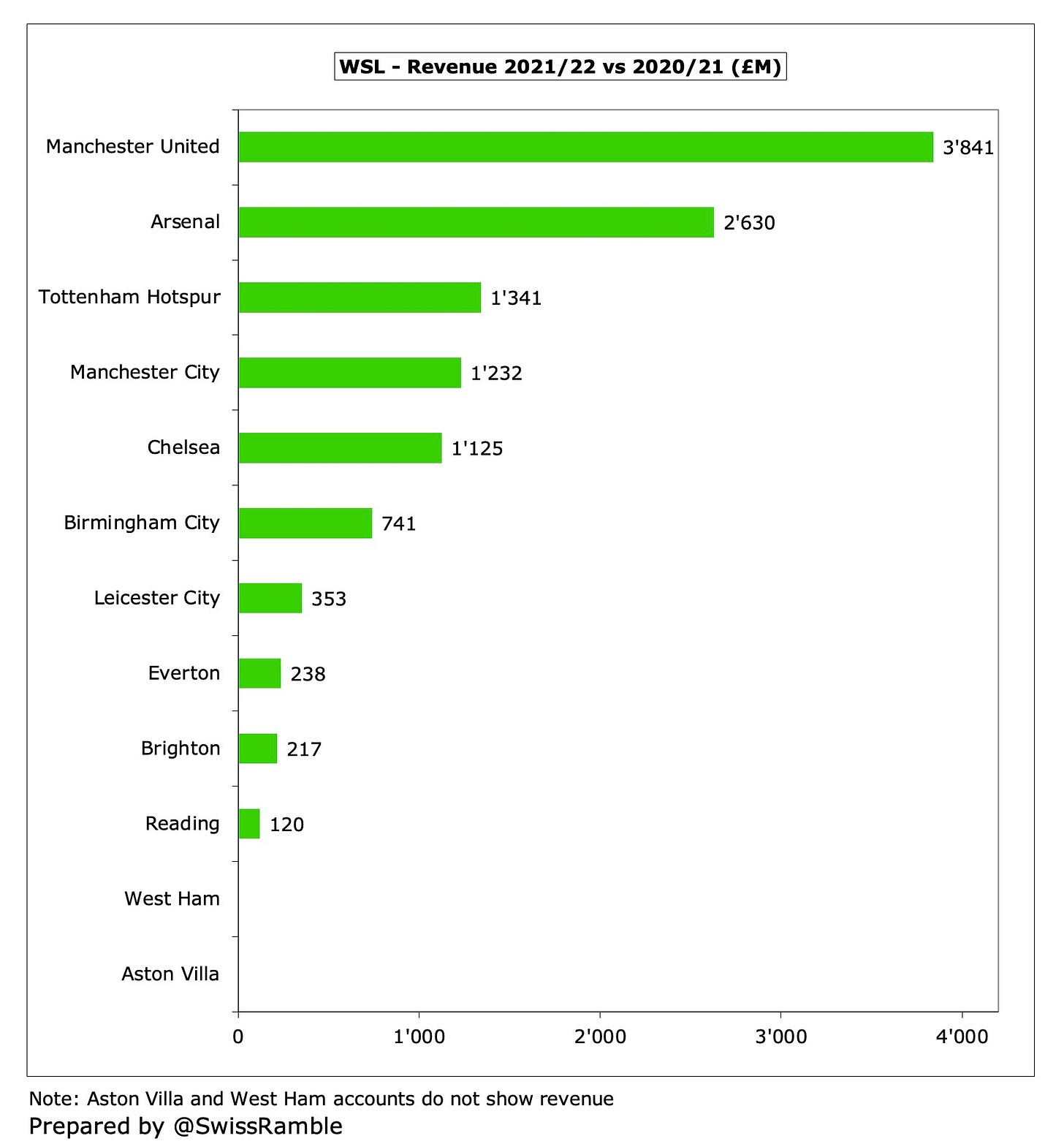

All of the WSL clubs experienced year-on-year revenue growth with the largest rises at Manchester United £3.8m and Arsenal £2.6m.

This is obviously good news, though it is true that each WSL club currently receives financial support from its associated men’s club. Most include this in commercial income, though Arsenal explicitly divulged £5.1m of group support.

Deloitte estimate that this financial support was worth £13m in 2021/22, which would represent around 40% of total WSL revenue.

In fairness, owner funding is fairly common in men’s football, though usually in the form of equity injections or owner loans, so this is not in itself a bad thing. Indeed, this should be regarded more as investment, which is required to grow the game by signing and retaining the best players available.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.