One of the most important trends in the world of football is multi-club ownership. According to UEFA’s latest benchmarking report, at the end of 2022 there were more than 180 clubs worldwide that were part of a multi-club investment structure, involving 6,500 players. This is nearly twice as many as four years before, while the number has increased fivefold since 2012.

Even that rapid growth is almost certainly understating the reality, as CIES Sports Intelligence identified more than 250 teams involved in multi-club ownership in March 2023.

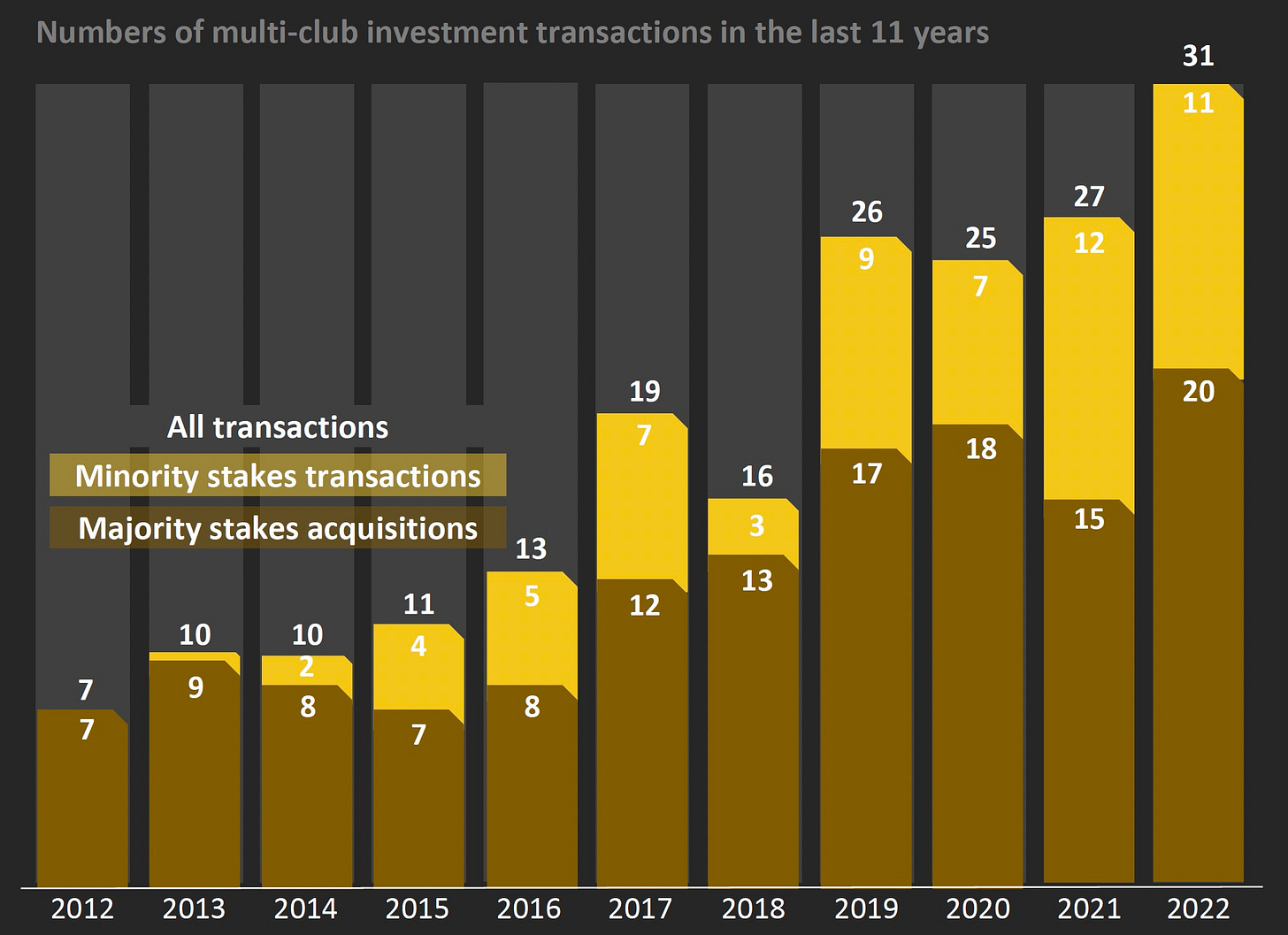

This has inevitably led to a rise in the number of multi-club investment transactions, which have virtually doubled from 16 in 2018 to 31 in 2022 per UEFA.

Although European football clubs account for a significant percentage of multi-club groups globally, many cross-investment structures involve at least one club outside Europe. In four of the “Big Five” leagues, as well as Belgium and Portugal, more than a third of all clubs have at least one cross-investment relationship with another club.

The growth has been driven by a combination of macroeconomic factors and global investment trends. Financial weaknesses and inequalities in the game, exacerbated by the impact of the COVID pandemic, have resulted in buying opportunities.

The perceived under-valuation of the assets, i.e. football clubs, has attracted the attention of US-based investors, with 27 multi-club investment groups (a third of UEFA’s total number) originating in America.

Before going any further, we should probably define multi-club ownership, which UEFA say is “a situation where a party exerts control and/or decisive influence over more than one club”. Similar, but not the same, is multi-club investment, where “a party has investment interests in more than one club (without exerting control or influence)”.

Main Examples of Multi-Club Ownership

As we have seen, there are numerous examples of multi-club ownership, but we shall focus on four significant players in the industry, partly to show that while this model has worked out well for some, it is far from being a panacea.

City Football Group

Probably the best known example of multi-club ownership is City Football Group, largely owned by Abu Dhabi United Group (ADUG). They first acquired Manchester City in 2008, but have significantly expanded their empire since then with investments in another 12 clubs all around the world.

As a result, CFG is the oldest and by far the largest multi-club project, including clubs in Europe (Manchester City, Girona, Lommel SK, ES Troyes AC and Palermo), North America (New York City), South America (Montevideo City Torque, Club Bolivar and EC Bahia), Asia (Yokohama F. Marinos, Sichuan Jiuniu and Mumbai City) and Australia (Melbourne City).

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.