Tottenham Hotspur’s 2023/24 accounts cover a season when they finished 5th in the Premier League under Australian coach Ange Postecoglou, who replaced Antonio Conte.

After a series of poor performances under the Italian, Spurs had failed to qualify for Europe for the first time since 2010, but the improved league position under “Big Ange” meant that Spurs secured a spot in the Europa League.

This season has been rather more problematic, as chairman Daniel Levy acknowledged, “We currently find ourselves in 14th position in the Premier League, navigating what has been a highly challenging season on the pitch.”

However, Tottenham are still in the Europa League, so they have a chance of living up to Postecoglou’s comment that he “always wins things” in his second year.

Profit/(Loss) 2023/24

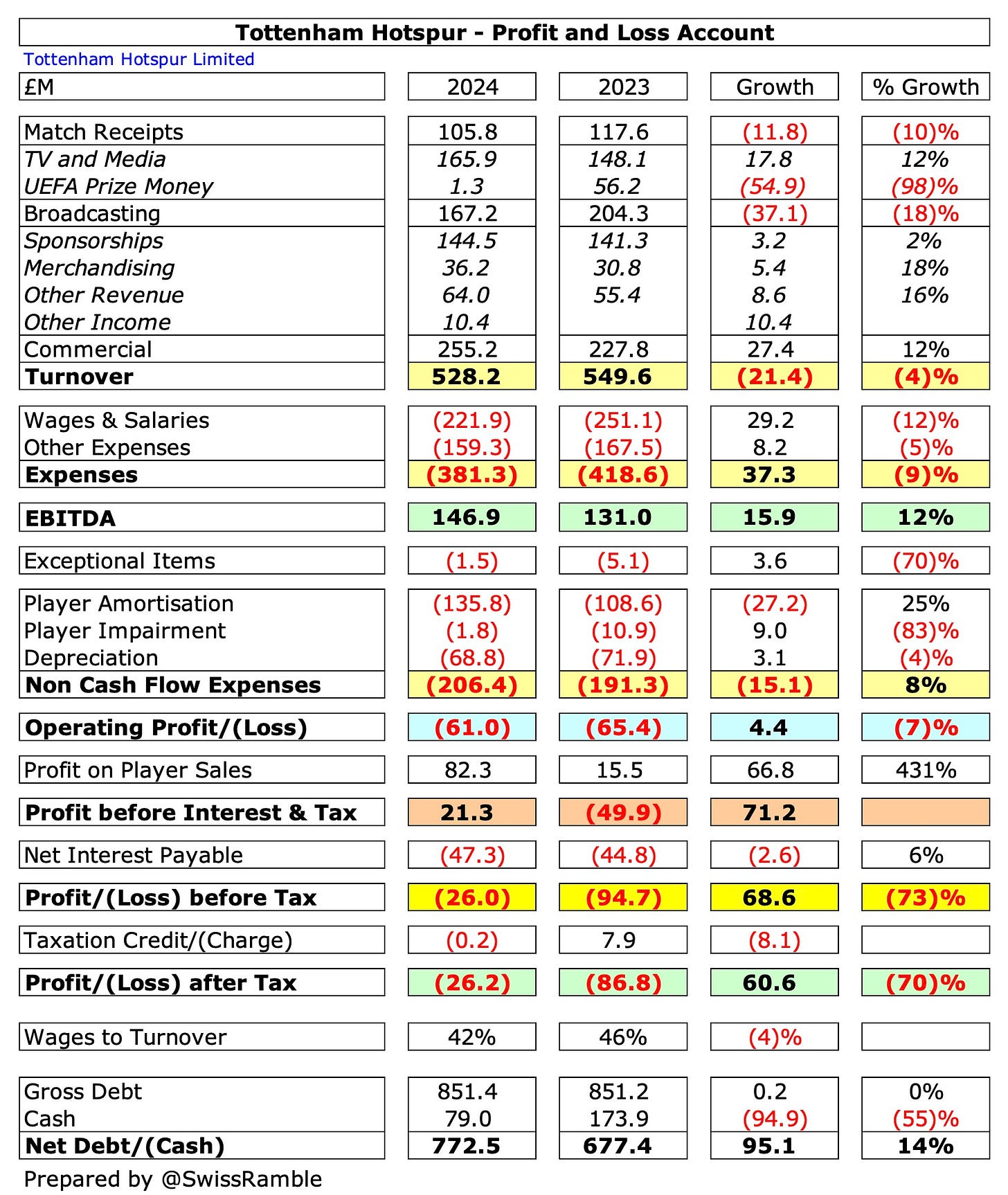

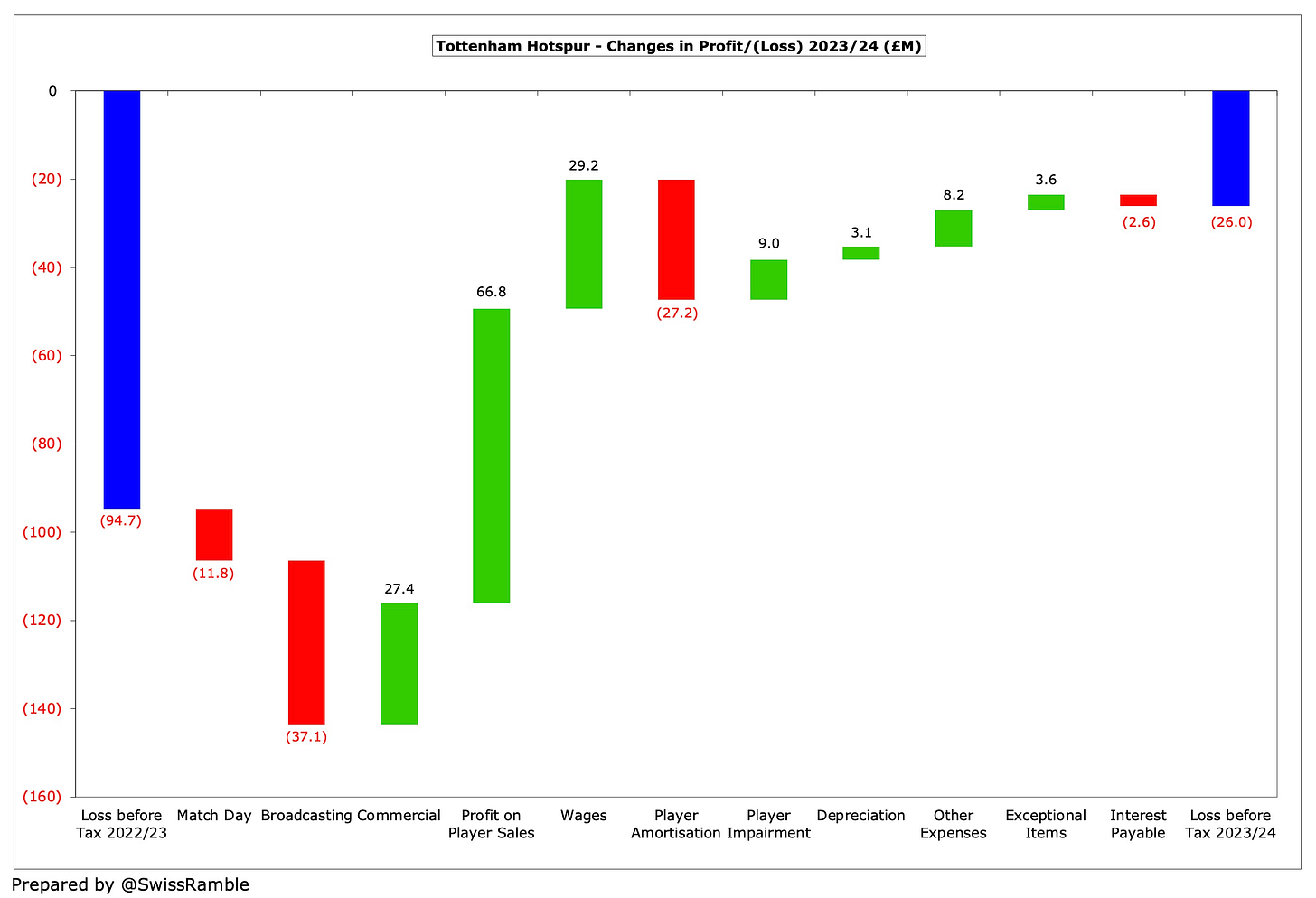

Tottenham’s pre-tax loss significantly reduced from £95m to £26m, despite revenue falling £22m (4%) from £550m to £528m, as profit from player sales shot up from £16m to £82m and operating expenses were also cut 4% (£28m) from £615m to £589m.

However, net interest payable increased £2m (6%) from £45m to £47m, which makes a big difference to the net result. In fact, without this hefty charge, Spurs would have made a £21m profit.

Their loss after tax was almost exactly the same as the pre-tax figure at £26m, but the year-on-year improvement was £8m less, because the previous season benefited from a tax credit.

The main reason for Tottenham’s revenue decline was the lack of European football, which led to reductions in both broadcasting, down £37m (18%) from £204m to £167m, and match day, down £12m (10%) from £118m to £106m.

This was partially offset by further growth in commercial, which rose £27m (12%) from £228m to £255m, a new club record. As Levy put it, “Our off-pitch revenues have significantly supplemented the lower football revenues this year, testament to our diversified income strategy.”

In response to the lower revenue, the wage bill was reduced by £29m (12%) from £251m to £222m, while other expenses fell £8m (5%) from £167m to £159m. Exceptional charges for onerous employment contracts decreased from £5m to £2m, while depreciation also dropped £3m, but was still a substantial £69m.

On the other hand, player amortisation increased by £27m (12%) from £109m to £136m, though player impairment reduced from £11m to £2m.

Despite the significant improvement, the fact remains that Tottenham still posted a £26m loss, though it should be noted that this was pretty much an average result for the Premier League.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.