Last year UEFA announced a new Financial Sustainability framework to replace the previous Financial Fair Play rules. Aleksander Ceferin explained, “UEFA’s first financial regulations, introduced in 2010, served their primary purpose.”

The President added, “The evolution of the football industry, alongside the inevitable financial effects of the pandemic, has shown the need for wholesale reform and new regulations.”

UEFA director Andrea Traverso noted, “Competitive imbalance cannot be addressed simply by financial regulations. It must be addressed in combination with other measures. This is why we changed the name. The name fair play was interpreted as creating a level playing field.”

Squad Cost Control Ratio

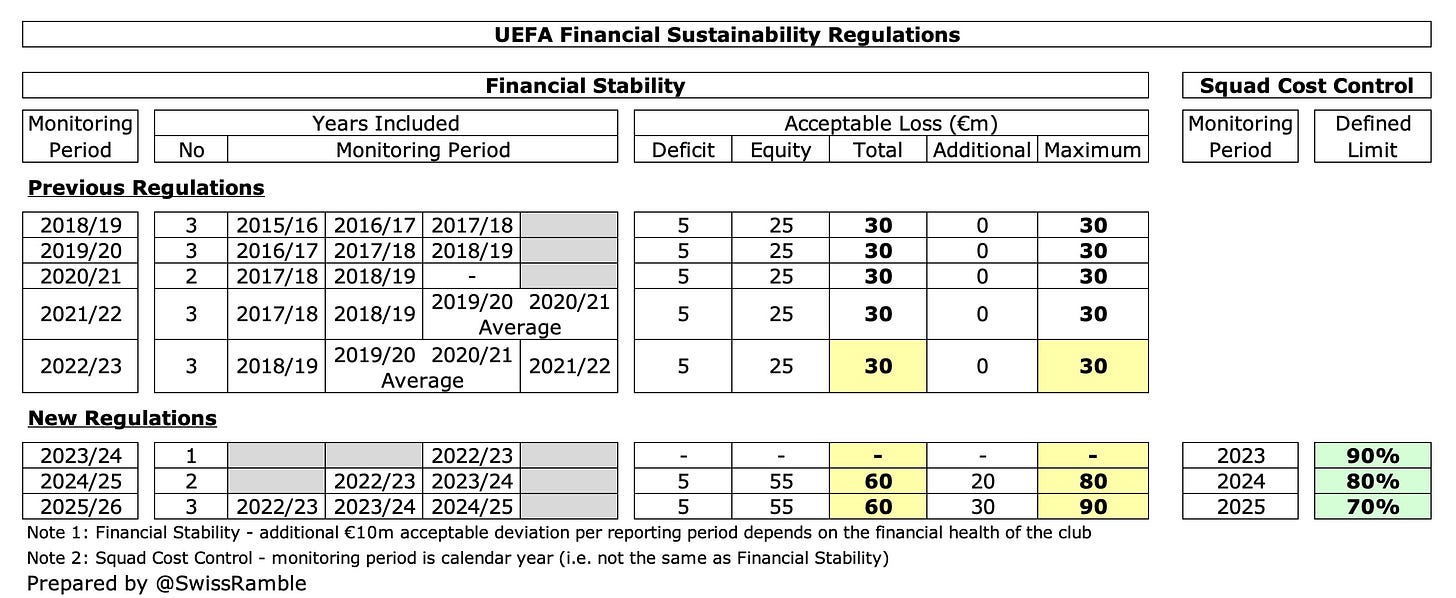

The biggest change in the new rules was the introduction of squad cost control with the ratio of player wages, transfers and agent fees being limited to 70% of revenue and profit on player sales.

The focus of this blog will therefore focus on whether the leading clubs are on track to meet the 70% cost control ratio limit.

New Regulations

Going forward, the focus of the new regulations will be on the financial sustainability of clubs with 3 key pillars being monitored:

Solvency

Stability

Cost Control

Solvency

Solvency requirements have been addressed by strengthening the rules around overdue payables for football clubs, tax authorities and employees to better protect creditors, including mandatory assessments and quarterly payment dates (15 days to settle overdue amounts).

Stability

Stability will be covered by the former FFP rules, whereby a club’s loss over the 3-year monitoring period is restricted to the “acceptable deviation”. However, the limit has been doubled from €30m to €60m, so long as any excess over €5m is covered by an equity contribution from the owner.

In addition, if a club is deemed to be in good financial health, then it could be permitted up to an additional €10m allowance per reporting period, i.e. €30m over the 3-year monitoring period. This would mean that a club’s FFP allowable losses could potentially triple from €30m to €90m.

Cost Control

UEFA’s objectives in adding the new cost control ratio were to:

Provide a direct measure between squad costs and income to encourage more performance-related costs.

Limit the inflationary impact of wages and transfer fees of players.

Unlike the Stability and Solvency rules, the Cost Control rule does not have a predecessor in the FFP regulations. UEFA had previously recommended keeping wages below 70% of revenue, but this has now been formally incorporated in the latest regulations as one of the three formal pillars.

This is interesting, as it is effectively the first time that UEFA has applied a salary cap, albeit a “soft” variant, while the financial sanctions could be described as a sort of “luxury tax”.

The cost control requirement must be fulfilled by all clubs that have qualified for the group stage of UEFA’s competitions with wages above €30m (for all employees).

Squad Cost Ratio Calculation

A club’s squad cost ratio is calculated as the sum of:

Wages of players and head coaches

Player amortisation and impairment

Termination payments for players and head coaches

Agents’ fees and cost of other intermediaries

Divided by the sum of:

Operating revenue (adjusted for fair value, if required)

Profit from player sales

Other transfer income/expenses

In this way, a club’s spending should be capped to 70% of the money it earns from football activities.

For example, if the club’s total earnings are £400m, then its spending cap for the relevant expenses referred would be £280m, i.e. £400m x 70%.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.