West Bromwich Albion’s managing director, Mark Miles, recently confirmed what every Baggies’ fan knew, namely that the club continued to face financial challenges. Specifically, he was referring to the need to sell players, “What is available to spend is dependent on which players go out.”

As a result, West Brom have already sold Irish international defender Dara O’ Shea to Burnley for £7m, but it would be no surprise if others were to leave The Hawthorns this summer.

Financial Issues

West Brom’s auditors had already rung an alarm bell when they cast doubt on the club’s ability to continue as a going concern without making player sales, “Should the forecasted player trading not be achieved, the group would need to both maintain existing and find further sources of investment in order to bridge its cashflow position until appropriate player transactions are fulfilled.”

MSD Loan

Another indication of Albion’s financial issues came when they took out a £20m 4-year loan with MSD Holding UK Ltd in December 2022 “to finance the general business operations of the club”, secured on the club’s assets including the stadium.

Moreover, this loan is high interest, currently charging nearly 15% (9.75% plus SONIA 4.93%), which means that Albion have to stump up around £3m a year.

Given the supporters’ understandable scepticism about the club’s management, they felt obliged to add, “for the avoidance of doubt, the loan will only be spent on the purposes of the football club”, though they did not define exactly what was meant by “purposes”.

The loan itself can be seen as an indictment of how the club has been run, given that Albion had benefited from Premier League money for many years, either directly or in the form of parachute payments.

Loans to Related Parties

One reason why Albion needed to take out this loan is that they have actually loaned around £7m to related parties, made up of two transactions:

£5m to Wisdom Smart Corporation Ltd, a related party to controlling shareholder Guochuan Lai, as the COVID pandemic saw his “international business suffer”, which is hardly comforting to Baggies’ fans.

West Bromwich Albion Holdings Ltd borrowed £2m from Warmfront Holdings Ltd and lent the proceeds to a related party (presumably Lai).

Although Lai has “repeated his assurance to the club that the loan and accrued interest will be repaid”, the full £7m has been written-off (impaired) in the accounts of the holding company. In fact, Lai has now missed no fewer than three deadlines for the repayment of the £5m loan.

This is not the first time that Albion have effectively acted as a bank, as £3.7m was loaned to former owner Jeremy Peace via the holding company in 2014 with the debt passed to Lai following the sale of the club. Including £1.3m interest, the amount owed is now around £5m.

Some shareholders have suggested that Peace used the money from the loan to buy more shares in WBA before the sale of the club in 2016, though this claim has been denied by the former chairman. The circumstances surrounding this old Loan are the subject of a KC Investigation instigated by the club last December.

Either way, the amount owed to the club is around £12m in total, though the chances or repayment seem fairly remote.

Ownership

Albion have effectively been in decline ever since the club was sold to a Chinese consortium in August 2016, paying a figure north of £200m to buy former owner Jeremy Peace’s stake.

Given Albion’s trials and tribulations, it is not a major shock that the club is effectively up for sale, as confirmed by MD Mark Miles, “I can confirm that Lai has said to me he is open to investment coming into the club. Whether that be a full or partial shareholding is yet to be seen, but he is now looking at alternative options that can get money into the club.”

Indeed, there have been reports that Egyptian businessman Mohamed Elkashashy and sports lawyer Chris Farnell have been in talks about making an investment. However, this might not be a dream ticket, given that Farnell was briefly disqualified from being a director of football after trying to takeover Charlton Athletic, while doubts have been raised over whether Elkashashy has the necessary funds.

Let’s take a look at West Brom’s most recent accounts (for the 2021/22 season) to get a better understanding of the club’s financial situation.

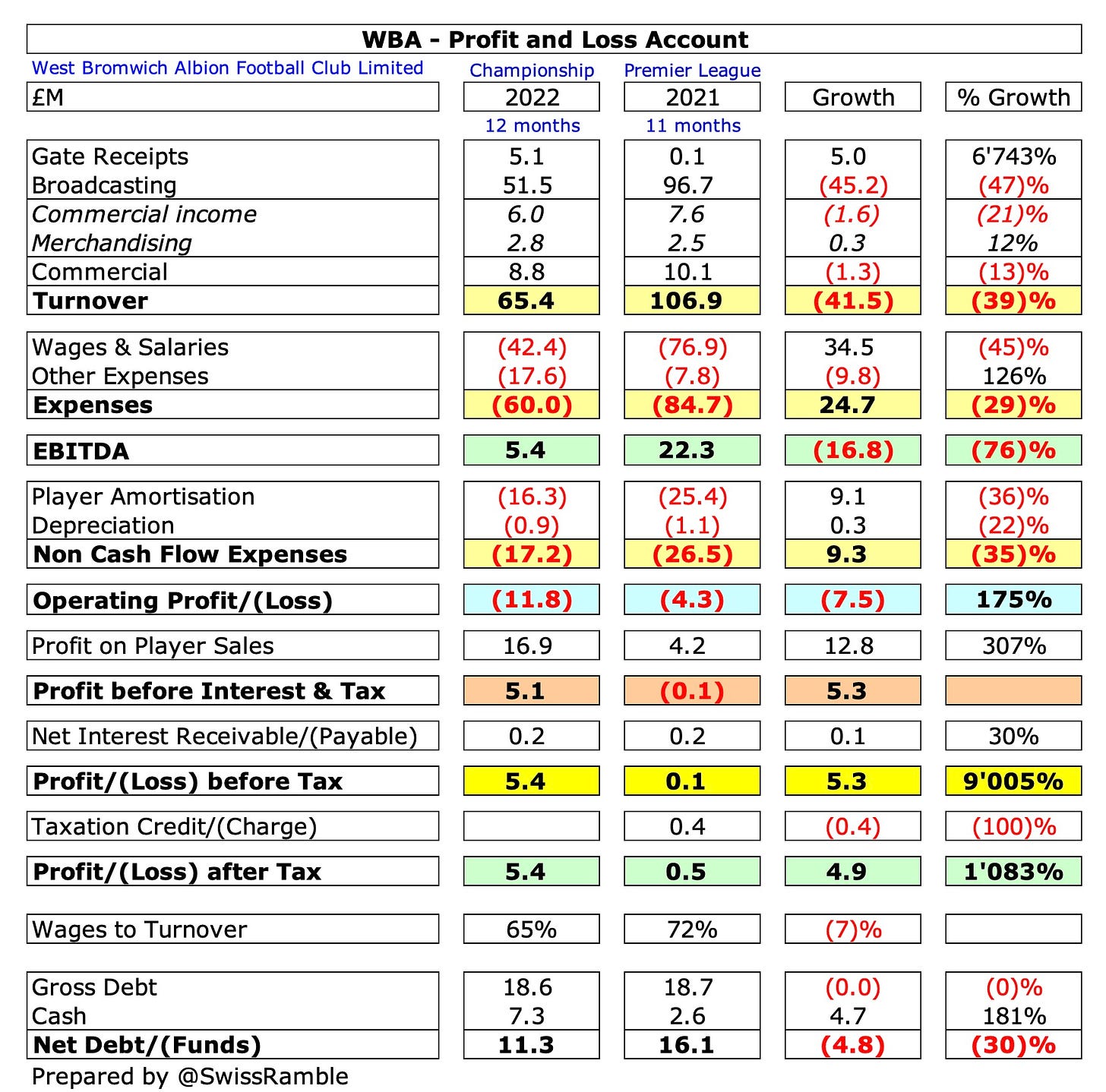

Profit/(Loss) 2021/22

These financial results covered a campaign when Albion finished 10th in the Championship, having been relegated from the Premier League the previous season.

Having guided Barnsley to the Championship play-offs in 2020/21, Valérien Ismael was appointed head coach, though he could not match this performance, so was replaced by the much-travelled Steve Bruce in February 2022, since succeeded by Carlos Corberan in October that year.

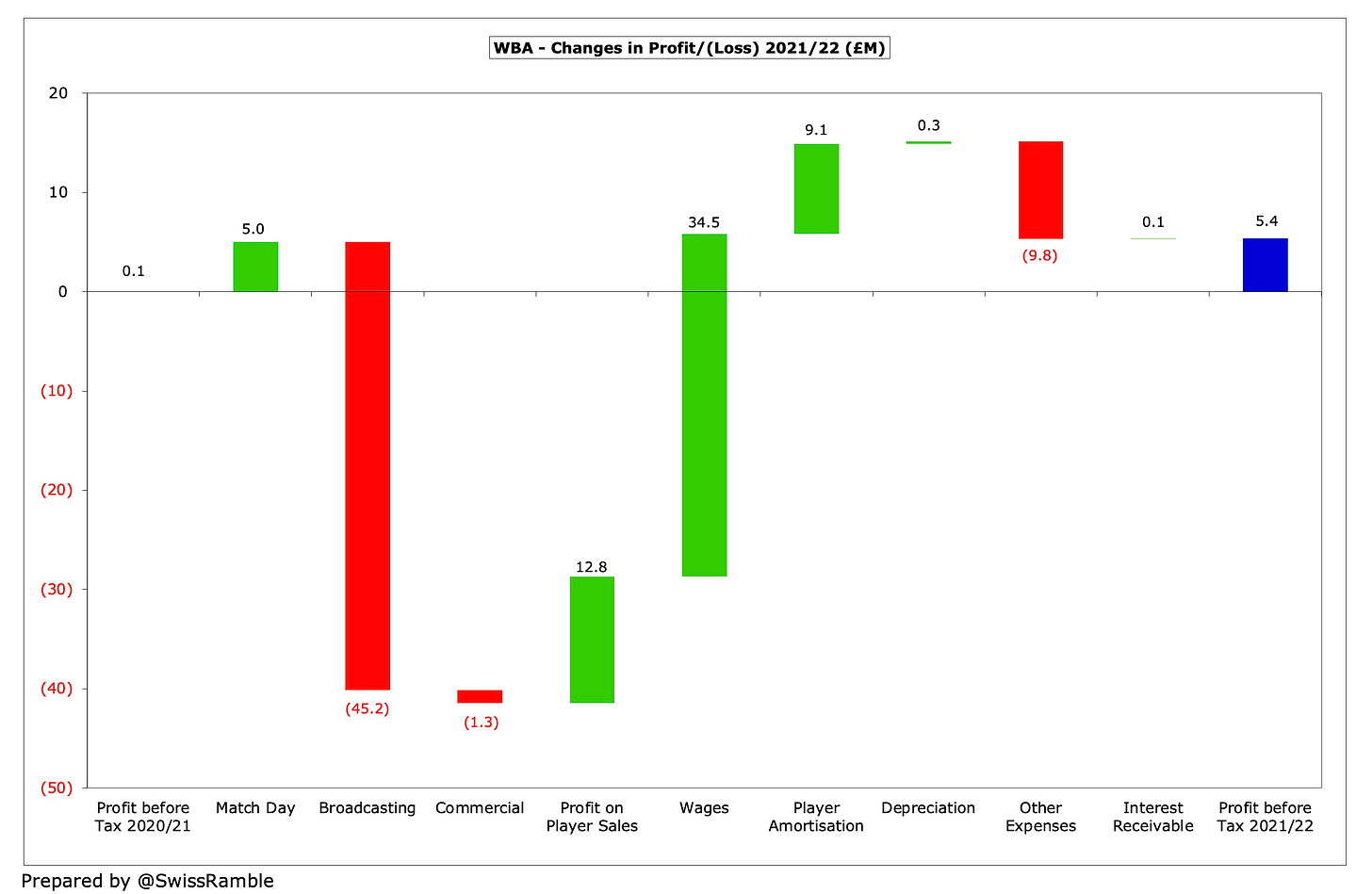

Despite relegation to the Championship, West Brom’s pre-tax profit actually increased from £0.1m to £5.4m, mainly thanks to profit from player sales rising £13m from £4m to £17m. Revenue dropped £42m (39%) from £107m to £65m, but this was largely offset by cutting costs £34m (31%) from £111m to £77m.

The main driver of Albion’s £42m revenue decrease was broadcasting, which nearly halved in the Championship from £97m to £52m, despite being in receipt of parachute payments. Commercial also fell after relegation, falling £1m (13%) from £10m to £9m.

However, the return of fans to the stadium after COVID restrictions were lifted meant an increase in match day from just £74k to £5.1m.

West Brom compensated for the lower revenue with steep reductions in staff costs. The wage bill was cut by £35m (45%) from £77m to £42m, while player amortisation was reduced by a third (£9m) from £25m to £16m. However, other expenses more than doubled from £8m to £18m, mainly due to the higher cost of staging games with fans.

Keep reading with a 7-day free trial

Subscribe to The Swiss Ramble to keep reading this post and get 7 days of free access to the full post archives.